Airline Tech M&A: The Quiet Evolution in Travel Tech Consolidation

Skift Take

This was written by Skift’s Rafat Ali with AI assistance, and edited by Skift. All quotes and figures have been confirmed with original sources, and further insights have been added by the writer and editor.

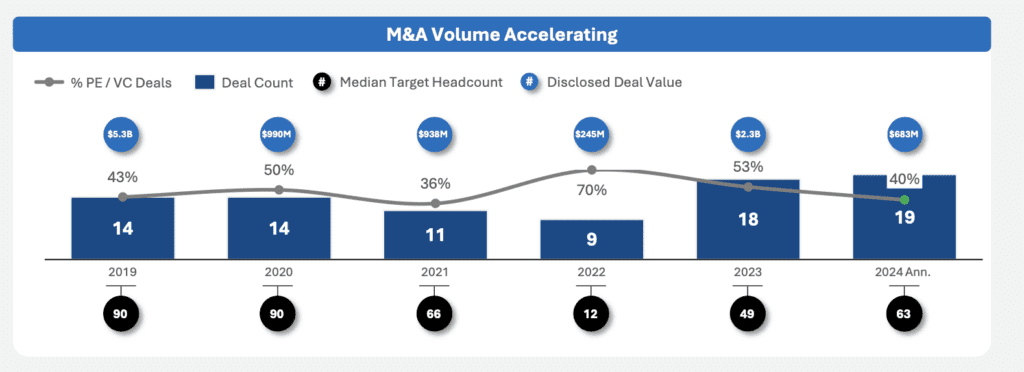

A new industry report from AGC Partners, Q4 2024 Travel & Hospitality Tech Market Update, signals a shift in airline technology mergers and acquisitions, forecasting an uptick in consolidation as private equity (PE) firms move to integrate fragmented players. While hotel tech and online travel agency M&A have long dominated headlines, airline tech deals have remained comparatively subdued—until now.

According to AGC’s findings, the sector is in the early stages of a meaningful consolidation trend. PE investors, enticed by the steady retention rates and significant market potential of smaller, specialized vendors, are spearheading these moves. Rather than pursuing the flashier, consumer-facing innovations found in hotel booking tools or Airbnb-style platforms, these investors are setting their sights on technology that optimizes revenue management, ancillary services, and operational efficiency. Though these solutions rarely make front-page news, they form the operational backbone of the aviation industry.

Historically, airline technology M&A has faced several hurdles. Fragmentation and complexity have deterred major roll-ups, while many airlines have opted to build or customize their own platforms in-house. Without marquee acquirers—akin to Booking Holdings or Expedia in the hotel and OTA space—these deals have attracted less media attention. At the same time, investors looking for immediate top-line growth have gravitated toward sectors promising stronger consumer appeal.

That dynamic appears to be shifting. As PE-backed platforms emerge, integrating once-niche point solutions into scalable offerings, the long-quiet airline tech sector is poised to command a larger share of industry conversation. With scaled platforms expected to anchor future M&A activity among companies earning $5–$50 million in annual recurring revenue, the foundations for a new wave of consolidation are now in place.

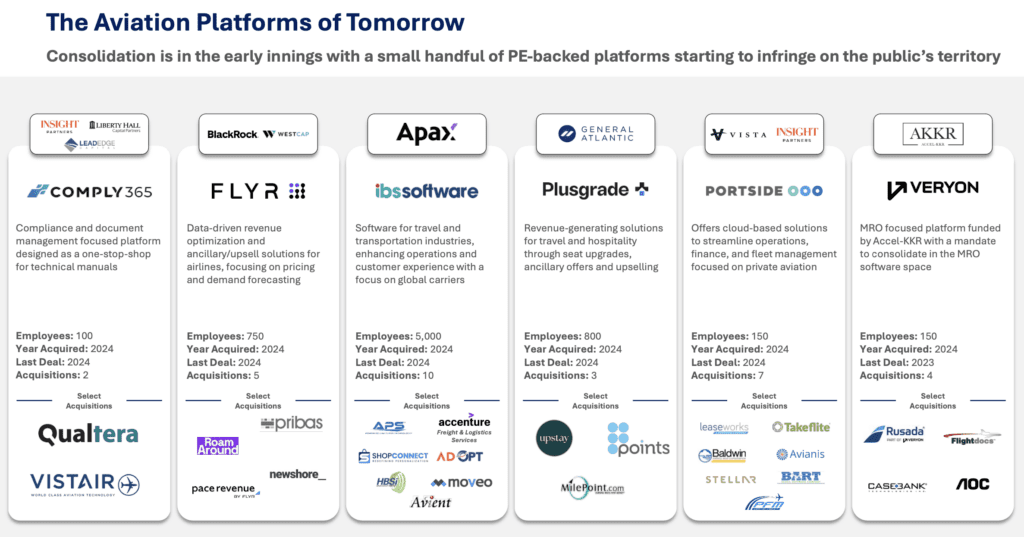

A small handful of PE-backed platforms and strategic players are emerging as the leading consolidators in airline tech:

- Comply365 (Backed by Insight Partners and Liberty Hall): Provides safety, compliance, and training management solutions to the aviation, rail, defense and aerospace industries.

- FLYR (Backed by WestCap and BlackRock): Provides data-driven revenue optimization, pricing, and ancillary upsell solutions for airlines.

- IBS Software (Backed by Apax Partners): Enhances airline operations and customer experience, focusing on global carriers.

- Plusgrade (Backed by General Atlantic): Specializes in revenue-generating solutions for airlines, particularly through seat upgrades and ancillary services.

- Portside (Backed by Vista Equity and Insight Partners): Offers cloud-based solutions for private aviation, including fleet management and financial operations.

- Veryon (Backed by Accel-KKR): Focuses on Maintenance, Repair, and Operations (MRO) software, targeting efficiency in aviation maintenance processes.

These consolidators are building platforms through strategic acquisitions, creating integrated solutions for revenue optimization, operational management, and passenger engagement.

Though it may never captivate consumers in the same way as hotel bookings or short-term rentals, airline tech is set to play a central role in the next chapter of travel innovation. The current PE-fueled trend suggests these behind-the-scenes platforms could ultimately reshape operational standards and passenger experiences in the industry’s not-too-distant future.