Skift Take

Stagflation, or a mix of slow growth and high prices, would be an unfamiliar crisis. Even the shrewdest hotel executives and investors would need to be on guard.

Hotel executives may be tuning out talk of future stagflation as they focus on serving today’s pent-up demand. But some economists worry that stagflation could emerge in the U.S., Europe, or Japan.

What is stagflation for those who didn’t live through it in the U.S. in the 1970s? It’s a strange brew of weak growth and stubborn price escalation. If left unchecked, it boosts unemployment in a way that hamstrings policymakers trying to escape it.

In the past month, about three out of four investment fund managers surveyed by Bank of America Global Research predicted U.S. stagflation. The former chairman of the Federal Reserve Ben Bernanke said stagflation is a risk, as did billionaire Ray Dalio and the Financial Times‘ chief economics commentator Martin Wolf. Possible stagflation drivers include the pandemic’s shocks to supply chains, spiking energy costs, and possible missteps by central bankers and governments.

“It’s been decades since we’ve had the specter of stagflation,” said Frits Dirk van Paasschen, the former CEO of Starwood Hotels & Resorts Worldwide. “Plus, the world was an entirely different place then. We’re in terra incognita, as they say.”

No wonder some travel leaders wonder if they should push for growth or push on the brakes.

Ordinarily, the hotel sector is cyclical. Its fortunes rise and fall with economic boom and bust. Nearly everyone has an intuitive sense of which hotel companies might prosper during booms — and which ones may struggle in downturns.

But things are getting weird — to use a technical term. The travel sector is ordinarily a leading indicator of recession. But maybe not this time. Today’s room rates seem invincible in many U.S. markets, surpassing 2019 levels — even though demand often hasn’t recovered. The U.S. fourth quarter could be strong thanks to the revival of business transient and group travel, PwC forecasted in May.

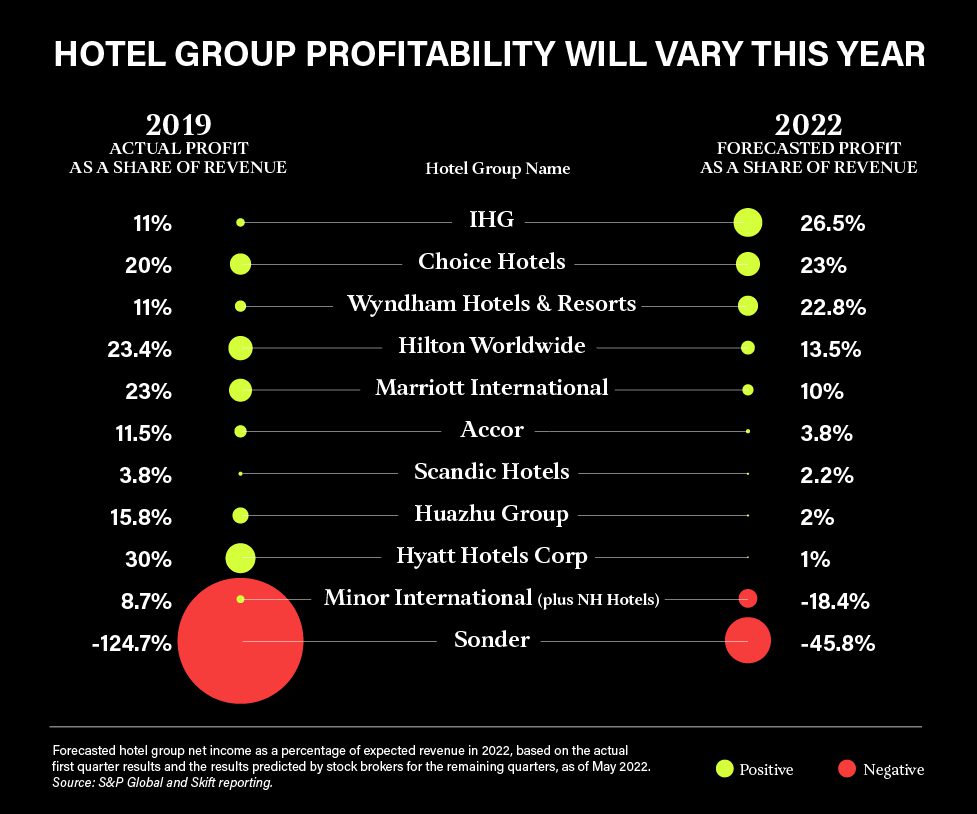

Yet if stagflation emerges, so will fresh challenges. Some hotel companies will prove more resilient than others. Key factors could be hotel company profitability, their cost structures, the types of guests that they mostly serve, and the nature of their debt burdens.

