Airlines Grow Revenues 40% Without Added Fees

This sponsored content was created in collaboration with a Skift partner.

Unlike most online businesses, which are focussed on delivering the product to the customer as quickly as possible after purchase – think Amazon - the airline industry has a lot more disposable time.

The average flight is purchased 45 days ahead of date of departure - giving airlines a clear window of opportunity to push relevant ancillary services, drive additional revenue and help enhance the customer experience.

So how can airlines take advantage? It’s all in the data.

Different customers have different needs, so airlines need to be able to successfully identify those needs. For example, a group of women traveling for a bachelorette party require very different ancillary services compared to a couple on their honeymoon - but both represent a clear opportunity to airlines able to identify them. So how is this achieved?

In order to offer products and services that customers find attractive, more and more airlines are looking to gather as much intelligence about passenger preferences as possible. And, while the industry is awash with talk of ‘big data’, this is still a step too far for many airlines. Instead, the first step for many involves dealing with ‘little data’ - the information already held across corporate systems, which is often disconnected, in silos and under-utilised.

While big data genuinely has the ability to transform business fortunes, the fact remains that most airlines are looking for quick-wins (think baggage fees), rather than large-scale implementations. Your average airline doesn’t even have a CRM solution to handle customers not linked up to a loyalty program. Best cases are segmented email marketing lists, and this makes it difficult to deliver real value from ancillary services.

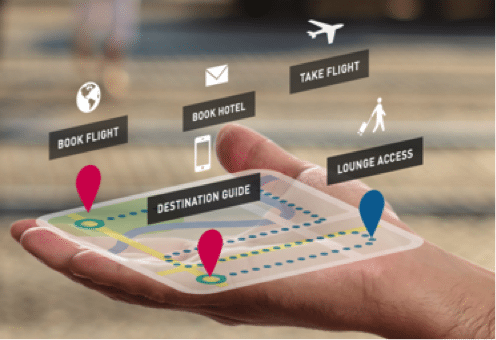

By unlocking value from little data already at their disposal, airlines can very quickly determine patterns in customer behaviour, and use that intelligence to suggest additional products or services, which they may want to purchase. With an average 45-day window, that could mean everything from renting cars, making dining and hotel reservations to purchasing in-flight meals, tickets to sporting events and duty-free items.

For example, our bachelorette party might prefer a limo rather than a cab to bring them from the airport to the hotel. We might also discover that, based on previous preferences, it would be worthwhile offering them tickets for tours and shows during their trip.

Let’s imagine that our bachelorette party contains several passengers who have received a less than satisfactory experience with that airline in the past. The 45-day window also gives airlines plenty of time to ensure that the customer experience is better than before – win back their loyalty.

And ancillary revenue is no small matter for airlines. According to a recent report by IdeaWorksCompany, revenue brought in from add-on products and services can represent more than 38% of a carrier's overall revenue - and this could be just the tip of the iceberg.

Bottom line, the better grasp an airline has on its customer’s preferences, the greater the opportunities for growth in ancillary revenue. While we are getting used to airlines suggesting insurance, hotels and travel after the point of booking, the future will see more of them selling a much broader range of products and services; before, during and even after the flight.

Build customer loyalty for a lifetime with Boxever's data solutions. Learn how to get to know your customers better here.

This content is created collaboratively in partnership with our sponsor, Boxever.