Google Flights Gets Aggressive by Intercepting Airline Trademarks

Skift Take

Google is aggressively placing itself more prominently than ever between the consumer and the airline in the quest for bookings. What does it mean? Airlines are getting more qualified leads but are losing control and getting even more beholden to Google.

Google has been getting increasingly aggressive with its Google Flights product over the last year. If you talk to Google's competitors, they'll tell you that Google Flights, without fanfare, is taking assertive steps and is indeed making market share gains at the expense of competitors.

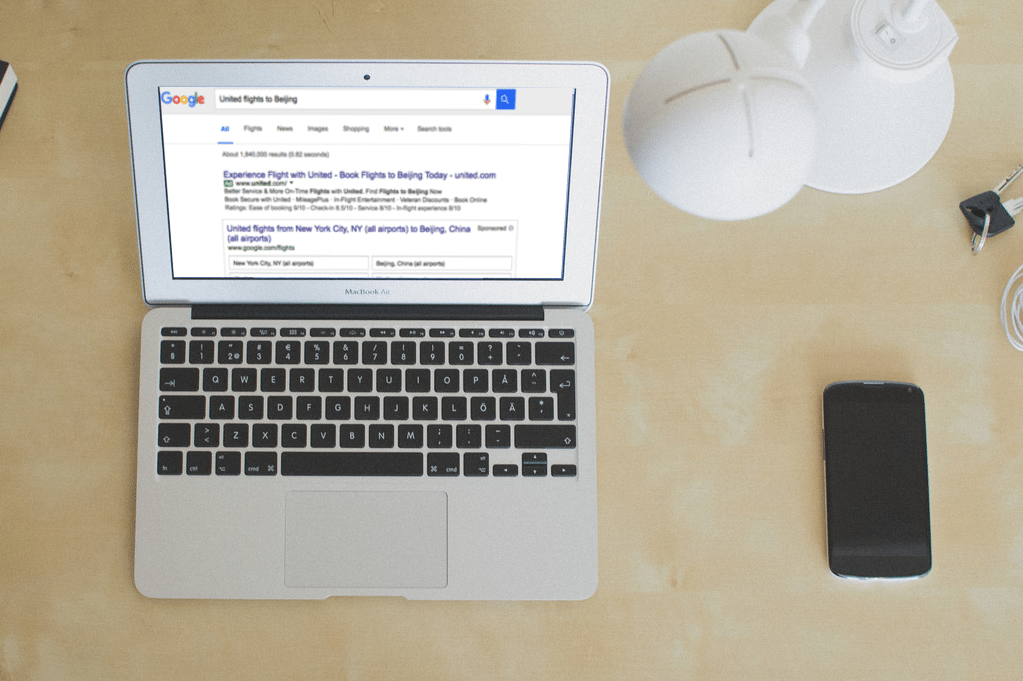

One such move is intercepting consumer searches on Google for a specific airline like "united flights to chicago" and displaying a Google Flights result at the top -- or near the top -- of the page instead of delivering a direct, free link to United.com or an online travel agency selling United tickets. So Google is transforming a search for a trademarked term like an airline's name and turning it into money for Google.

Google Flights knows the consumer's location and closest airports, fills in dates, and presents a United nonstop fare "from $117." When the consumer selects "More Google flight results," the consumer navigates to Google Flights and sees a curated list of United flights, including some under the heading "Best flights." These consider the tradeoff between "price, duration, number of stops, and sometimes other factors such as amenities and baggage fees," Google states.

"By redirecting a branded search term to a Google-owned property, Google creates a more refined search result (a set of specific flights on specific dates) before handing the consumer over to the airline," says Brian Clark, a partner at travel and hospitality consultancy Hudson Crossing. "Google is doing this in a bid to make more money on the more specific