Expedia CEO's 2012 pay rose 300 percent even as profits dropped

Skift Take

Expedia's logo of a soaring gold jet is an apt image for the pay of its CEO.

Among chief executives of Pacific Northwest companies with at least $1 billion in annual revenue, Bellevue-based Expedia's Dara Khosrowshahi saw the biggest pay increase last year -- a 309 percent jump to $14.4 million.

According to Equilar, an executive compensation data firm, the 43-year-old's pay included a $3 million bonus, triple the previous year's amount; $9.5?million in stock and option awards, nine times what he got the previous year; and $895,000 in other perks. His salary stayed at $1 million.

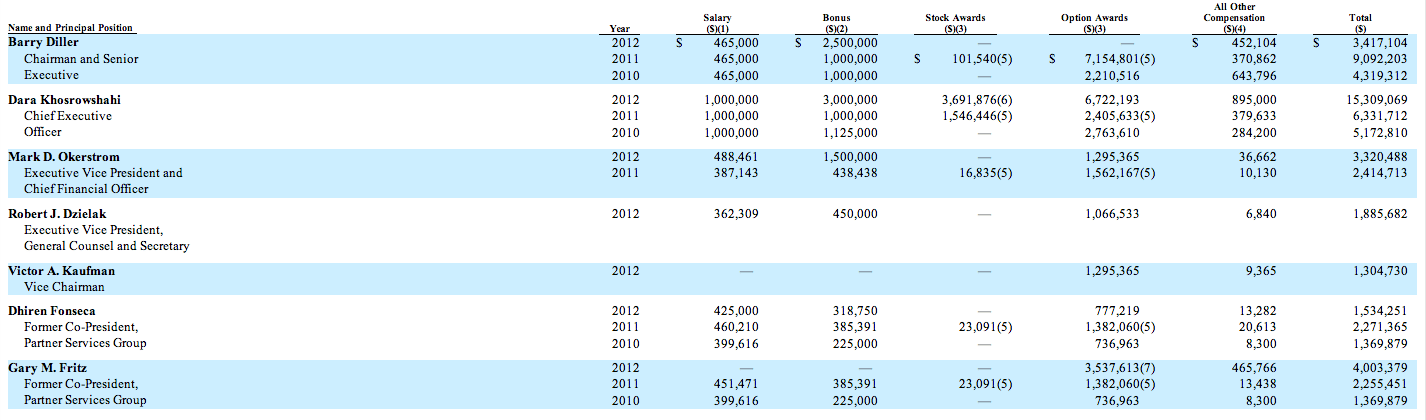

The 2012 compensation package, click on the image below for full table:

Most Pacific Northwest CEOs didn't see such windfalls last year, perhaps a sign that say-on-pay votes by shareholders are chastening the companies' compensation committees.

Median total compensation of CEOs at 123 public companies headquartered in Washington, Oregon or Idaho was nearly $1.4 million, and the total for those in office for two years or longer was almost flat compared with 2011.

Those at the top of the pack may reflect shifts in the economy: In 2008, the region's three highest-paid CEOs led industrial or information-technology companies. Now for the first time in five years, the top three CEOs run consumer-brand empires -- Nike, Starbucks and Expedia.

Nike's Mark Parker was the Northwest's highest paid CEO in 2012: He received $35.2 million in total pay, up almost 220 percent from the previous year. Starbucks' Howard Schultz, who held the No. 1 spot for three straight years, slipped to second place, with $28.9 million in total pay, up about 80 percent from 2011, according to Equilar.

Reported figures on CEO pay don't automatically mean a CEO actually receives that pay. Even if a company grants a CEO thousands of shares in options and future stock grants, the CEO may never be able to cash in if the firm's stock price falls or he's fired.

Dendreon CEO John Johnson, the fourth highest-paid Pacific Northwest CEO, was granted $11.2 million in total pay in 2012.

But it's a paper gain, not hard cash, said Fred Whittlesey, a Bainbridge Island-based executive-compensation consultant.

Only $1.65 million of Johnson's total pay is cash in the form of salary and additional pay for meeting targets. The rest is stock and options that are virtually worthless unless the company's stock price rises dramatically.

"A lot of them are theoretical numbers that may end up being worth zero," Whittlesey said.

But if the stock price takes off, the reported figures can vastly understate CEO pay.

Case in point: Starbucks' Schultz made more than $103 million in 2012 from exercising options granted between 2002 and 2009.

Nationally, last year's median pay of 323 CEOs at Standard & Poor's 500 companies was nearly $9.7 million, said Aaron Boyd, Equilar's director of governance research. CEOs who served at least two full years saw a median 6.5 percent increase in total pay over the previous year, he said.

At 101 Pacific Northwest companies where the CEO served at least two years, median total pay grew just 1?percent over the previous year.

That's sharply lower than in previous years' studies: In 2011 and 2010, median pay at Pacific Northwest companies rose about 13 percent.

"You're seeing it average out and level out to what you're seeing on a national basis," Boyd said.

More Pacific Northwest CEOs than before saw their total pay shrink: 43 percent of the CEOs in this year's Seattle Times analysis made less in 2012 than in the previous year; in 2010, only 29?percent did so.

