Expedia's Answer to TripAdvisor-Priceline Deal? Direct Hotel Booking on Trivago

Skift Take

Expedia is concerned that Booking.com's booking partnership with TripAdvisor will hurt Expedia traffic from TripAdvisor. Expedia's answer for now is Trivago taking hotel bookings. It's not a big answer for now, but it's a start. And Expedia might forge a booking partnership with Google in the future.

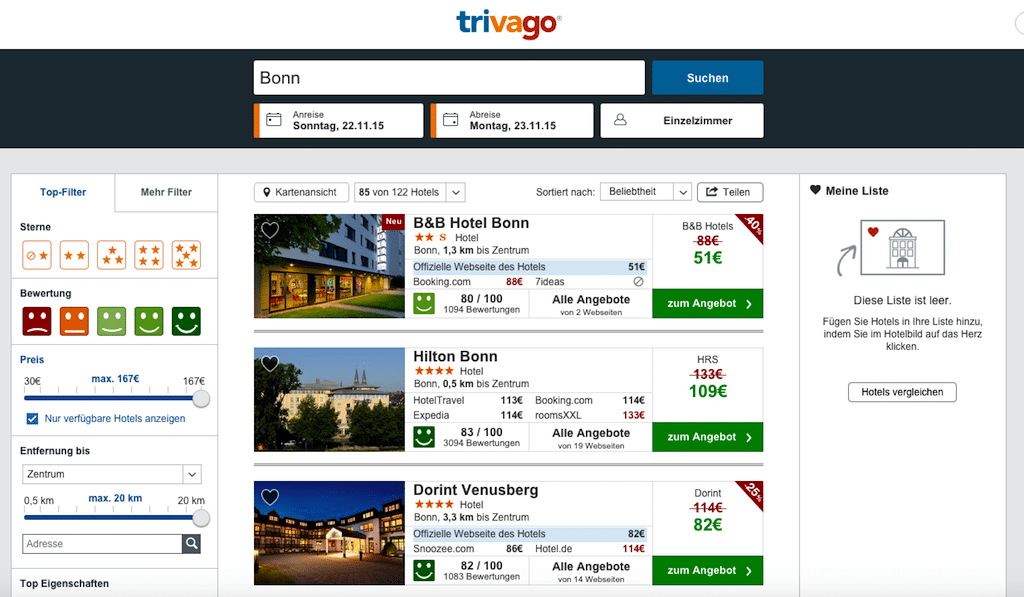

Expedia Inc. has an answer to TripAdvisor's blockbuster booking partnership with the Priceline Group. Similar to TripAdvisor Instant Booking, Expedia-owned Trivago has launched hotel bookings on its site and app in Germany, and plans to expand it into English-speaking countries.

That's the word from Expedia Inc. CEO Dara Khosrowshahi, who acknowledged concerns about the enhanced ties between rivals TripAdvisor and the Priceline Group during Expedia's third quarter earnings call today.

Metasearch sites such as Trivago and TripAdvisor traditionally show hotel offers from the hotels themselves and