Airbnb Share Price More Than Doubles in First Day of Historic Public Debut

Skift Take

Kudos to Airbnb for a dramatic comeback in its initial public offering. But the valuation, propelled by euphoric investors in a hot IPO market, was divorced from reality.

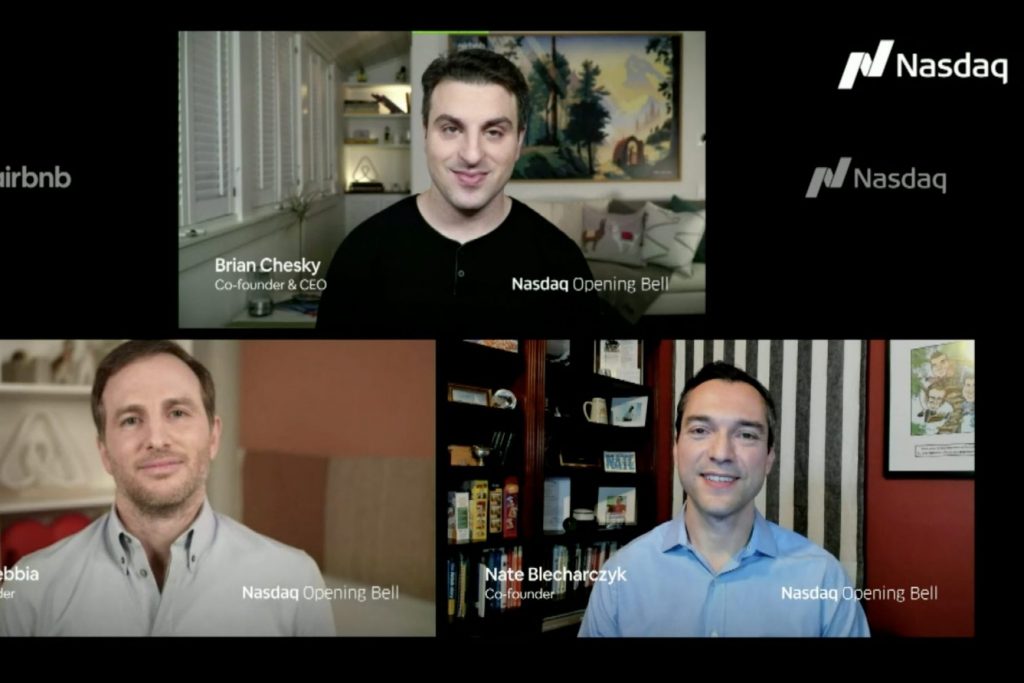

Airbnb, the longtime travel unicorn almost left for dead when its homesharing business nosedived in March, executed an initial public offering on Thursday of near-mythical proportions.

Priced at $68 per share Wednesday evening, the first trade was $146 per share. The company, which had an $18 billion private valuation during the depths of the recession, was trading at more than $158 per share in the first few minutes of trading, translating to a $109 billion valuation. That makes it larger than Booking Holdings' at $86 billion market cap and dwarfing rival Expedia's at $18.5 billion.

The combined valuations of Marriott and Hilton Thursday were $71.8 billion.

However, at the close of trading Thursday, Airbnb's valuation stood just shy of $100 billion — at around $99.5 billion — at $144.71 per share. The stock price had risen 112 percent over its $68 pre-IPO pricing Wednesday night.

Given some of the headwinds in Airbnb's future, the opening had a generous touch of unreality to it.

OK, it wasn't exactly mythical, but ABNB's public trading debut was the largest travel IPO ever, starting out at $68 per share and a $47 billion valuation, which was more than twice as large as more than two-decade-old Expedia's current market cap at $18.8 billion.

Airbnb's $47 billion valuation at the opening bested the previous record holder Hilton, which started publicly trading in 2013 at a mere $19.69 billion. (See chart below).

Airbnb, which raised $3.7 billion Thursday, could also boast of having the largest IPO of the year in a period when publ