Skift Take

The Expedia settlement means its hotel-tax practices are not one-size fits all. It has to pay the full taxes in places like Columbus, Georgia, and New York, but can avoid them in locales where it has beaten back lawsuits.

This is a big story about a relatively small city, and how the major online travel agencies wiped it off the map, only to have the city prevail in the end.

The issue was hotel taxes, and the news is that Expedia has settled a 6-year-old dispute with Columbus, Georgia, agreeing to pay $586,000 in back occupancy taxes, plus attorneys’ fees and expenses, for hotel bookings on Expedia.com and Hotels.com, the Ledger-Enquirer reports.

Expedia, the story says, also agrees going forward to pay occupancy tax on the full retail rate it charges consumers, and to re-list the cities’ hotels.

An Expedia spokesperson had no comment on the settlement, saying “we’re not able to comment on litigation.”

Expedia and the other major OTAs have been battling states, counties and municipalities over the hotel tax issue since 2004 when Los Angeles filed suit for back occupancy taxes. Expedia argues generally that it only owes taxes on the net rate it gets from hotels, and not on the full retail rate it charges consumers.

Despite this latest settlement, at the end of 2011, Expedia was dealing with about 50 hotel tax lawsuits, and was subject to audits and assessments from about 150 states, counties and municipalities in the U.S.

Some of the suits have gone Expedia’s way, and others, such as in Columbus, Georgia, haven’t. Columbus is the third-largest city in Georgia, offering about 4,600 hotel rooms, but it is obviously a very small market for Expedia and its OTA peers.

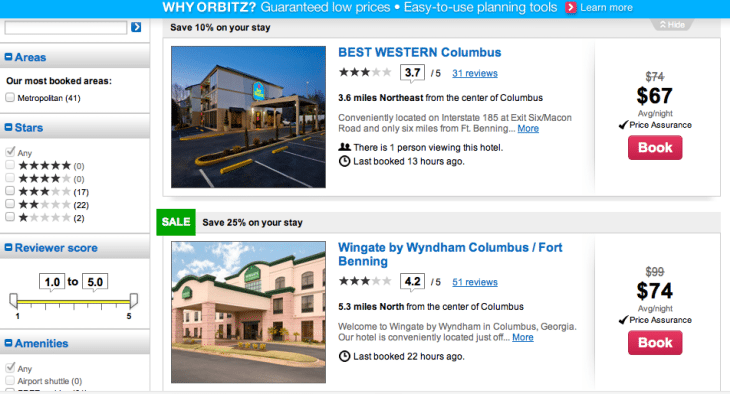

Expedia, Travelocity, Orbitz and Priceline stopped offering bookings for Columbus hotels as early as 2008 following a state Superior Court ruling that Expedia had to “collect the hotel occupancy tax based on the total amount it discloses to the consumer as the room rate, room charge or other comparable term.”

The four OTAs then banished the city’s merchant-model hotel inventory, which meant that their customers could only find rooms on their sites in nearby towns.

Even today, if you try to search for a room in Columbus, Georgia, on Expedia.com, the site doesn’t even let you search. Instead, you get an error message, referring you to “best-matching destinations,” with Columbus, Georgia, absent.

With the settlement, the city’s absence on Expedia.com and Hotels.com will undoubtedly be ending soon.

But, the OTAs’ hardball tactics hurt the Columbus, Georgia, hotel business.

When online travel gurus argue that hotels should merely sell direct to consumers and boycott the OTAs, they should look to Columbus, Georgia’s woes in lost hotel sales to see how it fared.

Critics of the hotel-tax lawsuits are correct in at least one-regard: Lawyers are the largest beneficiaries of these litigations.

The total amount of Expedia’s settlement was nearly $1.6 million, but the lion’s share goes to the city’s outside counsel, which collects $401,000 in fees, and $600,000 in expenses.

Orbitz settled with the city for $210,000 in 2010, and Priceline settled for $72,000, the Ledger-Enquirer reports.

In the U.S., Expedia is still the largest OTA hotel-provider, so this settlement matters to the city.

Have a confidential tip for Skift? Get in touch

Photo credit: Columbus, Ga., hotels are available on Orbitz.com (above), but they don't exist for Expedia.