Profits Give Many Hotel Companies a Crumple Zone

Most hotel groups appear sturdier than they were before the global financial crisis of 2008 and 2009.

“Travel as an industry is vulnerable to getting whipsawed,” said Seth Borko, senior research analyst at Skift Research. “Several unusual circumstances could add to volatility soon.”

“Yet hotel companies with high profitability will have more margin for error,” Borko said.

How long can hotels maintain high margins on average?

Borko cited supply-side drivers of inflation, such as how some hotels aren’t seeking full occupancy because they’re struggling to hire and keep staff. Supply chain disruptions are also affecting the cost to open hotels and run existing ones.

Demand-side drivers of inflation include how many consumers are still spending saved-up government stimulus money. Consumers and businesses have pent-up travel demand, making them less price sensitive than usual.

“Which factors are the greatest contributors to inflation, and which can be tamed?” Borko said. “I don’t think anyone can untangle that. We don’t know how long high margins will last.”

Inflation Might Be Manageable

Not everyone agrees that stagflation is something the hotel sector should be too concerned about.

Ryan Meliker, co-founder and president at Lodging Analytics Research, is skeptical. He sees today’s inflation as driven by factors that aren’t long-term like elevated home prices, car prices, and one-off supply shocks — such as China’s lockdown disrupting supplies and Russia’s war in Ukraine disrupting energy markets.

That said, Meliker believes some hotel companies would perform better in persistent inflation than others.

“There’s not a lot of recent data on the statistical relationship between inflation and hotel performance,” Meliker said. “But the data we do have says inflation is relatively positive for hotel pricing power and ADR [average daily rate] growth. The data also says inflation is generally positive for hotel cap rates.”

Investors may desire hard assets in an inflationary time. Hotels may be more relatively appealing than offices or other real estate assets because their demand is priced daily instead of less frequently. Those dynamics could bolster the hotel sector.

The caveat is that roughly 85 percent of the typical hotel’s costs are inflation-driven, Meliker said. Hotels that can keep costs under control will be advantaged.

“Hotels in heavily unionized markets will have labor contracts with fixed wages,” Meliker said, giving one example. “That might help management companies to keep costs under control.”

Stagflation Could Jostle Hotel Valuations

Hotel companies also tend to be fairly resilient overall during economic turmoil because demand never usually drops off too severely for too long — not counting pandemics.

Historically, the hotel sector has seen returns to equity investors fluctuate within a narrow band, which is one sign of its relative stability as an asset.

What economic charts since 1995 don’t cover is stagflation. If weak growth and rising interest rates happen at the same time as spiking costs for construction, labor, and operations, it may have unpredictable effects on any given hotel portfolio.

Supply growth might be hindered by inflation if executives postpone construction projects until they have more clarity on how deeply embedded inflation gets and how far interest rates may rise.

Yet cost-efficient operational models and companies backed by long-term investors could be advantaged for a while.

Hotel companies that are more asset-light would likely be better-positioned thanks to fewer fixed costs, noted Fitch Ratings.

So expect to see more companies outsource hotel management. In February, Seibu, a holding company in Japan, said it would sell Prince Hotels to GIC, the Singapore sovereign wealth fund. This year NH Hotels in Europe, backed by Minor International, plans to continue shifting its portfolio to an asset-light model. Last year NH sold and then leased back a hotel in Barcelona, which is another example of adding flexibility.

An underappreciated risk of stagflation may be that institutional investment in hotels could dry up faster than expected.

