Check your email for your free download of Skift Global Forum 2018 Magazine

Every company is already marketing experiences and the smart innovators at the edge are thinking about a post-experience economy. If everyone is marketing experiences, and if everything has become an experience, what does it mean to be truly different in travel?

By Andrew Sheivachman

If you’ve traveled recently, you’d be forgiven for thinking that a revolution has occurred in how airlines, hotels, and activities have evolved over the last decade.

What shiny new brands and digital marketing can’t hide, though, is that the same old core problems afflicting travel sectors persist and have become even worse over time. The age of the selfie has made it easier for brands to rely on style over substance, to promise something different that is, in fact, deeply clichéd.

Travel has always been an experience, facilitated by the services provided by travel companies, and it’s time to fix what’s broken.

We’ve all seen how an abundance of options has affected how people travel and the state of competition in the travel industry at large. In just 20 years, travel buying practices have undergone a series of revolutionary changes. While choice has increased, so too have the number of intermediaries, adding to confusion in the buying process.

As commodities like economy flights and standard hotel rooms have become marketed as experiences instead of products, the legacy travel industry is facing an identity crisis.

The post-experience economy, as Skift sees it, represents a paradigm that travel brands will have to embrace at the risk of being left behind by consumers who are hungry to spend money on memorable experiences. A vacation mediated by a la carte ordering via mobile phone is antithetical to our vision of travel’s future, where the now-disappointing and mundane elements of a trip become a strength instead of a weakness.

So what will drive this post-experience economy? We’re not sure precisely, but it’s worth asking the question, fostering some debate, and putting forth a few ideas on what it must embrace.

As commodities like economy flights and standard hotel rooms have become marketed as experiences instead of products, the legacy travel industry is facing an identity crisis.

Greater serendipity, for one, allowing travelers to stumble upon new, unanticipated discoveries. This self-determination will be key to the post-experience economies, as travelers become co-creators. The idea of co-creating your travel experience is a theme that has received some attention. Richard Sharpley, a professor of tourism & development at the University of Central Lancashire, has described the third and final phase of tourism’s evolution as “the post-experience economy in which tourists have become not passive consumers but active co-creators of the tourist experience.”

Travel brands must strive to constantly facilitate that moment of unexpected discovery that can turn a trip from something banal into an unforgettable experience. Without a solid core experience, though, creating the grounds for serendipity becomes nearly impossible.

