How Saudi Sees Luxury: Just '20% Will Be in 4- And 5-Star Hotels’

Skift Take

Skift reported recently that Saudi’s Vision 2030 is too expensive for tourists: If it eventually wants 70 million international visitors, it’s going to need more supply of hotels that don’t cost thousands of dollars a day.

The Saudi Tourism Authority was quick to acknowledge the issue: The STA pointed to developments beyond the most high-profile projects and said it needs to do a better job communicating.

“If you look at The Red Sea, Neom, altogether even, by 2030, they won’t even be 1% [of hotel capacity],” said the agency’s CEO, Fahd Hamidaddin, during the Arabian Travel Market (ATM) trade show in Dubai.

“It’s a fault of our media, our share of voice is going mostly to those flagship 1% projects. I have to say, Skift’s article was a wake-up call. It is a perception people have, and you rightly captured it.”

But according to Knight Frank, around 82% of upcoming rooms in Saudi are in the luxury and upscale categories.

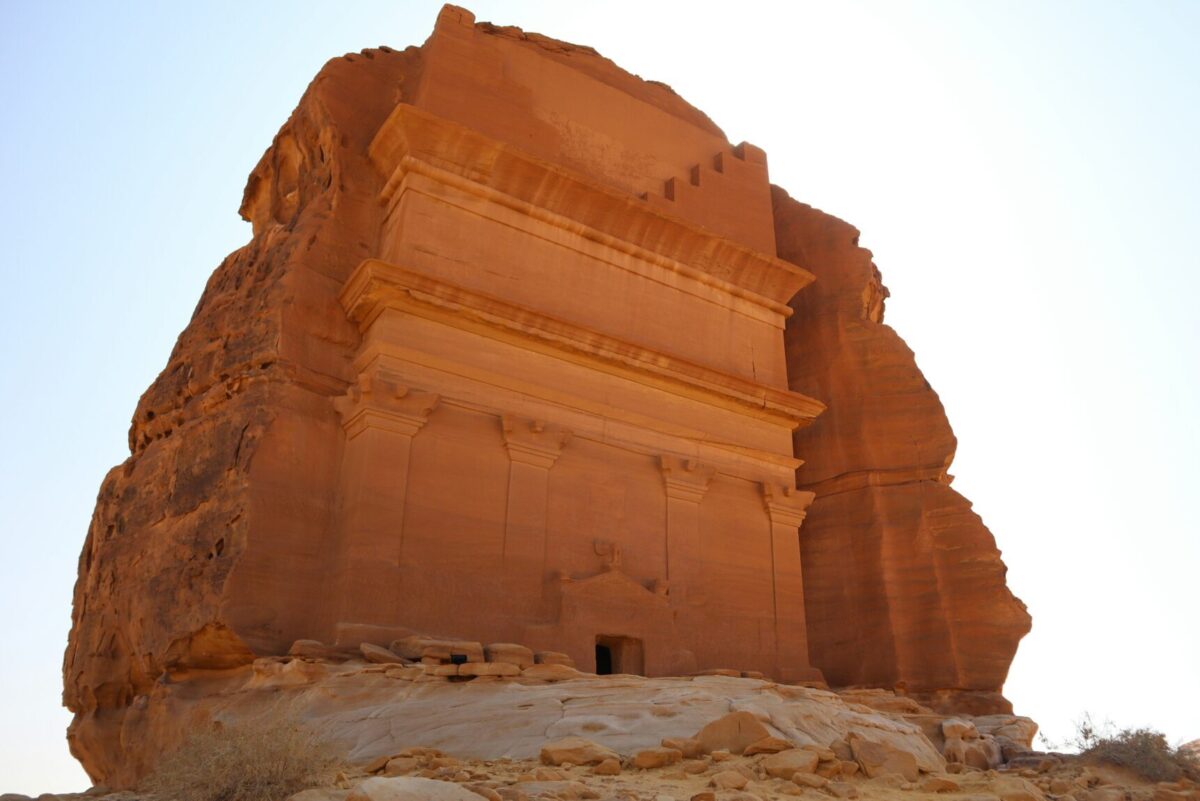

Of the 320,000 planned new rooms for Saudi by 2030, as many as 80,000 could be in Neom alone. The Red Sea’s official projection is for 50 hotels – 8,000 rooms and 1,000 residences. Diriyah, a cultural heritage site outside of Riyadh, has signed 42 hotels so far.