Years of ultra-low rates have pushed sovereign wealth funds, pension asset managers, and private equity firms to accept riskier assets to make up for their loss of income in safer instruments. If stagflation reversed the performance of their portfolio companies and certain corporate debt instruments, investors might have to revert to defensive maneuvers in the portion of their portfolios allotted to hotel investment.

In other words, stagflation may cause investors to stop showing up for hotel asset sales in the same numbers as before, pushing down hotel valuations in a spiral. Unless there’s a rush to hard assets with reliable cash streams, in which case some hotel portfolios may benefit.

Devoted Travelers May Be Undeterred

If stagflation mainly pinches personal spending, hotel companies may stay relatively unscathed — especially those with premium brands.

“It may not pay to overdo the gloom,” said Russ Mould, investment director at AJ Bell. “A lot of people in the UK, for example, are doing very well, thank you very much. Those who dine out, take weekend breaks, and book holidays may well keep on doing so, though they may well cut back a bit if they have to.”

Travel is disproportionately done by people with above the median household income. In the U.S., mild stagflation may not hurt the relatively well-off, which typically account for two-thirds of travelers. (Skift Research subscribers can find more data on this phenomenon in the report U.S. Traveler Profile and Key Statistics.)

Hotels may face more trouble if stagflation depresses business revenue and companies respond by reining in travel expenses, Borko noted. If firms eventually trim workforces, that will hurt leisure demand, too.

Certain geographies may be more vulnerable than others, particularly those that have struggled the most to recover from the scars of the past couple of years.

For example, the U.S. urban market with the lowest occupancy in April was Minneapolis, with rooms 52.5 percent full, on average, according to STR, the hospitality data and analytics company. The city is still down 22 percent compared with 2019 levels. The prolonged drought of business in that city and others is a weak base from which to deal with possible stagflation.

Hotels in countries with especially high average debt loads, such as Italy, may be vulnerable, too. Companies in those countries could face a higher risk of capsizing from too much debt as interest rates spike, which could lead to a fall in transient business travel domestically.

Countries heavily dependent on Chinese visitors may also find hotels struggling. Thailand tops the list of nations relying on Chinese inbound travelers, said Tourism Economics. China’s pause on international tourism may last until at least mid-2023. The pause is already having a dampening effect. In Phuket, the development of 73 percent of hotels is on hold, said C9 Hotelworks.

Debt’s Role Will Be Tested

Anecdotal wisdom about financial crises is that things fall apart faster than expected. Every downturn brings stories of a handful of companies being caught by surprise. Some struggle to service their debt as interest rates or as costs spike while revenues shrink.

Pain can be unevenly distributed. An inflationary environment can be beneficial to hotel companies that have fixed financing structures, such as having locked in favorable interest rates or terms. Inflation burns away liabilities.

Yet hotel companies that face a so-called cliff of having to either seek new debt or re-finance debt in a future year when interest rates are high may worry about heightened fragility, Borko said.

Another group of vulnerable hotel companies might be ones with loan terms that require them to maintain a relatively low ratio of debt to earnings. The risk is that their revenues could plummet while inflation drives up their costs.

More positively, leverage could help giants such as Wyndham, Marriott, and Hyatt opportunistically buy brands to bolster their market share. Owners of portfolios that have some properties unencumbered by debt will have the flexibility to sell assets to increase liquidity or pay off loans if stagflation turns profit-and-loss sheets into a game of pachinko.

Acquisition targets could include portfolios weakened by the pandemic. Many full-service “upper upscale” hotels, in particular, haven’t regained pre-crisis occupancy levels because of their dependence on business and group travel, which has been slow to recover.

One caveat: Many premium properties in desirable city-center and resort locations, such as Miami, have been commanding high rates and occupancy.

In short, stagflation — if it emerges — could paint a murky picture.

“There are so many moving pieces that anyone who says they have a clear idea of what the next 18 to 24 months look like either is in possession of a crystal ball we all want to have or is maybe more confident than they ought to be,” van Paasschen said.

Daily Lodging Report

Essential industry news for hospitality and lodging executives in North America and Asia-Pacific. Delivered daily to your inbox.

Tags: economic outlook, hotels

Photo credit: A guestroom at the Sir Joan hotel in Ibiza. Source: Sircle Collection Hotels. Eunice Stahl / Unsplash