The 20 Trends Destinations Need to Understand to Compete for Tourists

Skift Take

The 100th annual Destination Marketing Association International (DMAI) conference took place this week at ARIA Resort & Casino Las Vegas, bringing together destination marketing organizations (DMOs) of all sizes from around the world.

During the event, DMAI unveiled phase one of its DMAI DestinationNEXT industry report. It was designed to help DMOs understand travel behavioral trends and suggest strategies to capitalize on those trends, while providing new benchmarking tools and best practices to help drive business in today’s rapidly changing tourism environment.

In March, DMAI sent out a survey to DMOs worldwide to discern what they thought were the biggest issues impacting the travel industry in 2014. The survey included a list of 65 tourism trends and 49 potential strategies in response to those trends, which DMAI asked the DMOs to rank in order of importance in their region.

DMAI polled two panels of experts to source the specific trends and strategies included in the survey. One was top tourism industry executives from different travel sectors. The second was senior leaders in non-travel related fields of business, economics, technology and social sciences.

A total of 327 DMOs from 36 countries replied to the survey, constituting the highest participation rate of any outreach program ever created by DMAI.

During the Las Vegas conference this week, an overview of the report findings was presented by Paul Ouimet, executive VP of InterVISTAS Consulting, one of the primary architects of the report. He first discussed the top 20 trends and 20 strategies culled from all of the DMO supplied data.

“The first takeaway, it was really surprising to us how much consensus there was on what the major trends are, and their potential impact on the industry,” said Ouimet. “Out of the top 20 trends, 13 of them basically dealt with the adoption of technology, combined with social media and the implications of those on customer expectations.”

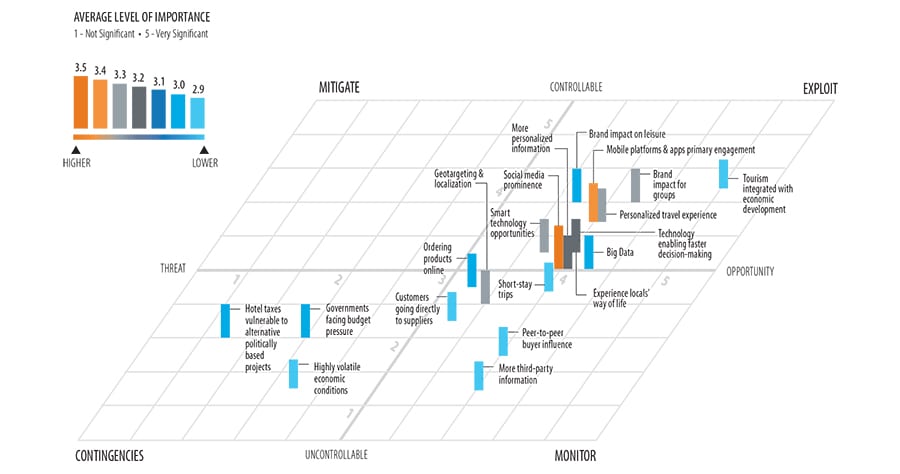

Ouimet then showed a SWOT-inspired “Future Map” plotting out the top 20 trends data to provide actionable information by coordinating threats and opportunities with controllable/uncontrollable scenarios. In terms of what can be controlled, and therefore strategized, the upper left quadrant represents threats that need to be mitigated, while the upper right quadrant represents opportunities. The threat quadrant is empty.

“I’ve done 15 to 20 of these future maps and this is the first time there were no trends or issues in the threat quadrant,” said Ouimet. “So the second big takeaway is there are tremendous opportunities today for DMOs to basically take advantage of some of these strengths to move forward.”

After technology, another primary trend theme that ranked high in the survey responses focused on the importance of destination brand management to drive business to a region. Among the top 20 tourism trends overall, DMOs ranked brand stewardship as #7 in importance for meetings/conventions and #13 for the leisure travel market.

The third most prolific theme revolved around the shift in DMO roles from sales/marketing organizations to regional economic development incubators. That was discussed considerably this year at DMAI.

“A lot of you talked about the trend of governments integrating tourism more in economic development within their communities,” said Ouimet. “That’s an opportunity for organizations to raise their profile and become more engaged in the community.”

Top 20 Trends & Strategies

Among the trend rankings in the DMAI DestinationNEXT report, there were three surprises that alarmed Ouimet and his team the most.

The first was the relatively low ranking (#45) of any perceived threat posed by Airbnb and the rest of the sharing accommodation providers. This could be slightly distorted due to the timing of the report. In the last six months, there’s been an increase in awareness among consumers that the sharing lodging economy is significantly more robust, more upscale and more business travel-friendly than was general consensus earlier this year.

Another surprise was the widespread concern regarding growing labor shortages and skill deficiencies in many areas of the tourism sector. The third surprise was the lack of concern about global warming impacting the tourism industry, which ranked second last (#64) in importance. It ranked among the top 20 in 2008.

Ouimet then discussed the three major transformational strategies pulled from the list of strategies prioritized by the DMO survey respondents.