One reason growth in executive pay has slowed, corporate-governance experts say, is that companies are responding to negative shareholder votes on executives' pay, even though boards aren't bound by them.

Starting in 2011, Congress required companies to hold advisory "say on pay" votes at least every three years so shareholders could weigh in on executive pay.

"It definitely gets the company's attention when there's a large vote against pay packages," said Greg Ruel, senior research consultant at New York-based GMI Ratings. "That alone sparks improvements in policy."

Say-on-pay

So far this year, at least 38 companies in the Russell 3000 have failed a say-on-pay vote, according to Los Angeles-based Semler Brossy, an executive-compensation consultancy.

Two were Pacific Northwest companies: Seattle-based Dendreon in April received only 31 percent shareholder approval for its pay package, while in May Idaho-based Hecla Mining garnered 49 percent approval.

More than 80 companies nationally got less than 70 percent shareholder approval, which is considered a warning sign that investors are unhappy.

But most companies are winning their say-on-pay vote: Forty-four of 52 Pacific Northwest public companies tracked by Semler Brossy received more than 90 percent shareholder support this year, a higher rate than the national average.

"The unfortunate part is it's really driven more by a company's stock price than any other thing," Whittlesey said. "If your price is doing well, you can get away with a lot of things."

Expedia lavishes CEO

Expedia didn't hold a say-on-pay vote this year, but it wouldn't have mattered: Chairman Barry Diller controls a majority of the eligible votes. Ruel, the GMI consultant, says almost 20 percent of the non-Diller shareholders voted in 2012 against the chairman's re-election.

"The minority shareholders seem angry about certain things at the company," Ruel said.

Compensation experts say Expedia's approach to CEO pay should bother shareholders.

"If a company wanted to thumb its nose at shareholders and proxy advisers, this is what that would look like," said Whittlesey, the executive-pay consultant.

To establish 2012 benchmarks for executive pay, Expedia picked 15 companies as its peers, including video-game publisher Electronic Arts, cruise-line operator Royal Caribbean and Alaska Air Group. Then Expedia used a different list of peer companies for setting Chairman Diller's pay.

"This is very lazy, sloppy peer-group construction," Whittlesey said.

According to Equilar, CEO Khosrowshahi ranked third in total pay at companies based in the Pacific Northwest, and his $3 million bonus was the highest awarded to any of this year's Northwest CEOs.

But while Nike and Starbucks grew net income from continuing operations in 2012, Expedia lost ground: net income dropped 7 percent over the year, excluding the impact of the spinoff of TripAdvisor in December 2011.

Expedia's bigger competitor, Priceline, recorded a 34 percent increase in net income from continuing operations over 2011.

The board's compensation committee said it rewarded Expedia's CEO with a $3 million discretionary bonus and 50,000 shares valued at $2.8 million partly because he met a target -- either boosting the company's stock price or hotel-booking line of business.

The bar wasn't very high: Just a 5 percent increase in either metric.

Those are unusual performance measures that essentially guaranteed the CEO would get his performance pay, Whittlesey said.

The stock market's volatility means Expedia's price would go up that much at some point, he said. And linking executive pay to hotel-room bookings has little to do with financial performance, he said.

"That's like how many widgets can we sell even if we lose money on them?"

But there's more.

In July 2012, the board's compensation committee granted Khosrowshahi 300,000 stock options valued at $6.7 million.

A month later, in connection with the CEO signing a new three-year employment contract, the committee decided to immediately vest 400,000 restricted shares it originally awarded Khosrowshahi in 2006.

Under the original grant, which involved 800,000 shares, the award was contingent on Expedia reaching $1 billion in a fiscal year in operating income before amortization -- a goal the company didn't achieve.

"You missed the goal, but we're going to give it to you anyway," Whittlesey said.

The committee said it wanted to ensure the CEO "has significant at risk equity awards to appropriately align his interests with the interests of our stockholders." Khosrowshahi is required to hold at least 80 percent of the shares -- now worth more than $20 million -- until August 2015.

(Equilar excluded $885,876 related to this accelerated vesting of Khosrowshahi's 400,000 shares in the figures it provided to The Seattle Times. For all the companies in this study, Equilar excluded accounting adjustments that firms make to equity awards granted in previous years.)

As for perks, Khosrowshahi received $421,197 from personal use of the corporate jet and was credited with $463,453 for the past three years' dividends on unvested restricted shares.

All told, including salary, bonus, options exercised and stock vested, Khosrowshahi received more than $36 million in income from Expedia in 2012.

"They really seem to go out of their way to pay him above and beyond the structure of his pay package by doing a discretionary bonus, accelerating restricted stock and giving these perks," said GMI's Ruel.

An Expedia spokeswoman said its dividend practices were common among public companies and that they apply to all Expedia employees, not just its executives.

Moreover, the company said, Expedia's stock price was up 112 percent in 2012 under Khosrowshahi's leadership.

As long as that's true, Wall Street isn't complaining.

"It was a year where the CEO delivered on some of the objectives he'd been calling out for the past few years," said Tom White, an equity analyst in New York for Macquarie Capital. "I'd be hearing about it if the general view was he was overpaid."

(c)2013 The Seattle Times. Distributed by MCT Information Services.

![]()