Skift Take

Banks such as JPMorgan Chase, Capital One, and Citi already have the customer base to appeal to travelers with attractive booking offers, cash back, and points, without having to ante up big for marketing like online travel agencies and hotels. The prospects for banks, with a history of clunky travel portals, will hinge on value proposition, user experience and execution.

Megatrends 2023

Discover the top trends that will define the travel industry for the coming year.

Big banks are making a bold statement in travel and will increasingly become the first place — at the top of the proverbial trip-planning funnel — where customers look to book their trips.

Depending on your perspective, major online travel agencies such as Expedia Group and Booking Holdings, which often power a piece of the banks’ travel offerings, are at times fueling the growth of formidable competitors at their own peril or are cashing-in on travel demand that they might not otherwise capture.

Both Expedia Group, which generated $788 million, or 21 percent of its total revenue, powering travel for banks, hotels and other partners in the third quarter of 2022, and Booking Holdings, which acquired hotel wholesaler Getaroom in 2021, are making strategic moves to expand their business-to-business partnerships.

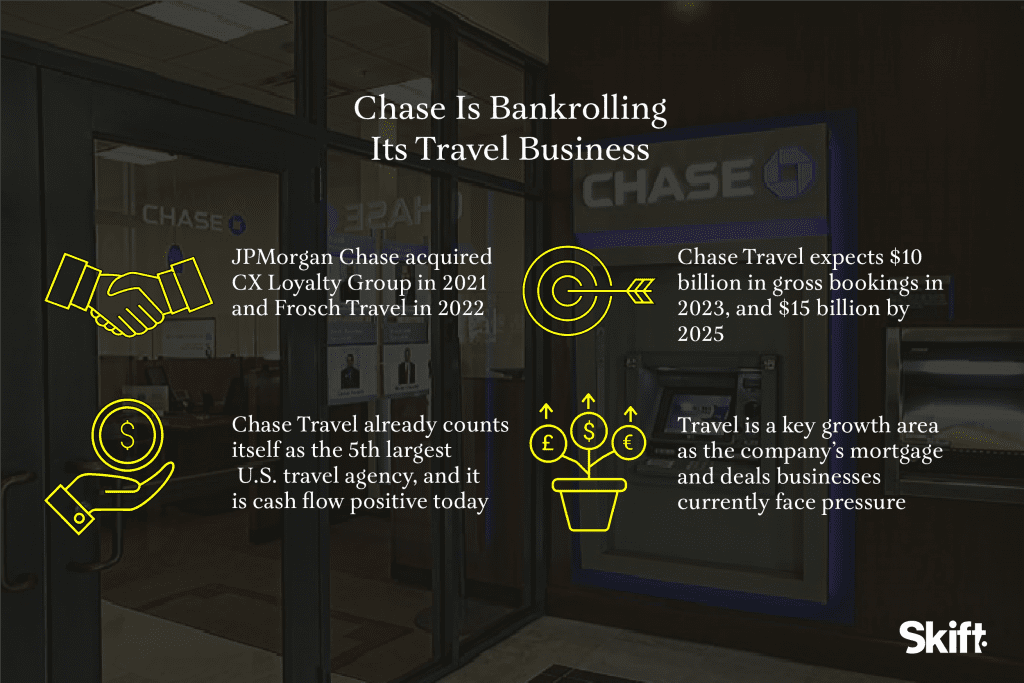

Consider developments at JPMorgan Chase, which already counted itself among the top five U.S. consumer travel providers in 2022 on the strength of its travel and rewards programs. Expedia ceased powering flights and cars for JPMorgan Chase in early 2022, but still provides hotels. Ariane Gorin, president of Expedia for Business, said the JPMorgan Chase relationship is still a big partnership for Expedia Group despite recent developments.

JPMorgan Chase acquired luxury and corporate travel agency Frosch in 2022, after buying travel and loyalty company CX Loyalty Group a year earlier. With these deals, JPMorgan Chase now controls the customer experience as a full-service travel agency and has “full ownership economics,” according to Co-CEO of Consumer & Community Banking Marianne Lake. In essence, that means the company can claim the vast majority of commissions, among other factors.

