CEO Interview: Cheapflights and Momondo Attempt a Dual-Brand Strategy

Skift Take

Imagine if Kayak acquired Skyscanner and they decided to divide up the world, pursuing different markets for their travel-metasearch offerings.

Or if Trivago decided to launch a second metasearch brand, and they decided to pick off different countries, targeting diverse demographics with different offerings.

Multi-brand strategies (see Priceline, Booking.com and Agoda or Expedia, Hotels.com and Hotwire) work well enough in other categories, so why not metasearch?

It hasn’t really been tried before, but the Momondo Group, created in 2012 after 18-year-old Cheapflights Media acquired Denmark-based Momondo, is giving it a whirl.

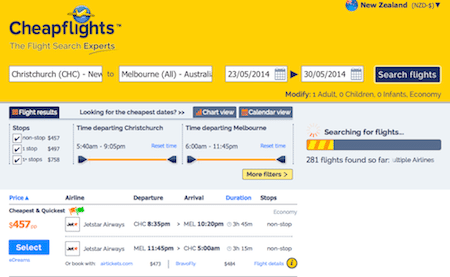

UK-based Cheapflights, which has until now specialized solely in publishing negotiated flight deals, just launched what it hopes will be a harbinger of things to come — a flight-metasearch site in New Zealand.

That’s a huge departure for Cheapflights, which has been a Top 10 online travel agent site in the UK, according to Hitwise. Cheapflights has flight-deal sites in the UK and Ireland, the U.S., Canada, Australia, Germany, Spain, France, Italy, and South Africa, but wants to cash in on the hot, and presumably more lucrative, metasearch trend.

Meanwhile, Denmark-based Momondo, with its strength in the Nordics and Russia, has a presence in the U.S. and Europe, and ramped things up with the launch of dedicated metasearch sites over the last year in Ireland, Poland, Ukraine, China, Hong Kong and Taiwan.

“We think that a dual-brand strategy (and our mixed model approach) gives us a global advantage in giving consumers what they want in different markets, demographics and products, says Hugo Burge, CEO of Momondo Group.

“Our overall goal is to make more inspiring and better travel search,” Burge says. “That clearly means different things to different markets, and we believe this tailored approach has served us, and more importantly, our users, well.”

Zugu, then Momondo

The New Zealand metasearch launch is a big change for Cheapflights, which has a complicated short history with metasearch. Cheapflights had been solely a deal publisher until a few years ago when it launched a new metasearch brand, Zugu.

But, the project was shut down and Cheapflights, which had been bootstrapped since its early days, opted instead to borrow some $32 million and acquire Momondo.

What’s the difference between deal-publishing and metasearch?

On its Cheapflights UK site, Cheapflights publishes one deal at a time, and the user can click over to one website, such as BA.com, to book. This is the way Cheapflights has done business over the past 18 years or so.

But, on its just-launched site in New Zealand, users might see a Christchurch to Sydney flight, and they’ll view airfares and booking options from eight websites at a time.

The difference for Cheapflights is that it is hopping onboard the metasearch bandwagon, and it is a safe bet that the economics are much more attractive in metasearch, where a range of online travel agencies and airlines are competing for clicks and bookings.

The combined Cheapflights and Momondo have a presence in more than 30 countries, and in April, for the first time, revenue from metasearch “became the majority part of our business,” Burge says.

The Momondo Group has been fairly silent over the last couple of years while it has been integrating the two brands, paying down debit, and expanding the Momondo team from 17 employees to 100.

But, the privately held Momondo Group recently released first quarter of 2014 results, showing EBITDA up 32% year-over-year to around $5.37 million on revenue of $24.3 million, a more than 29% jump.

But, does going out into the world with two metasearch brands make any sense?

Two Meta Brands

Burge argues that the two brands are “differentiated but complementary.”

“For one thing, the geographic footprint of the two businesses mesh in nicely to give different market strengths and each has its own target markets based on its perceived strengths and where it is succeeding,” Burge says.

“In some markets we are both doing well, and that is fine, too,” Burge adds. “That is the beauty of the sheer size of the travel industry.”

It remains to be seen, though, whether the differences between Momondo and Cheapflights and the rest of the pack are significant enough for big, long-term success.

Burge cites various studies showing Momondo finding the cheapest flights, but rivals assuredly can trot out their own studies, too.

“We are not the same as other bland travel search sites,” Burge says, pointing to Momondo features such as Best Fit Flights, Flight Insights, Momondo Places and Friend Compass, the Cheapflights New Zealand site, and “our colorful, tailored newsletter products.”

Tough U.S. Market

The travel metasearch market can be really tough, particularly in the U.S., where heavily funded Room 77, which had a product with some differentiation, recently licensed its tech and dispatched a chunk of its staff to Google and for all practical purposes, downgraded its metasearch operation in favor of its CheckMate mobile hotel-check-in brand.

Hipmunk, too, which has its famed Agony index for flight search, and has been pioneering multi-device search, also has had trouble breaking through against the big-spending ways of Priceline and Expedia, for example.

“I think the market focus and differentiation of Room 77 was not enough,” Burge says. “To take on the U.S. as your first market, where there are very established players and less hotel price differentiation, does not seem a good strategy to me, however much money you have. Great energy, differentiation and company culture are worth more than just money every time.”

Cheapflights has long had a presence in the U.S. and Canada, and has been among the Top 20 online travel sites, according to Hitwise, but Momondo will find the going tough in the U.S. amidst the torrent of TV advertising and bigger players.

Momondo’s revenue is up 125% year over year in the U.S., Burge says, albeit from a relatively small base.

Burge says the Momondo Group “has terrific presence in U.S., but it is not a major focus right now.”

“I don’t think the game is over for us in the U.S., Burge says. “It is a matter of timing for us.”

Fortunately for the Momondo Group and others, the global travel market, with all its geographies, is huge place and opportunity. It’s all a matter of choosing the correct targets, allocating resources wisely, and hopefully having the right brands to make a go of it.

We’ll see how it goes.