“The number one strategy is on the sales and marketing side moving from broadcast to engagement, from push to pull,” said Ouimet. “This is a major paradigm shift for many sales and marketing organizations.”

Number two is brand building, relating to destination product development and visitor experience servicing, which Ouimet asserts is becoming “a major responsibility of the DMO of the future.”

“This is an area I think where many of your members, hoteliers and other stakeholders really need to get this message clearly,” he said. “This is a very, very important piece to sort of emphasize upon our stakeholders in the industry that it’s not good enough anymore just to do sales and marketing.”

The third transformational strategy highlights the rapid evolution of the DMO business model. According to the survey, over 36% of non-profit, membership-based DMOs anticipate significant changes in the next five years requiring them to engage with a wider range of stakeholders.

“There was a lot of talk about a broader role in economic development,” explained Ouimet. “A lot of talk about new performance measurements and more uniformity, and DMAI has done a lot in that area. And a lot of talk about more partnerships and collaboration with internal industry people as well as external outside the industry.”

NEXTPractices

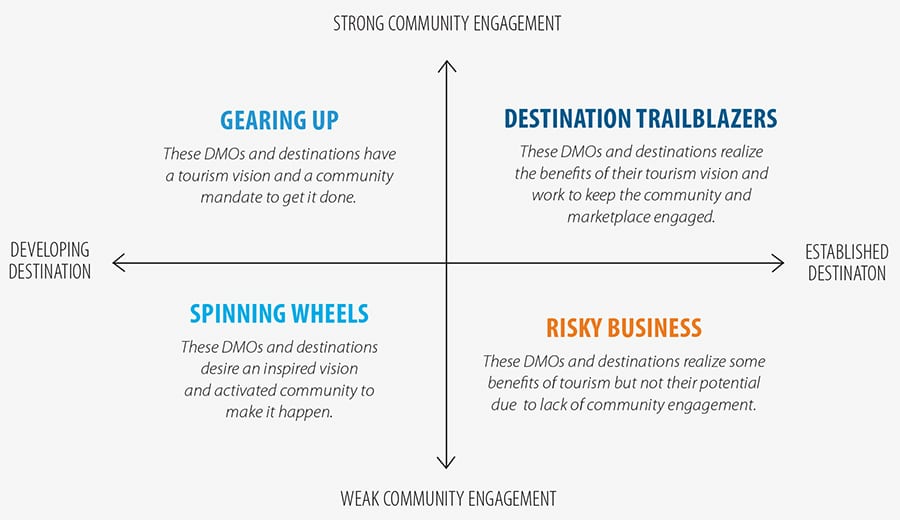

The DMAI DestinationNEXT report suggests the success of a DMO is based on how well it’s funded and firmly established, and how well it’s integrated into the local community. Based on those factors, the report publishers devised the four-quadrant scenario model above detailing the vitality of a DMO, categorized from least to most successful as: Spinning Wheels, Risky Business, Gearing Up and Destination Trailblazers.

The study goes into considerable detail about how DMOs can recognize which category they fall under, and how they can develop their infrastructure, services and community advocacy to move up the scale.

The focus of phase two of DestinationNEXT over the next nine months is to identify best practices, branded as “NEXTPractices,” to further help DMOs accomplish that evolution by tackling the three aforementioned transformational opportunities.

Ouimet explains that a web-based diagnostic tool will soon be available for DMOs to complete a self-assessment that will plot them on the scenario model. That will be in conjunction with regional workshops around the world to collect specific, real-world case studies to share with the entire DMAI membership.

“So that, what comes out of this is not going to be what a few consultants say,” summed up Ouimet. “It’s what you as a collective industry—the wisdom around this room—basically determines as being the best strategies.”

The Top 20 Trends

- Social media’s prominence in reaching the travel market (e.g., Facebook, Pinterest, Twitter, Weibo).

- Mobile platforms and apps becoming the primary engagement platform for travelers.

- Customers increasingly seeking a personalized travel experience.

- Smart technology (e.g., phones, bag tags, and cards) creating new opportunities for innovative new services and processes.

- Travelers demanding more information, control, interaction, and personalization.

- Geotargeting and localization becoming more prevalent.

- Brand identity for destinations becoming more critical in terms of meeting planner perceptions about value and experience.

- Customers increasingly looking for a travel experience that allows them to experience a local’s way of life.

- Technology enabling faster decision-making by customers, thereby, increasing business to a destination.

- Consumers becoming increasingly comfortable with ordering products online.

- Hotel taxes increasingly vulnerable to alternative politically based projects.

- Big Data arriving for the tourism industry.

- The brand of a destination becoming a more important factor in travel decisions to consumers.

- Governments facing pressure to reduce or eliminate direct financial subsidies to the tourism sector.

- Short-stay trips and mini vacations becoming increasingly popular.

- More third-party information providers aggregating content about destinations.

- Peer-to-peer buyer influence driving customer purchases.

- Governments dealing with tourism from an integrated, multidepartmental perspective, focused on economic development.

- Customers increasingly going directly to suppliers for goods and services.

- Economic conditions continuing to be highly volatile, subject to global and regional shocks.

Greg Oates covers hotel/tourism development and travel brand media. email/twitter