Skift Take

With global airlines slated to have a margin of around $6 per passenger in 2014, it is clear that ancillary revenue, whether it be bag fees or selling frequent flyer miles to partners, is making the difference.

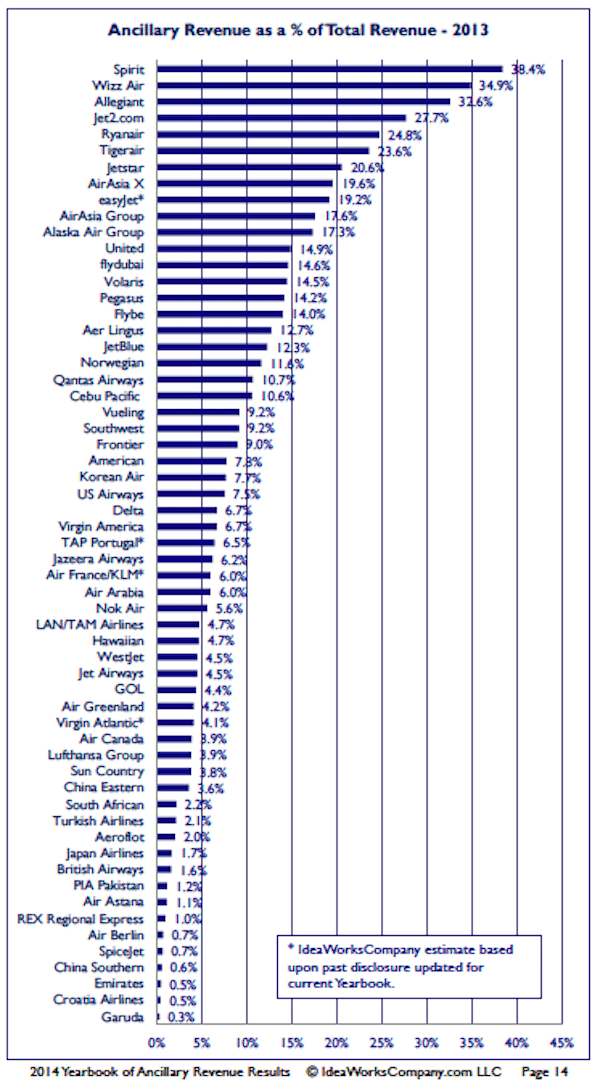

Spirit Airlines got a higher percentage of revenue, 38.4%, from ancillary services in 2013 than did any of the other 58 airlines around the world that disclosed their revenue from such fees and services.

But, in terms of actual dollars generated, 10 airlines made the billion dollar club in 2013, generating at least that amount in ancillary revenue.

United Airlines was the overall leader in ancillary revenue ($5.7 billion), followed by the combined American and US Airways ($3.18 billion) and Delta (2.52 billion).

The top 10 globally were: United Airlines ($5.7 billion), Delta $2.52 billion) American ($2.07 billion), Air France/KLM ($1.71 billion), Ryanair ($1.68 billion), Southwest ($1.62 billion), easyJet ($1.38 billion), Lufthansa Group ($1.28 billion), Qantas ($1.27 billion), and US Airways ($1.1 billion).

The new-entrant to the billion dollar club in 2013 was the Lufthansa Group ($1.28 billion)

These are some of the findings from IdeaWorks Co., which released a report [embedded below], updating its findings about airline ancillary revenue numbers and trends in 2013.

Only nine airlines achieved more than $1 billion in ancillary revenue in 2012, according to IdeaWorks.

In addition to Spirit, the other airlines among the top 10 in ancillary revenue as a percentage of total revenue were: Wizz Air (34.9%), Allegiant (32.6%), Jet2.com (27.7%), Ryanair (24.8), Tigerair (23.6%), Jetstar (20.6%), AirAsia X (19.6%), easyJet (19.2%), and AirAsia Group (17.6%).

Here are the numbers for all 59 airlines:

IdeaWorks, citing Spirit’s annual 10-K report to the Securities and Exchange Commission, generated ancillary revenue from checking and cabin baggage (43%), passenger usage charges (30%), other items (13%), advance seat selection (9%), and sales of frequent flyer miles, largely to partners (5%).

Interestingly, those passenger usage charges are geared to cover Sprit’s distribution costs, and charged when customers book flights on Spirit.com, call its third-party call centers, or book through travel agents.

Spirit charges a range of fees for carry-on and checked bags, including $100 for each when taken care of at the airport gate. Spirit argues that its charges for these fees enable it to keep the basic fare low.

Revenue Per Passenger

Jet2.com, and not Spirit, was the leader among the 59 global airlines in terms of ancillary revenue per passenger ($55.61). The other nine in the top 10 were Spirit ($51.22), Qantas ($45.67), Allegiant ($44.87), AirAsia X ($44.43), United (40.97), Korean Air ($38.93), Wizz Air (34.41), Virgin Atlantic ($33.92) and Alaska Air Group ($32.61).

These revenue per passenger numbers are an interesting way to look at the import of ancillary revenue to airlines as IdeaWorks cites IATA CEO Tony Tyler’s forecast in June that global airlines would achieve an average net margin of 2.4% in 2014, or less than $6 per passenger.

In 2013, according to IdeaWorks, the 59 global airlines that reported their ancillary revenue averaged $16 in ancillary revenue per passenger, enabling many to achieve profitability or at least to stem larger losses.

Among some of the interesting ancillary revenue tidbits in the report:

- Quantas got the highest percentage of revenue (80%) among the 59 airlines from selling frequent flyer miles to partners

- Air Greenland got into the hotel business and attracted $8.1 million in revenue from Hotel Arctic, which the airline owns and calls the globe’s “most northerly 4-star hotel.”

- Allegiant has an exclusive agreement with Enterprise Holdings for air and car rental packages, and the airline thus sold 844,858 car rental days in 2013.

- Southwest generated $195 million in ancillary revenue in 2013 from EarlyBird check-in.

The 59 airlines covered in the IdeaWorks report took in $31.5 billion in ancillary revenue in 2013, and that compares with 53 airlines generating $27.1 billion in 2012.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ancillary services, fees

Photo credit: United's gives travelers choices in buying EconomyPlus seats for individual flights or by subscription for the year. United Airlines