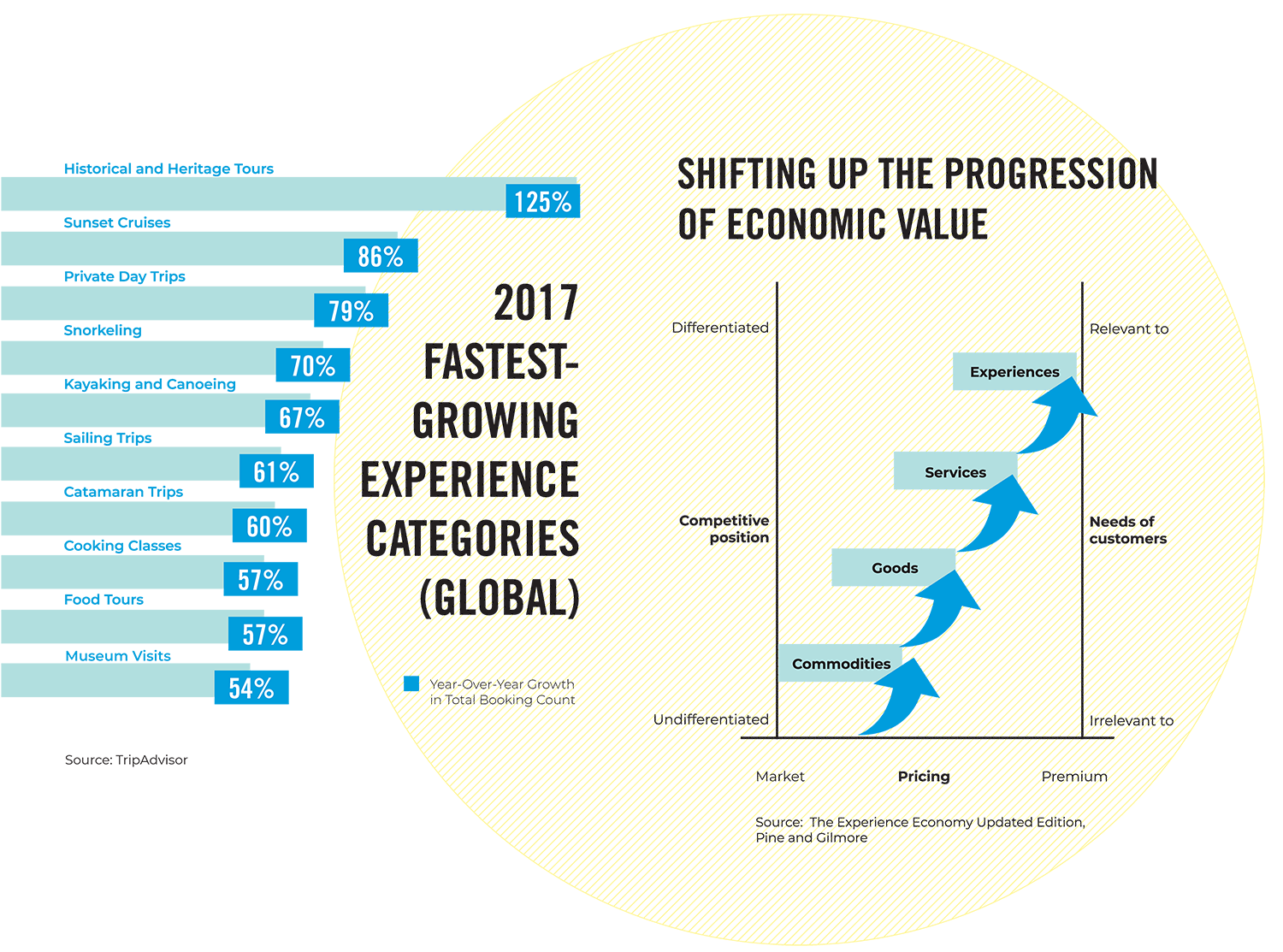

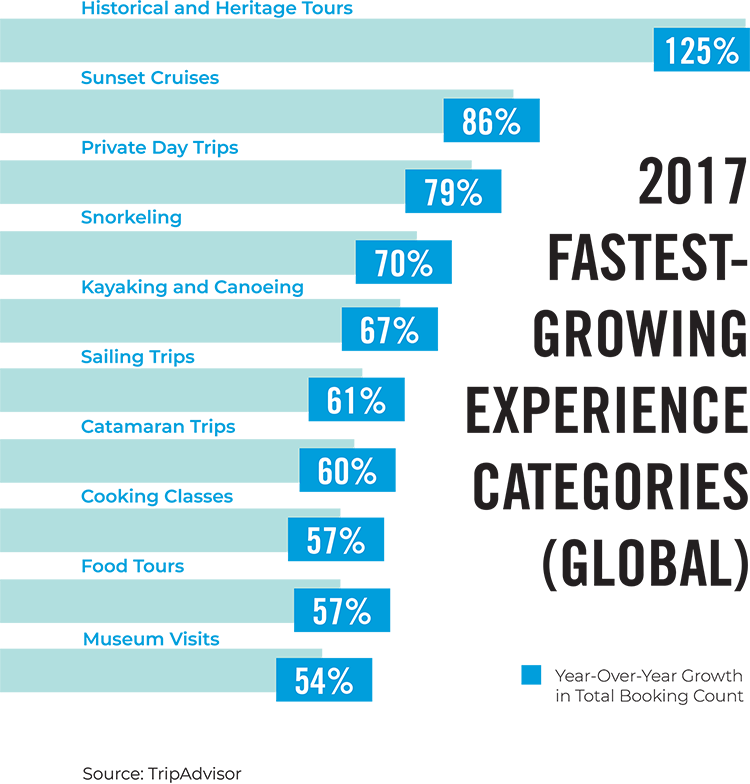

The research behind the original experience economy, a term coined by consultants Joseph Pine and James Gilmore in the 1990s, posited that companies can charge more for their offerings by transforming services into experiences. Compare Starbucks to your local hole-in-the-wall coffee shop, for instance, or consider the impact of Disney on the expectations for the family vacation experience. Transformation follows after experiences, according to their thesis, creating a product that ensures an impact can be made on a customer’s psychology.

