Does OpenTable Deal Signal New Acquisition Strategy for Priceline?

Skift Take

A new CEO, and a new and more aggressive acquisition strategy?

The Priceline Group's announcement that it agreed to acquire restaurant reservations platform OpenTable for $2.6 billion represents Priceline Group CEO Darren Huston's third acquisition since taking over for Jeffery Boyd on January 1.

To be sure, the other two acquisitions, namely that of Buuteeq and Qlika, pale in comparison. And just to put these into perspective: Priceline paid $133 million for Booking.com in 2005.

Here's a look at five of the Priceline Group's recent acquisitions:

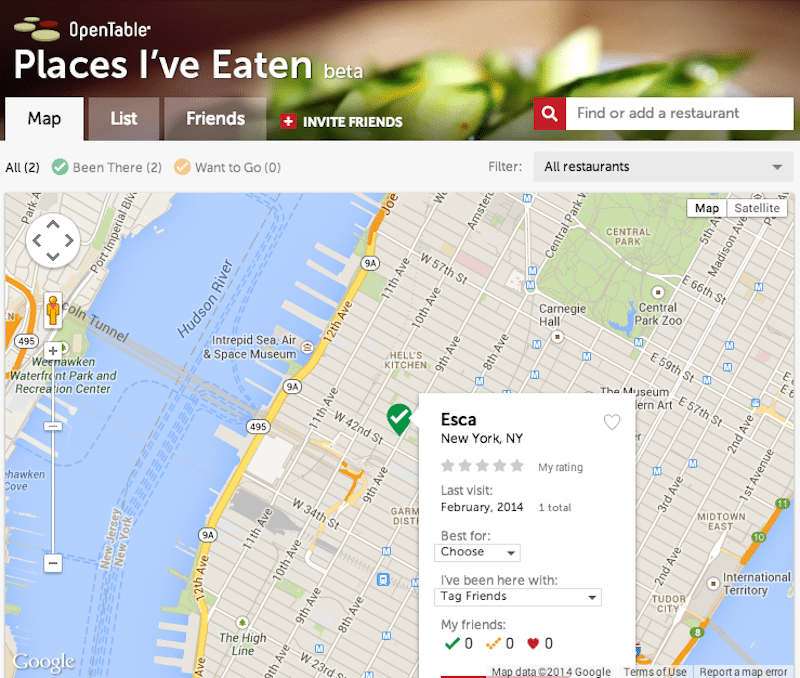

OpenTable

Using its non-digital wallet, the Priceline Group announced June 13 it intends to acquire OpenTable for $2.6 billion in cash in a bid to replenish and fatten its bankroll by targeting the global restaurant business.

The deal, which would close in the third quarter, is among the Priceline Group's largest, and is greater than the $2.1 billion it paid (mostly in stock) for Kayak in 2013.

In addition to aggressive plans to accelerate OpenTable's growth, Priceline intends to cross-promote restaurant reservations among its brands, and to tap into innovations in mobile and payments.

Buuteeq

Just three days before announcing the OpenTable deal, on June 10 the Priceline Group revealed it had acquired Buuteeq, a hotel digital marketing platform, in a quest for Priceline companies Booking.com and Agoda to have the capability to provide more all-encompassing digital solutions to hotel partners. The terms of the deal were not disclosed.

Qlika

While Buuteeq became part of Booking.com, the Priceline Group snagged then-Israel-based Qlika, a two-year-old startup focusing on digital mico-targeting and search engine marketing, for Thailand-based Agoda for $3 milliion.

That digital targeting prowess comes in especially handy for all of the Priceline Group brands, including would-be new member OpenTable.

Kayak

The largest acquisition prior to OpenTable, Kayak came into the Priceline Group fold in 2013 for $2.1 billion, or $1.9 billion net of cash acquired. (The acquisition price at $2.1 billion turned out to be greater than widely reported at the time of the announcement.)

Years earlier, Priceline had downplayed the value of travel metasearch as practiced by Kayak and others, but had a change of heart as the market changed and now competes head-on with TripAdvisor, Expedia's Trivago, Skyscanner, and Google, among others.

Rentalcars.com

Perhaps the brand with the lowest profile in the Priceline Group arsenal, Traveljigsaw, which eventually was rebranded as Rentalcars.com, entered the Group in 2010.

The Priceline Group took a majority stake in Traveljigsaw in 2010, and in April 2013 acquired the rest of it for an aggregate price of $192.5 million.

Independent-Minded

The Priceline Group largely enables acquired brands to operate independently of one another, and actually likes the competition among them when offerings overlap. The Group also places a major emphasis on the management team that comes along with the acquisition, insisting on a cultural and philosophical fit.

Research outfit eMarketer argues that the OpenTable acquisition sets up the Priceline Group in further competition with Google for local advertising dollars.

As with Priceline 2013 acquisition of Kayak, "OpenTable creates more potential revenue streams from search listings, extending its reach beyond pre-trip travel bookings and into opportunities for local advertising dollars," eMarketer states.

"In Q1 2014, Priceline Group reported $73.66 million in global advertising revenues, up from just $3.5 million in Q1 2013. The Kayak deal closed in May 2013."