Airfare Clearinghouse Promotes Routehappy Execs to Fit New Data Strategy

Skift Take

Fare-filing clearinghouse ATPCO has announced changes in its c-suite. So we checked in to see how it's progressing on its modernization effort. The challenges are daunting.

Airlines are seeking to modernize their airfare clearinghouse, ATPCO, formerly known as the Airline Tariff Publishing Company. Leadership changes announced Thursday underscored the airline drive.

For decades, number-crunchers at airlines worldwide have used ATPCO as a tool for tracking price changes by competitors. But changing times had revealed its weaknesses.

"The airline industry is moving slowly toward where price points might be created dynamically at the point of sale without any filed fares," said the clearinghouse's CEO Rolf Purzer. "It's a slow change, and we're adjusting to the change."

The non-profit firm, owned by 16 airlines, has been broadening its services. It now tries to help airlines present to shoppers images of premium cabins and other products in standardized formats that all online sellers can use. It is also working on new pricing and audit capabilities. The moves are bringing it into competition with private technology companies. To compete, airlines aim to rev up the company's metabolism. About one in three of ATPCO's 500 workers has joined since October 2016.

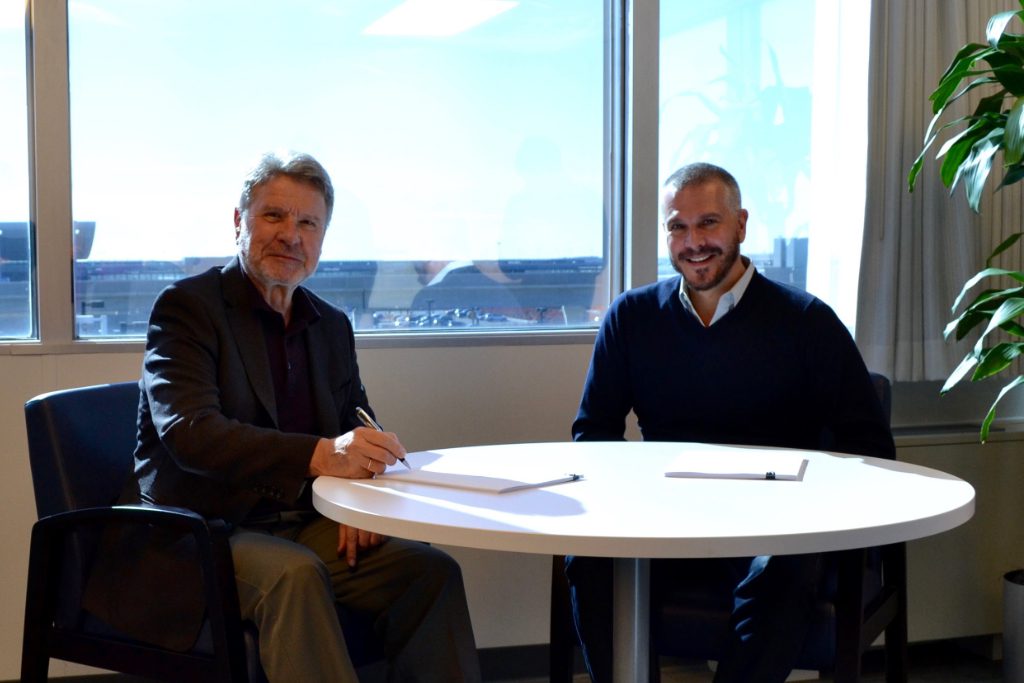

Since he became CEO in February 2017, Purzer has made changes. The biggest came in February 2018, when ATPCO acquired Routehappy — a startup that helps airlines provide rich digital content for flight shopping and that had raised more than $8 million in venture funding.

P