5 Smart Insights for the Short-Term Rental Industry

Skift Take

The largest and richest companies in travel seek a slice of the short-term rental market, yet they can sometimes seem as uncertain about the future as the smallest players are. Everyone seems to be grappling with how to cope with seismic changes.

The largest and richest companies in travel seek a slice of the short-term rental market, yet they can sometimes seem as uncertain about the future as the smallest players are. Everyone seems to be grappling with how to cope with seismic changes.

From the stage and in conversations among attendees, top leaders from a cross-section of the industry shared what's on their minds at Skift Short-Term Rental Summit in New York on Thursday. The following are key takeaways:

Convergence Is Taking Place

Fewer and fewer companies are purely playing in only short-term rentals or only traditional hotels. Many companies are pursuing blended approaches, though with somewhat mixed results.

"We are a hotel operator in addition to being an STR [short-term rental] operator," said Sonder CEO Francis Davidson, noting how his company began with short-term rentals but that now runs 26 licensed hotels, too.

Jennifer Hsieh, vice president of Marriott's Homes & Villas unit, told Skift Hospitality Editor Nancy Trejos that Marriott is learning from the rentals business and applying the lessons to its hotel business, and vice versa.

The leading U.S. hotel lobby, which has long challenged the rise of short-term rentals, seems under increasing pressure to admit professionally managed short-term rental brands as equal brands. Brian Crawford, executive vice president of government affairs for AHLA [American Hotel and Lodging Association], said that he recognizes there's now a "connective tissue" in hospitality and that the situation is fluid and dynamic.

As we noted in our recent Skift Research Report on short-term rentals, the sector's impact goes beyond hotels, with realtors and property investors looking at short-term rentals as a lucrative alternative to their regular practices.

On the online demand generating side, Kayak CEO Steve Hafner announced on stage that Kayak's mobile app for travel price-comparison search will add the ability to let users check in to Lyric and other select hospitality brands next year. The move highlighted how the roles of so-called aggregators are shifting in an era of super apps.

The Low-Hanging Fruit May Be Gone

Another takeaway from the event is that the window is narrowing for entrepreneurs to find remaining untapped opportunities and scale them up to become public companies.

Startup founders face stiff competition from well-capitalized, tech-savvy players like Airbnb, who are making investments and introducing products for all aspects of the industry.

"This is a real estate business sitting next to a technology business, and you have to be good at both," Laurence "L.T." A. Tosi, the former chief financial officer of Airbnb and, before that, of Blackstone. (See our quick summary of our interview with Tosi.)

Other attendees pointed to revenue management services as a possible exception. Andrew Kitchell, the CEO and co-founder of short-term rental brand Lyric, touted the rate-setting service Wheelhouse his company offers to property management companies. When asked about the broader competitor set of companies like Beyond Pricing, which he had co-founded, and the dozen or so other players, Kitchell said he thought consolidation might happen, yet an independent company will likely thrive.

Property managers will not use, en masse, a rate-setting tool from a giant tech company like Airbnb or Booking.com because they'll want to keep their data siloed, which means at least one independent revenue management company will likely emerge, Kitchell argued.

Tools for independent hosts may remain another scalable opportunity. Vered Raviv Schwarz, chief operating officer of property management platform Guesty, argued that a broad swath of independent and small operators would continue to need tech services.

No Quick Fix to Regulation

Industry leaders cited several examples of promising policies for regulating short-term rentals. Yet the intense debates among traditional hotel operators, online travel companies, professional property managers, and leaders representing destinations suggested there won't be uniform new rules any time soon, if ever.

The summit's liveliest panel talk featured representatives from AHLA, Expedia Group, and Vacasa. They crossed swords about regulations for short-term rentals.

One point the panelists saw some potential common ground on was seeking solutions at local rather than national levels. The consensus was short-lived, though. In the following session, Olivier Grémillon, vice president of global segments at Booking.com, made a case for national-level rules as a practical privacy measure, given that some municipalities are villages. So the debate continues.

In a complicating twist, some hotel groups are lobbying for stricter regulations for short-term rentals at the same time as they enter the sector through acquisitions or new brand launches, as illustrated by a talk by Marriott on its efforts.

Professionalism Is the Watchword

While renting out homes is a centuries-old concept, new technologies and a flood of investment have created a recent boom.

Airbnb said it was cracking down on improper behavior by guests. Margaret Richardson, the company's vice president of Trust, said Thursday Airbnb is cracking down on so-called "open invite" parties, such as ones promoted on social media. The move came in the wake of a Halloween shooting at an Airbnb rental in a San Francisco suburb.

