Skift Take

The global hotel business is wide open with room for plenty of players to succeed, but Booking.com is way ahead of the curve and the article tells why.

Source: Skift

Author: Dennis Schaal

With 226,100 hotels in the fold and counting, Booking.com has been experiencing phenomenal growth and kicking butt. How does Booking.com do it?

Officials from parent company Priceline have long acknowledged that retaining Booking.com’s motivated and capable management, allowing the brand to operate independently, and offering Booking.com’s breadth of hotel supply have contributed to its phenomenal growth and success.

But, what is the secret sauce and how has Booking.com been able to execute so efficiently on its goals?

To understand that, and the global-hotel envy felt in the corporate suites of Expedia, Travelocity and Orbitz Worldwide, you have to return to the mid-point of the past decade.

At that juncture, the major U.S.-based online travel agencies were paying an inordinate amount of attention to the merchant model and its buffed-up margins, although they were warring with hotels over issues such as control, brand standards, rate parity and room allocations.

Negotiations between chains and properties, on the one hand, and OTA market managers on the other had become increasingly cumbersome, testy and complex. It had become difficult to police rate parity for the hotels when participating in the merchant model, and getting preferred placement in OTA search result displays led to protracted discussions and operational challenges.

The year 2005 became a turning point.

Still focusing on the merchant model, Travelocity bought UK-headquartered lastminute.com for a whopping $1.174 billion in July 2005, and the distraction of integrating its hodgepodge of sites and technologies may have set back Travelocity for years.

Cendant had picked up pan-European OTA ebookers for $404.3 million in February 2005 and it eventually became part of Orbitz Worldwide. Only six or seven years later did ebookers begin to make some headway.

Expedia, which already counted hotels.com (with its merchant model) among its brands, was content to grow mostly organically in the hotel sector at the time.

Enter Priceline which in July 2005 bought Amsterdam-based Booking.com for a mere $133 million, and paired it with Cambridge, UK-headquartered Active Hotels. The latter had been acquired about 10 months earlier for $161 million.

Booking.com and Active Hotels eschewed the merchant model in favor of a retail, or agency, model and replaced complexity with simplicity and efficiency for hotels.

Using a Booking.com extranet, hotels could set their own rates and room allocations, and collect payment from guests at the property. Commissions to Booking.com started at 12% instead of the 25%-30% margins given to the other OTAs and having to wait months to collect on prepaid bookings.

Importantly, the Booking.com extranet had a preview button that enabled hotels to immediately view where their properties would appear in Booking.com search results should they decide to give Booking.com a higher commission.

Instant gratification, so to speak.

And, with the preview button, this simplified process immediately replaced all of the complexities of discussions with other OTAs when tweaking net rates and seeking to see properties rise in OTA hotel-sort positions.

Expedia, the major OTA challenger to Booking.com, has in recent years been playing catch-up, having been outmaneuvered and out-executed by Booking.com. Expedia acquired Italy-based Venere, which uses an agency model, in 2008.

How can Booking.com be so successful with its relatively paltry 12% to 15% commissions?

Focusing on standalone hotels, Booking.com is considered to have best-in-class availability, even in tertiary global markets, because of its breadth of supply, and it can pour more money into search engine marketing because the conversion rates on its landing pages are widely considered to outpace the competition.

And, Booking.com is believed to be one of Google’s largest advertisers.

As one search engine official recently put it, referring to Booking.com: “They just get it. The scale they are doing it at is unbelievable.”

Or as another official articulated: “Digital marketing is their DNA.”

Consider that Booking.com’s AdWords sponsored links often appear atop Google pages because of their bid prices and quality scores, and then Booking.com is adept at conversions on its landing pages, which appear in 41 languages.

For example, If you search for hotels in Toulouse, France, the Booking.com landing page has a map-based search prominently displayed, and then there are all kinds of features on its hotel pages to entice conversions.

Notice all the different messages triggering conversion on a typical Booking.com page:

- “It’s busy in Toulouse on your selected dates, so prices might be higher than normal. Tip: Try different dates if you can.”

- “Latest booking 41 minutes ago.”

- In green lettering, you can see that a hotel is “Available,” that the price is US$201.13, and that there is “FREE CANCELLATION.”

- And the overall message, although not explicit, is you’d better hurry and book that room: “Last chance! Only 1 left.”

When you select a particular property, you’ll view a strikethrough price for a particular room type, the lower Booking.com rate in green and a “Book now” button, with the phrase beneath it, “It only takes 2 minutes.”

You can go on and on considering the ways Booking.com turns lookers into bookers on its hotel pages, including the “collaborative filtering” that Amazon pioneered.

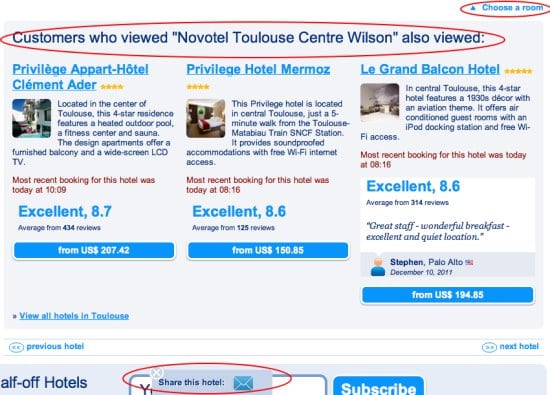

For example, near the bottom of a hotel page, you can view a shaded box, with the headline: “Customers who viewed ‘Novotel Toulouse Centre Wilson’ also viewed,” with the following display showing other properties which might be in this traveler’s consideration set:

All over the Web and mobile, you’ll see OTAs imitating Booking.com’s conversion techniques.

The only question is whether it’s too little, too late.

Have a confidential tip for Skift? Get in touch

Tags: hotels