The Pitfalls and Perils of Online Travel Acquisitions

Skift Take

Ctrip, when acquiring Skyscanner, should call up, or at least compare notes with, companies as varied as Sabre, Travelocity, the Priceline Group, and Expedia when mulling the challenges in integrating a new prized possession. These new playthings can in rare cases turn into the success of a Booking.com, but on the other hand they have the potential to wreak havoc.

As China's largest online travel agency, Ctrip, is poised to close on its pending $1.74 billion acquisition of flight-searcher Skyscanner and then to integrate its technologies, products, and workforce, it's appropriate to point out in the excitement of the moment that these sorts of deals don't always work out as intended.

Acquisitions, after all, are hard to do.

The most obvious and recent example of a tough acquisition is the Priceline Group's $2.6 billion purchase of dining reservations platform OpenTable in 2014.

Citing OpenTable's expansion issues, but not getting too specific about its precise problems, the Priceline Group recently took at $941 million non-cash impairment charge against OpenTable's goodwill. The impairment charge was a drag on the Priceline Group's third quarter net income although the parent company vowed to continue to invest in OpenTable, albeit in a more measured way.

Opentable Hype Versus Reality

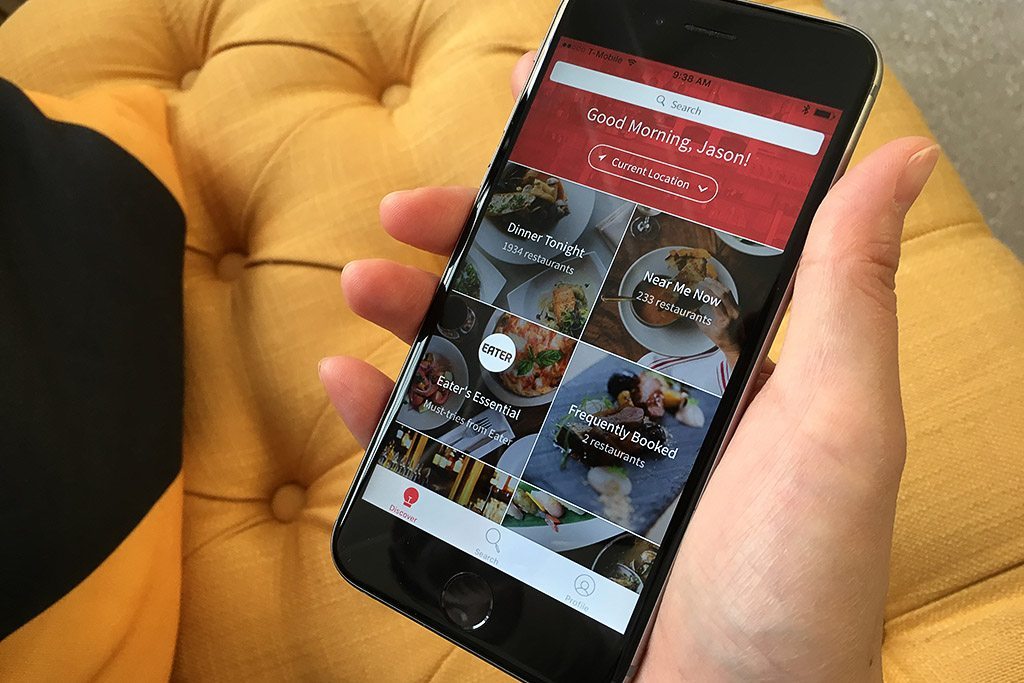

In the heady days after the Priceline Group acquisition of OpenTable, Priceline officials waxed on about how the restaurant reservations platform would be a natural extension of its brands, especially in the mobile era where travelers are checking their phones to find something to do, or a place to eat, spontaneously and in the moment.

On the morning of the acquisition, then-CEO Darren Huston said: "Over the long term, we are excited with the prospect of OpenTable building a strong and profitable gl