Something funny has happened in travel over the last decade, though, that doesn’t align exactly with this thesis. Hotels, airlines, cruise lines, and other sectors have started selling commodity products as if they were experiences. Marketing for these sectors followed suit, appealing to travelers on an emotional level and promising a certain experience instead of a service. But make no mistake, most of these companies are selling travel services, and calling a service an experience instead doesn’t make it so.

The industry has been ill-served by the term transformative travel and all the moralistic pandering that comes with it. By marketing trips as personally transformative, the sector has undermined itself by prescribing what a vacation is supposed to be.

What is memorable about a trip, most often, comes down to interacting with the people and culture around you. The unexpected moments that are unpredictable and ultimately force you to look at the world differently with a new sense of understanding or humility. These tend not to happen in a hotel lounge or around other tourists.

A 2017 SkiftX survey on transformative travel found that 38.8 percent of those polled said the people around them led to a transformative moment, while 35.2 percent said a spontaneous and unexpected adventure did the same. Just 8.7 percent, for contrast, felt transformed by their accommodation.

Discovery and serendipity have been superseded, particularly in popular destinations where the main attractions are swamped with tourists from across the globe. Have you really been to Paris if you didn’t take a selfie in front of the Eiffel Tower? Have you been to Rome without proof you posed in front of Trevi Fountain? Can planting trees in a hurricane-ravaged forest really change who you are or transform your outlook?

The answer, it should go without saying, varies from person to person, and from moment to moment, in ways no one can predict. Marketing commodities like a seat on an airplane or a room in a hotel as transformative is a particularly misguided strategy; customers lose all their context for making a buying decision and come away disappointed when reality doesn’t live up to the hype.

What is memorable about a trip, most often, comes down to interacting with the people and culture around you. The unexpected moments that are unpredictable and ultimately force you to look at the world differently with a new sense of understanding or humility.

The travel experience almost never lives up to expectations sold to travelers, unless you are willing to pay for a luxury experience; and even then, you are subject to the randomness of bad weather and unmotivated tour guides. Often, these are features of a particular destination and not a problem to be solved. Travelers, though, crave experiences that move them emotionally and let them look at the world differently. It’s hard to square this with the commercial mission of worldwide travel giants and services they sell.

How can travel brands embrace discovery and serendipity, keeping consumers within their platforms while allowing for the unexpected experiences that define an amazing trip?

What lies beyond the experience economy is a world where travel brands act as trusted guides, allowing travelers to define their experience as co-creators without being prescriptive about outcome. First, though, a focus on reforming the fundamentals of service provided by travel companies is necessary to create fertile ground for industry innovation and consumer choice.

Each sector of travel has to make a serious effort to solve the pain points that are now seen as inescapable for consumers. So many parts of the core travel experience are completely antithetical to the espoused value and marketing of travel brands. It’s time for global travel brands to admit their failings and embrace a base level of quality, outside of the luxury and upscale sectors which thrive on solving these service issues.

It’s time for global travel brands to admit their failings and embrace a base level of quality, outside of the luxury and upscale sectors which thrive on solving these service issues.

Covering up the unpleasant nature of the air travel experience with expensive lounges or more diverse dining options, for instance, doesn’t make up for uncomfortable seating arrangements or delays that shatter a carefully crafted vacation.

A cool bar with microbrews in an aging, neglected hotel doesn’t make a traveler’s guestroom experience any better. A restaurant with Edison bulbs hanging overhead and complicated cocktails isn’t compelling if the food is bland and expensive. What good are improvements to business class seating for the 200 other people crammed together in economy class?

Regarding experiences and activities, data show that travelers will book these in destination; earlier this year, Skift Research found that only 19 percent of travelers will book a tour or activity a month or more in advance. This means the battle to sell add-on experiences will be fought long after the basics of a trip are booked.

Companies need to reinvent and fix the core components that drag down the basics of the experiences offered to customers, with an eye on enabling choice and creating an ennobling experience outside of that core.

In the midst of an unprecedented democratization of travel, tourism at large has struggled with growing pains that have had a negative impact on destinations and tourists alike.

The most impactful experiences can happen when you least expect it, in destinations that have been deemed dangerous or unseemly by the media, or when you see through the seams of an experience that has been carefully constructed to provide a particular outcome. Smart tour operators know this, and this is why they are baking freedom and downtime into the design of tours.

