Still Struggling, SeaWorld Announces Major Cost-Cutting Plans

Skift Take

SeaWorld has a couple of big goals: Cut costs in a big way and get more people to visit. We're not sure how those priorities are going to work together.

With attendance, revenues, and profits still sinking, SeaWorld Entertainment on Tuesday announced plans to cut costs significantly and take a "do-more-with-less" approach to new rides and attractions.

In a call with analysts to discuss third quarter earnings, president and CEO Joel Manby said the theme park company was working on a "comprehensive" program to reduce costs by $65 million with net savings of $40 million over the next couple of years.

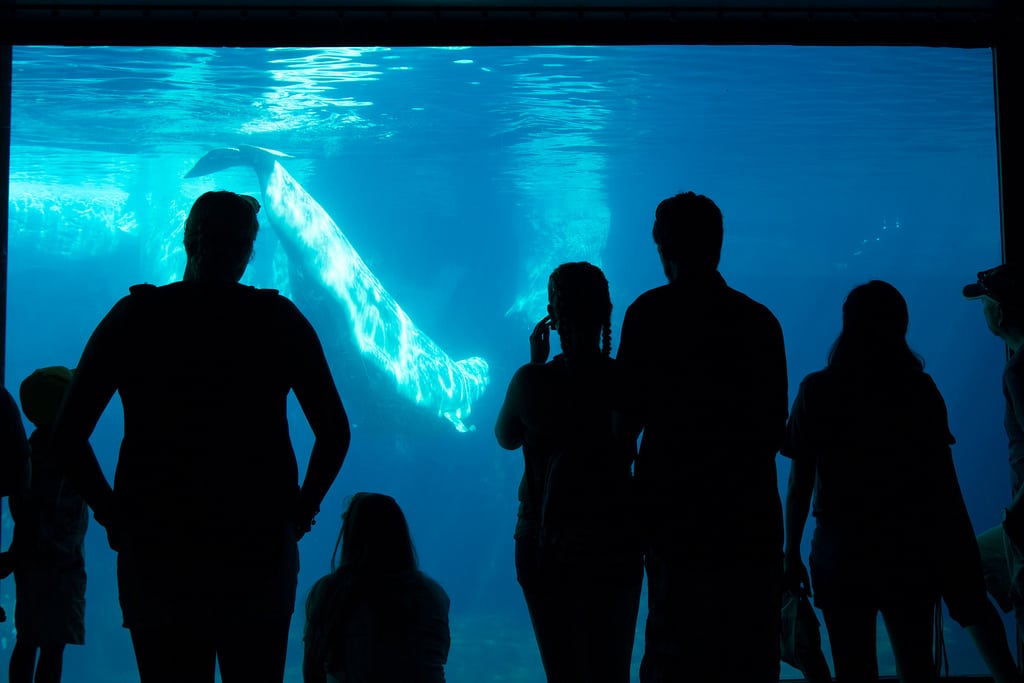

SeaWorld Entertainment announced in March that it would end its signature killer whale shows and stop breeding orcas following the controversy that erupted over the documentary Blackfish. The company has since seen improvements to its image, but financial performance has remained a drag.

"We've been through some difficult times, but we've got a clear strategy that we are executing," Manby said. "Obviously we want to mov