Sharing Economy Can’t Save Tour Guides, says Tour Startup CEO

Skift Take

Berlin-based tours and activities startup GetYourGuide just bought the assets of a dead business — in more ways than one.

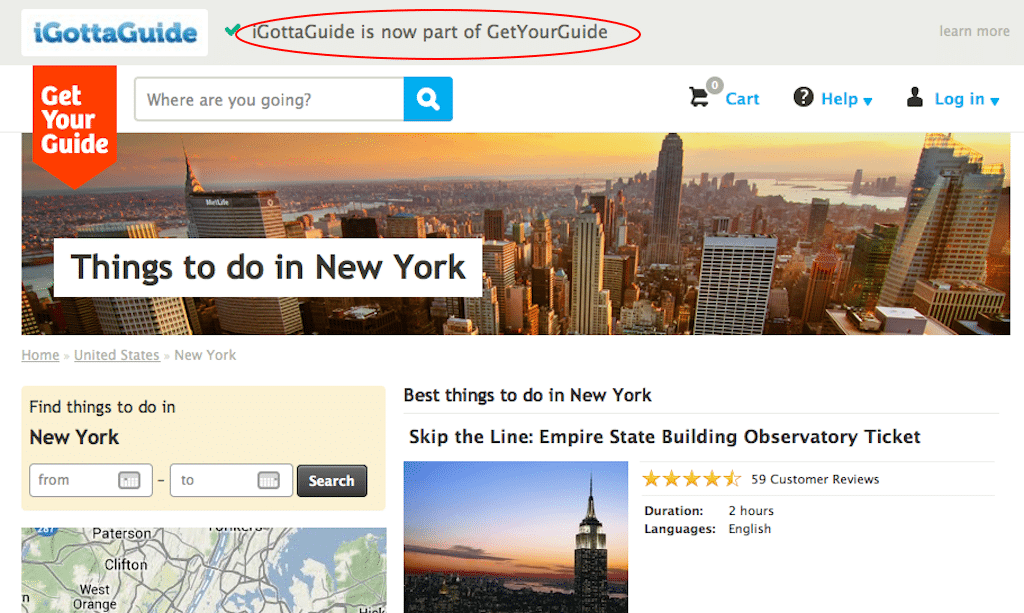

GetYourGuide, with $16.5 million in funding, purchased the assets of IGottaGuide, a defunct New York City-based company that specialized — sharing economy-style — in matching amateur and professional tour guides with tour-seeking locals and travelers.

GetYourGuide is shutting down IGottaGuide as a brand, just as GetYourGuide did after it acquired the assets in April of another so-called peer-to-peer tour guide company, Gidsy.

GetYourGuide CEO Johannes Reck tells Skift that the peer-to-peer tour guide sector — if you could ever really call it that in terms of consumer adoption — is dead.

Kaput.

Reck should know because GetYourGuide started as a peer-to-peer tour guide business, and then pivoted into tours and activities such as offering tickets for the London Eye 4D Experience, New York City helicopter tours, and 3-hour San Francisco Segway tours.

“The interesting thing is that peer to peer for activities is basically dead,” Reck says. “Not a single company has succeeded in it, including the initial version of GetYourGuide, which we tried in the beginning.”

“I think the peer-to-peer market will go belly up,” Reck says. “Gidsy was the first. That was a very strong signal.”

Why Buy a Dead Business?

So why would GetYourGuide buy IGottaGuide’s assets if the sector is stagnating?

Reck says IGottaGuide “is a good buy for us in terms of building our New York presence,” and will help with organic search.

IGottaGuide’s founders are being retained as consultants on the North American market while the brand is being terminated, with users redirected to GetYourGuide.

Reck says IGottaGuide’s peer-to-peer tours will indeed be integrated into GetYourGuide’s website, as Gidsy’s were, as a niche offering, what Reck terms “the long tail.”

Core Products Versus Peer-to-Peer Tour Guides

“We are still very focused on the fat tail,” Reck says, referring to more established tours and activities that tend to be run by professionals.

Skift wrote a series of articles on the hopeless economics of peer-to-peer tour-guide startups, and the challenges facing even the more established and well-funded tours and activities startups, including GetYourGuide and Viator.

The competition between GetYourGuide and Viator will heat up, especially as GetYourGuide puts more resources into the U.S., Reck says, and he believes both companies are likely to acquire more tour startups on the cheap.

“Viator took the U.S. and we took Europe,” Reck contends, referring to online and mobile tours and activities startups and their relative market clout.

Au Contraire, Viator Says

Viator CEO Barrie Seidenberg challenges Reck’s notion that Viator plays second fiddle to GetYourGuide in Europe.

“I am not sure what he (Reck) is basing his remarks on in terms of metrics and measurement,” Seidenberg says. “If you look at key business metrics like volume of product sold and sales to customers within a given region, I am confident of Viator’s leadership in the space in both the U.S. and Europe.”

Of course, they aren’t even in the conversation with major event-ticket vendors such as Ticketmaster, and established tour companies and distributors such as Gray Line.

Of struggling and defunct peer-to-peer tour guide startups, Recks says “all of them will be falling into our arms.”

Seidenberg of Viator says it is not focused on acquiring peer-to-peer startups, although three years ago it acquired and integrated OurExplorer, which now boasts a network of 6,000 private guides.

“As for the future, Viator is focused on strategic initiatives that we believe have greater potential to accelerate our already formidable and organic growth, build the strength of the Viator brand, and deliver the best local experiences possible for travelers,” Seidenberg says.

Acquisition Targets?

If GetYourGuide, Viator or even online travel agencies such as Expedia indeed go shopping for tours and activities startups in the U.S., Vayable and Peek, among others, could be in the consideration set. Zozi, which supplements its tour offerings with gear sales, is small, but could be of interest.

GetYourGuide would seem to be more in need of U.S. acquisitions than Viator, given GetYourGuide’s goal of getting some traction in the U.S.

Vayable is probably the most prominent of the second-tier tours and activities players in the U.S. market while Peek is very small, but comes with investors including Google’s Eric Schmidt, Twitter and Square co-founder Jack Dorsey, and others.