Lake forecast at an investor day in mid-2022 that Chase Travel would process more than $10 billion in travel volumes in 2023, and would reach $15 billion by 2025, if not sooner. The business was already cash flow positive in 2022 and expected to generate around a 5 percent net margin, she said.

The plan was to launch ChaseTravel.com for cardmembers, and to make it available to customers with Chase bank accounts thereafter. “The business will require little marketing expense as we leverage our existing customers and channels, reinforced by our loyalty program, Ultimate Rewards,” Lake said.

Just think about that: With 66 million U.S. households and 5 million small business customers in the fold, JP Morgan Chase is looking at the potential of a $15 billion travel business by 2023, and the company envisions needing to spend minimal amounts on marketing.

Using the latest annual numbers available, 2021, for context, that $15 billion in gross bookings would have made Chase Travel nearly one-third the size of the 2021 version of Airbnb, and nine times larger than India online travel agency MakeMyTrip.

By The Numbers: Chase Travel’s Expected Volume

-

$10 billion

in 2023

-

$15 billion

by 2025

-

5%

net margin in 2022

With banks facing pressure from vanishing investment banking deals, and with soaring interest rates squelching the mortgage business, a bunch of banks are expanding beyond their traditional co-branded card and loyalty business into travel booking products, as well.

“Ultimately, the fact that banks and credit card companies are investing heavily and innovating in the travel space is a great thing for the customer,” said Matt Knise, managing vice president of U.S. Card at Capital One. “Financial services and travel have long been intertwined, however, the travel-related user experience provided by financial services companies has often been an afterthought.“

Capital One Travel, which relaunched with flight, hotel and car inventory from Hopper in 2021, is launching its own luxury hotel collection with 10x rewards for VentureX cardholders and is expanding its airport lounges. Capital One expanded its equity stake in Hopper in 2022.

In addition to JPMorgan Chase’s travel acquisition spree and Capital One expanding its Hopper relationship and contracting with some hotels on its own, Citi is expanding beyond its travel portal, which is currently powered by JPMorgan Chase-owned cxLoyalty, and is developing a new Citi Travel portal in partnership with Booking.com. On the business travel front, in late 2021 U.S. Bancorp acquired travel and expense management platform TravelBank.

In addition to banks and even Uber digging deeper into travel, fintech companies are, as well. In 2021, the UK-based fintech app Revolut expanded beyond its core financial services for the first time, and began selling hotels, homes, and guest houses.

Richard Clarke, managing director at AB Bernstein, thinks much of the online travel agencies’ efforts in powering banks’ travel business is “madness” because they are actually strengthening competitors who likewise want “to sit at the top of the funnel.”

Clarke said when online travel agencies do such business-to-business partnerships, they usually have to give up nearly half of their commissions, lose the customer relationship, and must confront the prospect that their businesses become increasingly commoditized.

“I do think it is a challenge for them, and they almost risk facilitating the fragmentation of their own business,” Clarke said.

Expedia Group’s Ariane Gorin disagrees, saying travel is “not a zero-sum game,” and there’s room for additional players.

Expedia powers travel offerings for some of Canada’s largest banks, including TD Bank and the Royal Bank of Canada, has relationships with American Express Global Business Travel for hotels, American Express Travel, Accor, JP Morgan Chase, airlines, and many others.

“If we power all the other demand out there then that’s great for our company,” Gorin said.

Gorin added that Expedia will be able to compete because of the strength of its variety of brands, and its “massive loyalty program,” which will get relaunched and consolidated into one, from several, in 2023.

Expedia’s business-to-business segment notched $554 million in adjusted earnings before interest, taxes, depreciation and amortization in the 12 months leading up to September 30, 2022, on $2.35 billion in revenue.

The travel offerings of individual banks are a fraction of Expedia and Booking’s overall size at this juncture, but if the banks’ travel programs continue to grow, and travelers increasingly get accustomed to shopping for travel through their credit card companies and bank account vendors with their cash back and loyalty points in the mix, then these may be tough habits to break.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Tags: banks, fintech, megatrends 2023, online travel, travel booking