Richardson also hinted that Airbnb is considering making changes to its listings and user interfaces. For instance, it may make it more transparent when a host is a professional or an amateur.

Speakers and attendees at the Summit rallied around the notion that the way to find scale efficiencies is to build their own technology for critical operational needs.

"While industry chatter tends to play up the differences between hotels and alternative accommodations, there are some striking similarities between the traditional hotel industry and the professional short-term and vacation rental management companies, especially when it comes to technology questions," said senior research analyst Wouter Geerts of Skift Research.

"Hotels often rely on antiquated technology, and many of the software systems for vacation rental managers are also on the older side," Geerts said. "I thought it was notable how many players felt they needed to build their tech. Even if the functionality may be somewhat basic, new tech can fit modern needs for cloud-based services and the ability to connect with lots of tools and vendors, among other factors."

Yet perspective is in order. Independent hosts run the majority of rentals worldwide, Geerts said.

Independent hosts and the community feeling they can bring continue to matter. In some markets, short-term rentals continue to enable amateurs to generate revenue. They also introduce visitors to local experiences. Those twin advantages can be critical to helping destination management organizations showcase their locales, said Leah Chandler, chief marketing officer of Discover Puerto Rico.

One way to think of the rise of short-term rental brand is to compare it to the rise of the boutique hotel phenomenon roughly two decades ago, argued Drew Patterson, chairman of Transparent Intelligence.

A Hunger for Ecosystem Data and Perspective

So many new players have rushed into the short-term rental space that the sector is still catching up with the benchmarking and data analysis.

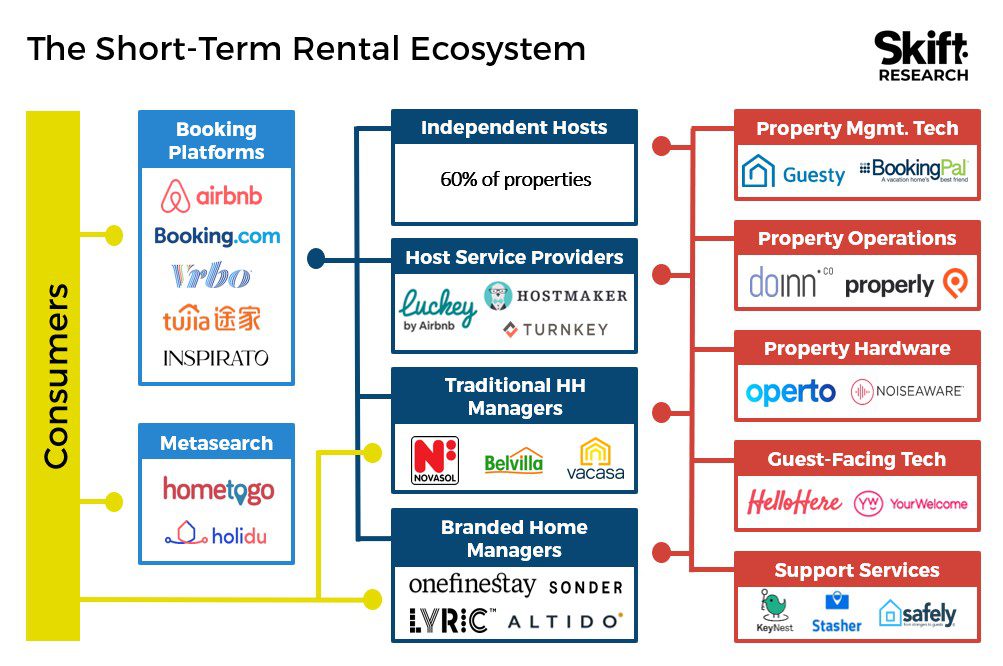

In a recent report, Skift Research highlighted the ever-expanding ecosystem that is forming around platforms like Airbnb and Vrbo.

"After we published the report, readers took me by surprise with their interest in even a simple diagram of the ecosystem," said Geerts.

It's such a fast-moving industry a lot of people are still trying to get a lay of the land. People are asking questions about how the different players relate to each other.

"No one wants to get put in a box," said Geerts. "Yet everyone wants to put other players into boxes, as a helpful shorthand to understand the industry ecosystem. There's a hunger to know where the growth is and how prospects vary by the business model."

See Skift Research's The Short-Term Rental Ecosystem and Vendor Deep Dive 2019 for more.