Despite increased airline traffic, global carriers posted just a slim profit margin in 2012

Skift Take

IATA reports that passenger traffic grew 5.3% in 2012, a tad slower than the 5.9% growth in 2011, but despite the increased demand in 2012, global airlines produced a net profit margin of a stingy 1%.

IATA thus describes a sobering business environment if you are concerned about the ongoing health of the global airline industry.

"Growth and high aircraft utilization combined to help airlines deliver an estimated $6.7 billion profit in 2012 despite high fuel prices," said Tony Tyler, IATA’s director general and CEO. "But with a net profit margin of just 1.0% the industry is only just keeping its head above water.”

Of the $6.7 billion in global airline profits, North America contributed $2.4 billion, or nearly 36%.

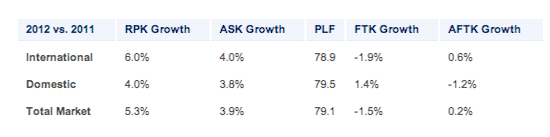

Passenger traffic growth in international markets led the way at 6% while U.S. domestic travel increased just 4%, IATA stated.

Although passenger traffic was up, air cargo fell 1.5% in 2012. The cargo numbers dropped as world trade declined "sharply" and shipping picked up some of the slack as trade shifted toward bulk commodities, IATA stated.

Here are the IATA data, 2012 versus 2011, for Revenue Passenger Kilometers, Available Seat Kilometers, Passenger Load Factor, Freight Ton Kilometers, and Available Freight Ton Kilometers:

The strongest passenger growth in international markets came from emerging regions, including the Middle East (15.4%), Latin America (8.4%), and Africa (7.5%).

North America (1.3%) experienced the slowest international passenger growth of any region because of "restructuring, consolidation, and tight capacity management," and achieved the highest load factor (82%).

Tyler expects 2013 will be a profitable year, but it won't be off the charts. He says:

"We are entering 2013 with some guarded optimism. Business confidence is up. The Eurozone situation is more stable than it was a year-ago and the US avoided the fiscal cliff. Significant headwinds remain. There is no end in sight for high fuel prices and GDP growth is projected at just 2.3%.

"But improved business confidence should help cargo markets to recover the lost ground from 2012. And the momentum built-up at the year-end should see the passenger business expand close to the 5% historical growth trend. 2013 will not be a banner year for profitability, but we should see some improvement on 2012."