Skift Take

Hotel executives should no longer consider Airbnb solely a budget hospitality brand catering to a fringe element of consumers.

Spend enough time with any hotel executive and the issue of Airbnb will always come up eventually, with someone asking, “What impact do you think Airbnb is going to have on the hotel industry?”

It’s the future tense of that question that’s important, because no one knows the answer for sure and no one knows how concerned they should be.

Hotel consulting company HVS came out with a new report suggesting that hotel executives first need to have an “awareness of the increasing quality, availability, and economy of lodging options offered through Airbnb. Many hoteliers and hotel executives are too quick to dismiss Airbnb, thinking its listings far too humble, too inconsistent, and too unappealing to travelers accustomed to more upscale accommodations.”

For example, in February this year, Kimpton Hotels CEO Mike Depatie appeared on a Bay Area NBC television affiliate with three business reporters, including Michal Lev-Ram, senior editor at Fortune Magazine.

She asked, “So how many hours a night does Airbnb keep you awake? Are you worried? Are you stressed?”

Here is the first half of Depatie’s answer:

“No. Oddly enough I was with Chip Conley yesterday, he’s a friend of mine who runs hospitality experience for Airbnb. I went down to Airbnb’s headquarters, he was very gracious to have me there. By the way, it was a lot of fun, I loved it. I think they’re a real disruptor. I think they’re definitely going to disrupt the business in some way, they’re already doing it. I think it’s public out there that there’s plans to sell 40 million room nights this year, 30 million of which can be offshore, 10 million here in the United States. There’s five million traditional hotel rooms in the United States. That’s two nights occupancy.

“So it’s not insignificant but Airbnb is mostly a lower priced product. You know, we’re priced at $200 a night. They’re probably priced around $100 a night. Their average stay is five nights. Ours is probably about two nights. They’re heavily skewed toward leisure. We’re heavily skewed toward business. And so I think they’re going to get into that market but I’m not totally worried about them. They’re a bigger competitor for more limited service hotels at a lower price point.”

Maybe that was true in February.

The HVS report shows an Airbnb listing for July 11-13, 2014 for a three-bedroom, 4,000-square-foot luxury apartment in Soho with 12-foot ceilings priced at $990 per night. During the same dates, a standard 600-square-foot guest room at Four Seasons New York ranges from $750-$1,095 per night depending on the view.

Checking out availability in Miami where there are three Kimpton Hotels, again for the same dates, there are 497 listings in the $200+ per night range.

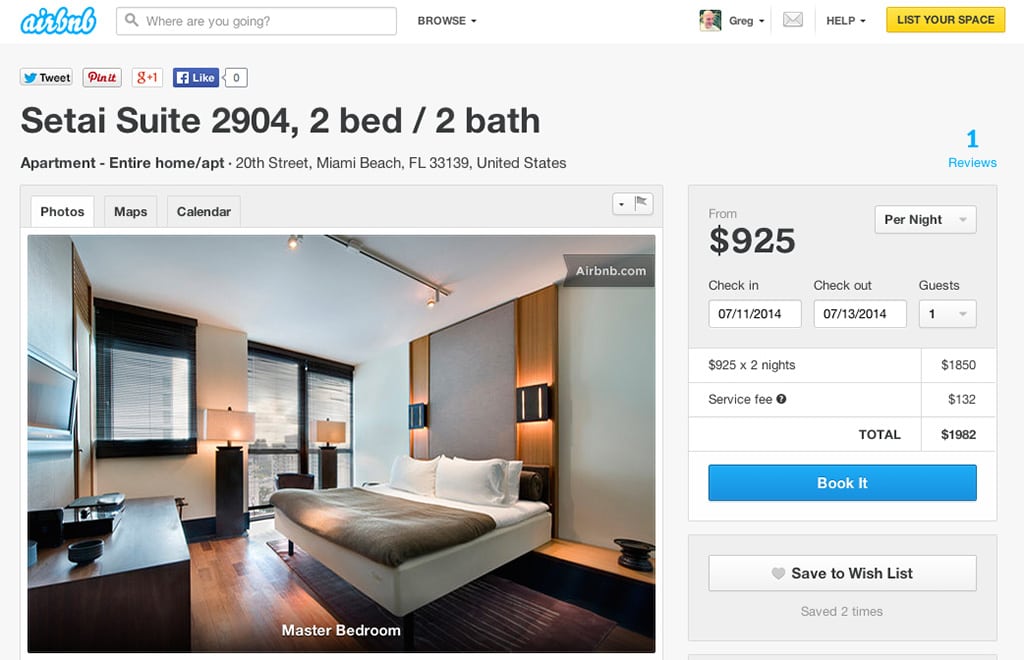

Or, at The Setai Miami Beach, a two-bedroom waterview residence unit with a balcony is listed on Airbnb for $925 per night in July. On the hotel website booking engine, a similar two-bedroom hotel unit costs $2,300 per night during the same timeframe.

As for the notion that Airbnb caters only to the leisure market, Lev-Ram replied to Depatie’s above statement saying that she rents her place often on Airbnb, and most of her guests are business travelers.

The HVS report also highlights Berkshire-Hathaway’s annual shareholder meeting last month for 38,000 attendees in Omaha. Typically the local hotel inventory can accommodate the group each year, but CEO Warren Buffett advised shareholders to book Airbnb this year to combat the hotel price gouging that always happens during the event.

Where the HVS report falls short is in the Conclusion section suggesting some of the drawbacks of Airbnb. The whitepaper states that Airbnb doesn’t “offer any consistent amenities (such as Internet access, food and beverage outlets, concierge services, recreational amenities, or parking) that are standard at full-service hotels.”

It is exactly those amenities that many travelers who fit the Airbnb profile don’t want to pay for, or even require, and which build in significant additional cost. Especially in large cosmopolitan cities where Airbnb is most active, if a guest is adventurous enough to book Airbnb, they’re also more likely to explore outside the hotel for interesting restaurants and bars, and they don’t need a concierge to point them in the right direction.

As for the issue of Wi-Fi, the quality of in-room online access is often abysmal in many large branded hotels, not to mention overly expensive. Meanwhile, the average Wi-Fi access at most individual residences in modern cities is satisfactory for even heavy users with two or more devices.

The report sums up, “it would be wise for hoteliers to look into finding ways to list their rooms on Airbnb as well.”

At first glance that statement seems unrealistic, but in an era of so much disruption in hospitality and tourism, is that plausible? Or would hotels then be competing against themselves?

What the HVS also doesn’t take into account is the overall “cool factor” and mystique surrounding Airbnb and other alternative accommodations offering a unique experience. Last year in Dublin during the TBEX travel blogger conference, Chip Conley and his Airbnb story resonated deeply with those in attendance sitting in a dreary hotel ballroom.

That, as much as price, is driving Airbnb’s market penetration.

20% of World Cup attendees are staying in an Airbnb listing. Based upon # of listings, Airbnb has become Brazil's largest hospitality co.

— Chip Conley (@ChipConley) June 17, 2014

Greg Oates covers hotel/tourism development and travel brand media. email / twitter

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: Airbnb listing for The Setai Miami Beach Airbnb