“Customers are looking for experiences and moments that are unique and shareable for them,” Jeff Russill, senior vice president of marketing and product for tour operator G Adventures, told Skift. “With traditional tourism packages where everything is prescribed and cookie-cutter, it’s really hard to deliver that because of how they’re built in the first place.”

Aside from the greatest hits, tour guides now actually direct tourists to the experiences that will hold the most interest for them, even if they sit outside of the theme or structure of the overall multi-day tour. In most cases, something experiential just means an unexpected or untraditional experience. By acting as guides and subverting expectations, tour operators are learning on the fly how to become more indispensable to travelers.

This model should be instructive for other sectors of travel, as well; instead of upselling, tour operators are now increasing their value to customers by improving the quality of their experience.

Not only can brands not sell something they can’t reproduce, they shouldn’t equate serendipitous, emergent experience with a discrete product outside the brand core. What is the value of staying at a Kimpton, for instance, if Kimpton is simply selling you products from a suite devised at the corporate level of InterContinental Hotels Group?

Hospitality giants are building platforms to capture demand for experiences, selling activities or providing access to restaurants and events. Marriott International and AccorHotels have led the way, with AccorHotels in particular making a big bet on pushing beyond the traditional hospitality mindset that silos hotel brands from the everyday lives of consumers. While it will be nice financially to take a cut of all these purchases, the emergence of platforms like AccorLocal doesn’t bode well for hotel brands cultivating their own aesthetics and intangibles.

The paradox of choice resulting from so many purchase options just a tap away will lead to consumer confusion and paralysis.

Why innovate on the property level when you can effectively outsource experiences, and take a cut of profit, instead? Should a concierge recommend a restaurant from his experience if it can’t be monetized?

The paradox of choice resulting from so many purchase options just a tap away will lead to consumer confusion and paralysis. Hotel brands, in particular, can capitalize on guiding customers toward proper experiences. A menu of options is no match for the sense of excitement that comes from discovering something new and unexpected.

Hotels are on the front line of the traveler experience, and this is an advantage they should maintain and improve on in a world where Amazon and Google are sniffing around moving more deeply into travel.

Hotels represent part of the fabric of a city, though, even if tourists do not, and by cultivating a range of offerings outside the traditional hotel or tour experience, they can create a more memorable stay for travelers. Luxury hotels understand this best, with brands like Ritz-Carlton and upscale boutique hotel brands integrating local atmosphere and activity options into their overall product offerings that add up to something that is more than the parts.

“I just went to a Bruce Springsteen concert and he said that the most important equation in life is one plus one equals three,” hotelier Ian Schrager told the architecture and design magazine Dezeen in June. “You need that for love, you need that to make music and you need that to make a great hotel. You put all the details together and you wind up with something that is more than the sum of the individual parts.”

Doing away with the concept of living like a local will help hotels adapt. If you travel somewhere, you simply aren’t a local; this trend has led to a treacherous flattening of aesthetics in hotels and restaurants worldwide, often with serious economic ramifications for businesses that resist change.

Smart boutique brands are already experimenting with this, toeing the line between local hangout and a hub for guests, but face a challenge of remaining relevant to travelers as they spend most of their time outside a hotel’s walls. Better marketing also plays a part in this; hotels need to learn how to stand out from the morass of generic Instagram posts and hashtags that have blended together into a distracting blob.

The variety of different products offered by Airbnb has shown that choice is essential to the contemporary traveler. The relationship between guest and host can have a deep impact on a trip, for instance, as hosts often fill the position abdicated by the traditional hotel concierge. Airbnb understands this deeply, as evinced by its Airbnb Experiences platform.

The growth of Airbnb has shown how powerful challenger brands can become in the travel industry, so expect more global hospitality players to embrace variety as they compete for customers. Without a rock-solid and scalable level of service on the property level, hotels will lose out on loyalty and guests will look to competitors instead.

Despite the global growth of the air travel sector into low-cost and emerging markets, the overall experience for travelers has suffered due to consolidation and economic pressure on the fundamentals of the industry. Seats have shrunk, bizarre incidents involving passengers and pets have skyrocketed, and it seems like the flying experience has been eroded with the intent to force travelers to spend money.

