Las Vegas Sands Eyes NY's Long Island as Meetings and Tourism Draw

Skift Take

Las Vegas Sands is pursuing a multi-billion flagship casino, entertainment and hospitality development following its agreement to purchase a long-term lease over the home to the Nassau Veterans Memorial Coliseum, opened in 1972 on Long Island in New York. This would be the company's first entertainment project in the U.S. since it sold its Las Vegas properties last year.

Pending approvals from the Nassau County legislature, Sands will acquire control of up to 80 acres in Nassau County. Pre-pandemic, Long Island saw more than 9 million visitors annually, according to Nassau County Executive Laura Curran.

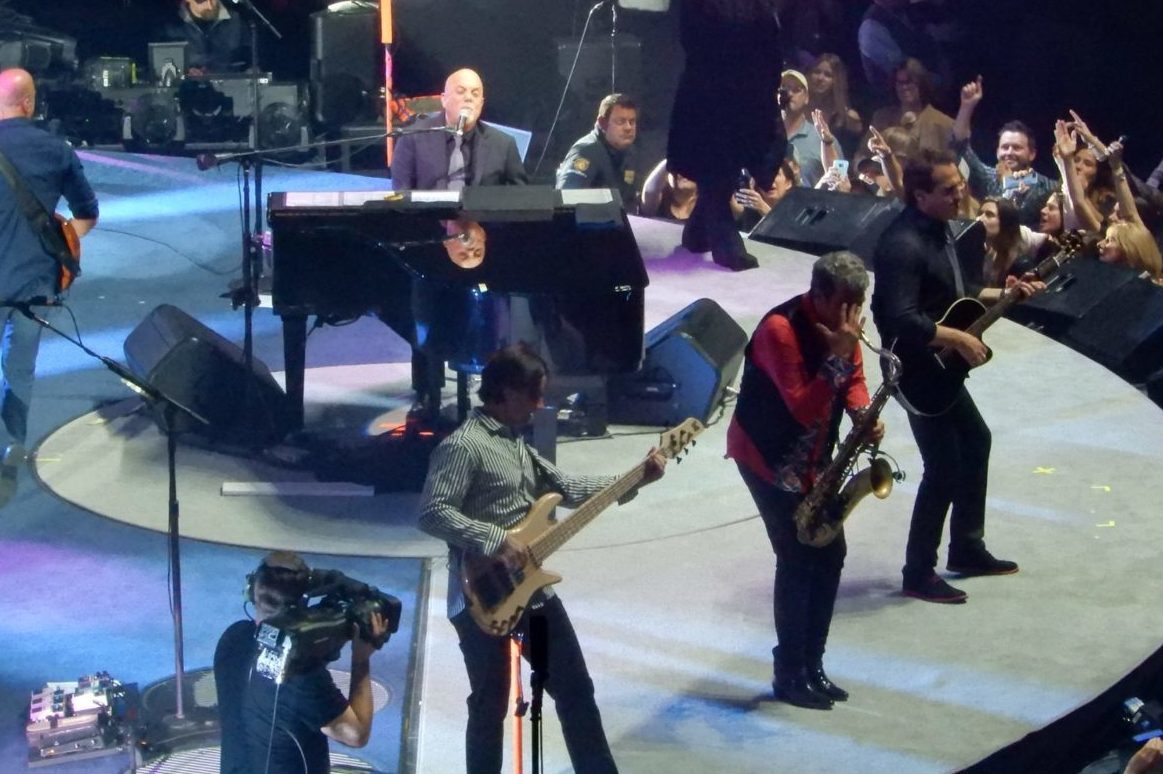

Casino gaming is planned to represent less than 10 percent of the development’s total footprint. Proposed plans for the Nassau Coliseum include four and five-star hotels, celebrity chef restaurants, and a world-class performance venue in honor of the Nassau Coliseum’s live music legacy.

As opposed to some of its competitors, Sands' ambitions look to bring tourists and meeting professionals outside of the obvious choice of Manhattan, some 30 miles to the east on Long Island. New York City is still struggling to return its tourism an