Special Report: Investors boycott tours and activities as peer-to-peer shakeout looms

Skift Take

This is part three of our three-part series on the online tours and activities market, focusing on the buzz around venture-backed startups in the space. Here is Part One and Part Two.

Tours and activities is a sector still trying to prove it is a viable market, and venture capital for the most part is sitting on the sidelines.

Earlier this year five-year-old GetYourGuide raised a $14 million Series A round from Spark Capital and Highland Capital Partners Europe, and that created some excitement.

But in recent years just 11 tours and activities companies have announced seed or venture capital funding of $1 million or greater, Skift has found, with these companies raising a total of $65.6 million.

That funding includes $20 million for Viator, a tours and activities company founded 18 years ago, that says it is now relying on organic growth.

Here are the companies with $1 million or more in funding:

| COMPANY | FUNDING |

|---|---|

| Viator | $20 million |

| GetYourGuide | $16.5 million |

| Zozi | $10 million |

| Isango | $8 million |

| My Destination | $2.3 million |

| Stray Boots | $2.25 million |

| Sidetour | $1.5 million |

| Triptrotting | $1.5 million |

| Peek | $1.37 million |

| Gidsy | $1.2 million |

| Tripping | $1 million |

You can get an appreciation of how relatively small that $65.6 million investment is when you consider that travel metasearch company Kayak and fare-search technology company ITA Software raised about $196 million and $100 million, respectively, on their own before making their exits.

“I have never thought it was a big enough market to get excited about and jump in,” says one experienced venture capitalist. “The investment in tours and activities is in the tens of millions, not the hundreds of millions.”

There are dozens of companies in tours and activities, and many are trying to prove to would-be investors that the addressable market, which PhoCusWright pegged at about $4.1 billion in the U.S. in 2009, is large enough to sustain their businesses.

The dearly departed

Skift checked the status of more than 80 tours and activities startups around the world and found that at least a dozen of them have closed up shop or became inactive over the last couple of years. These include AvidTrips, Groupenture, Nature & Kind, Tourabout, iGottaGuide, Omoly, Skyara, RAVN, Tourbie, YowTrip, Touringa, and WePlann.

Another two companies were acquired in 2010. Google executed an “acqui-hire” of Ruba, and NileGuide acquired Localyte; neither of the acquired companies had attracted much funding. And, Localyte’s new owner, MediaShift, plans to phase out the service, as Google did with Ruba.

A big chunk of the tours and activities startups are of the peer-to-peer variety, offering local guides and their tours to the sites’ communities.

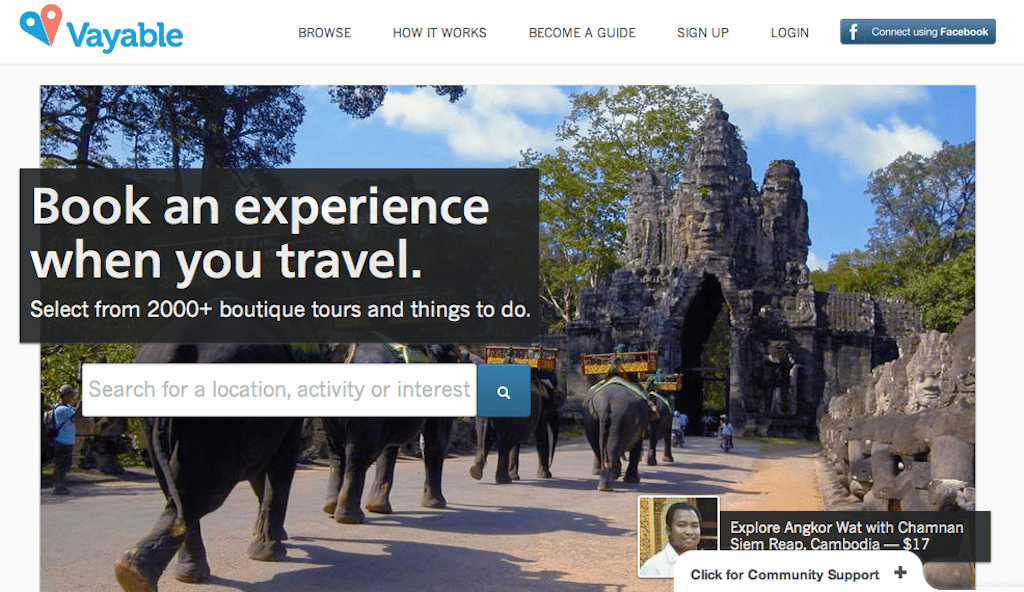

Vayable argues that the market is viable

One such startup is San Francisco-based Vayable, which says it has more than 5,000 guides and a 15,000-member community with a focus on tours in San Francisco, New York, Paris, London, and Istanbul.