Almost all the hotels in these projects are luxury names, with a few exceptions, such as a Yotel in Neom and a Radisson Red in Diriyah.

Hamidaddin said these projects – which will house the likes of Four Seasons, St. Regis, Langham and many other luxury names – will only appeal to around 20% of travelers, maybe even less.

“Do you know the 80-20 rule? That 20% of travelers generate 80% of income,” Hamidaddin said. “Those are not mass-market travelers. Actually, the reality is it’s not even 20% – it’s 5% of travelers generating 80% of revenues for any top destination.”

He continued: “What is the state of Saudi? 80% are mass travelers at mid-income or below…the real business today is far from luxury and the development of new hotels is absolutely balanced between all the tiers. We know that not more than 20% [of travelers] will be in four- and five-star hotels.”

How Hotel Operators Are Responding

Paul Stevens, Accor’s COO Middle East, Africa and Turkey – Premium, Midscale & Economy explained: “When you see a market take off and position itself in a global environment, generally in this region [the Middle East], they use luxury and stand-out, and iconic hotels. That’s totally understandable [because] it gets the ‘Wow factor,’ international interest and gets people excited.”

“The reality is that the majority of people in the world are really economy and mid-scale brand customers. So, we need to continually offer that mid-scale and economy brand so the system continues so they have an aspiration of luxury.”

Other operators, such as Radisson, are waiting their turn to operate a hotel in one of the big projects.

"We want to be in the giga-projects but most of their [the Saudi government's] focus in the initial phases is luxury and ultra-luxury. We hope in future phases to be part of their development strategy," said Elie Milky, Radisson’s regional vice president of development.

Luxury Hotels Act as Marketing Engines

On the sidelines of ATM, Diriyah chief marketing officer Kiran Jay Haslam explained to Skift the power of these aspirational properties.

“We tend to, all of us as giga-projects, we have to wave the flagship. These luxury hotels are the emotional magnet of experience. These hotels are exceptional marketing tools.”

Diriyah is spending upwards of $60 billion with hotels from Moxy and Radisson Red up to Six Senses and Ritz-Carlton.

Moxy is an upscale brand of Marriott's targeting a younger guest, while Radisson Red is an upscale brand of Radisson's typically geared towards locals.

Unlike other major projects built solely around tourism, Diriyah is a new city that needs to accommodate a wide range of residents.

“Diriyah is for everyone,” said Haslam. “We’re not a project separated from Riyadh, we’re only 20 minutes from the international airport. We have to be for everyone, it’s impossible not to be. You might pass a laundromat, or a falafel stall or a cafe. It’s all part of our masterplan. We want people to live there. We want people to visit and think they want to live here [later on].”

"Diriyah has 22,500 residential homes coming onto the market. That means that real life will be there. If you’ve got a home in Diriyah, and you choose to AirBnB it… we have to look at price points. We need to bring young people in and people who don’t have squillions to spend on accommodation."

During ATM, Hamidaddin also pointed to other options to serve more travelers. “There is a big shift between usual hotels and alternative accommodation. People are choosing to stay in farms, apartments, and homes. They can be [for] mass [market] tourists,” he said.

Hamidaddin said Saudi is one of the largest short-term rental markets in the region, with upwards of 160,000 listings.

One of Skift’s megatrends this year looked into the need for more short-term rentals in Saudi and the wider region.