“In Europe and Asia, airports are owned and run by private corporations, or semi-private corporations,” said airport architect Pat Askew, who leads the aviation architectural and interiors practice at HKS. “They’re only in the business to make money, and sometimes they operate in an environment where airline fees and ticket charges are regulated so the airports have to make up the difference by selling a lot of stuff through retail, or through food ... you’re kind of stuck, and people, I guess out of boredom, or curiosity, will go spend money.”

At the same time, particularly in the U.S., the quality of airports has declined remarkably. There are often not even enough seats for flyers at their gates, and exorbitant prices compel travelers to spend on creature comforts to dull the pain of delays and poor service. The vast majority of travelers book air travel based on price; the experience is going to be lackluster no matter what, so it’s not worth paying more to fly economy on one particular airline.

This exposes another fallacy of the experience economy in travel: Simply grafting experiences onto a broken core of services does little to alleviate the overall pain felt by travelers. Take the growth of airport lounges around the world and the intense demand for an escape from the rigors of a traditional airport terminal. In many cases, the quality of lounges for economy passengers has declined as demand has increased, driven by services like Priority Pass that grant increased access. Still, it’s hard to argue that time spent at the airport is not a waste, whether you are sitting at the gate anticipating your vacation destination or downing an overpriced coffee on the way to your next sales meeting.

Simply grafting experiences onto a broken core of services does little to alleviate the overall pain felt by travelers.

Airlines are perhaps the most constrained of any travel sector when it comes to turning flights from a drag into a memorable experience. Their business model is based around filling every seat on a plane, since the planes are flying no matter what; shrinking seats and reduced amenities have resulted from the financial pressure placed on public airline groups. Competition from newer airlines offering bare-bones service for a reduced price have forced major airlines to rethink how they sell flights, stripping out things that used to be included and selling them back to consumers.

We dubbed this phenomenon "Hate-Selling" years ago, and it’s only intensified since then. The path forward for airlines is to differentiate on service instead of price, since competing airlines are in a constant race to the bottom on airfares in order to fill their planes up. The continued success of Southwest Airlines, JetBlue, and others show that offering a better core experience is not only a sound business decision but attractive to flyers as well.

Financiers and industry consultants will say this is impossible for airline groups to accomplish, but change is necessary for the traveler to come first and for the flight service to evolve into an experience.

In the midst of a global building boom, the cruise industry has been effective at improving its core product offerings while embracing a variety of restaurant, attraction, and activity options for customers.

Royal Caribbean International has been perhaps the most effective major line at adding new attractions into the core cruise value proposition: Robot bartenders, bumper car arenas, skydiving simulators, and the promise of an upgraded private island in the Bahamas have helped the brand morph from an economy product to something more high-touch. Carnival Cruise Line, as well, was able to weather a string of public relations disasters earlier this decade by advertising the cruise experience as an affordable, fun-filled escape.

The cruise industry, though, faces two major challenges: dealing with a potential lag in consumer demand after building too many ships, and innovating on the product side to bring in first-time cruisers.

The solution is for cruise lines to further specialize in terms of design and experience, using ships as laboratories to experiment with new concepts and diverse experiences at sea and on land for those traditionally underserved by mainstream cruising. Simply selling cruising as an experience isn’t enough; the core product has to reflect the quality and diversity of experience present in shore excursions and upscale sections of the ship.

If everything in travel has become an experience, the experience more often than not is disappointing. It is vital for global travel brands to take a serious look at their core product offerings and identify the misfires that drag down the experience for travelers. From there, they can innovate.

As we look ahead at Skift, we see trend lines converging around a future with better service for travelers in addition to more choice. The challenge of figuring out exactly how digital platforms will enable brands to sell cohesive, powerful experiences instead of a variety of disconnected services has yet to be resolved.

As we explored at length during our first annual Skift Tech Forum earlier this year, the promise of personalization in travel will likely never adhere to the vision of artificial intelligence-powered platforms automatically predicting what people will enjoy. This is why humanity and compassion will be key to creating a serendipitous experience for travelers going forward, regardless of sector.

The only true way for travel companies to differentiate is to compete on the quality and dependability of their core products. As airlines move beyond the cabin and hotels beyond the guestroom, a new focus on the core services that travel brands provide should emerge once again.