Founded in 2010 and with seed funding from more than a dozen investors, ranging from Y Combinator to Michael Arrington and former Expedia CEO Erik Blachford, Vayable has been profitable since August 2012, says Jaime Wong, Vayable co-founder and CEO.

Vayable and the peer-to-peer market are capitalizing on “a cultural shift in taste and consciousness with people not wanting the double-decker bus anymore,” says Wong, who concedes it is still “a nascent market” with no clear winners yet.

“No one’s exploding yet,” Wong admits, likening the situation to the early days of companies such as eBay, Amazon, and Airbnb. “None of these were launch-and-go businesses.”

The peer-to-peer market faces considerable challenges: relatively small transactions; tight margins; advance-booking requirements; guides who advertise their services on multiple sites and who may be unlicensed; and maintaining enough business when leisure travelers are apt to only take a one or two vacations per year.

Vayable charges travelers a 3% service fee, collects a 15% commission on the tours, urges guides to abide by local laws, offers reservations from 5 days’ ahead to same-day, and finds that some travelers book multiple tours for each trip, Wong says.

Sleeping giants awakening?

“There are signals that there is a real market here,” Wong says, referring to pronoucements from Expedia that it intends to put new resources and focus on tours and activities.

Sometimes people in tours and activities appear to be grasping for hopeful signs, and some worry privately whether Kayak’s recent decision to stop offering tours from GetYourGuide in Kayak’s mobile apps is a bad omen, or an isolated development.

“I expect 2013 to be the year some of the sleeping giants finally wake up and take serious look at the sector,” says Alex Kremer, co-founder and COO of Flextrip, a tours and activities distribution network based in Boulder, Colorado. “Expedia’s announcements late last year have helped that along more than anything.”

“Combine that with the influx of capital for B2C sites like GetYourGuide, and you have the signs of an interesting couple of years ahead,” Kremer says.

Still, there are some significant challenges, including growing user-acquisition costs, lack of brand recognition for B2C brands, and operational inefficiencies ranging from voucher systems to booking cutoffs, Kremer says.

“Both of these are being worked out,” Kremer says, referring to the voucher systems and booking cutoffs, “but it will take time.”

What have you done lately?

Funded startups, meanwhile, are pressing onward.

For example, San Francisco-based Zozi, which has raised $10 million in funding to date from entities such as the Pritzker Family, LaunchCapital, 500 Startups, Forerunner Ventures, and ZIG Capital, relaunched its website in November 2012 to transition from a deal site into an “adventure marketplace,” says spokesperson Tian Lee.

And, late last year, Zozi expanded beyond “local experiences and travel getaways” and began selling outdoor gear and apparel from companies such as Adidas, New Balance, Patagonia, and Timex, Lee says.

There’s been some talk that London-based Isango has faded after raising $8 million in a Series A round in 2008 from SPARK Ventures and Beringea.

However, products director Deepak Jha challenges that notion, saying Isango has “revenues in reasonable-sized double-digit millions,” and is considerably larger than GetYourGuide.

Isango, with more than 100 micro-sites and a focus on the UK, Austria, Germany, Switzerland, Australia and Canada, projects growth of 70% to 90% in 2013, Jha says.

Business model debate

Then there’s San Francisco-headquartered Viator, with $20 million in funding, and Carlyle Venture Partners as the lead investor.

Some have charged that Viator has plateaued, and that its business model is hampered by an emphasis on affiliate deals.

Viator CEO Barrie Seidenberg counters:

“Our direct-to-consumer business through our Viator-branded properties today represents the majority of our revenue. Having said that, while the affiliate model may not be high margin, it is also growing nicely, and there are other benefits to these partnerships as they add scale to our business and value for our partners with minimal associated costs.”

Critics have also pointed out that 5-year-old GetYourGuide has almost raised as much funding as the much-older Viator.

“Fortunately, we have had no need for outside capital to fund what’s been considerable growth over the past several years,” Seidenberg says. “We continue to see opportunity for significant growth, which we will be able to fund organically, with mobile being a key component.”

Peer to disappear?

If the larger players in tours and activities face challenges in distribution, brand recognition, mobile, and the size of the addressable market, Kremer of Flextrip expects that the P2P companies in particular are in for some bloodletting, although he diplomatically says “headwinds” are on the horizon.

“Margins are incredibly tight (just 10% in some cases) and the promiscuous behavior of guides in terms of working with multiple P2P marketplaces will prove very challenging,” Kremer says. “The amount of distribution volume required to make things work at those margins has no chance of materializing anytime soon.”

While the funded tour and activities startups are struggling for traction and more P2P companies will likely drop out of sight over the next year or two, even venture capitalists who are currently abstaining from investing in the sector acknowledge that the mobile revolution could change the game.

The dynamic could be transformed when you might be able to sit in your hotel and book a tour an hour later on your tablet — or whatever the mobile device du jour may be.

Says one big-time investor: “I haven’t been tempted to jump in, but mobile could change everything.”