Exclusive: Amazon's New Hotel Business Begins to Take Shape

Skift Take

Amazon has begun to broaden the way it works with hotels using the precise business model that Skift reported in November that it would.

In the past couple of weeks Amazon Local updated its iOS and Android apps and began on-boarding a handful of independent hotels offering their rooms at published rates, which is a big departure from the steeply discounted, distressed inventory that has been the mainstay of Amazon Local over the past couple of years.

That's important because Amazon is trying to give hotels the flexibility to work with Amazon on an ongoing basis and not just when they have rooms to sell at 40 percent or 52 percent cheaper than published rates when the hotels are feeling the pinch.

You can expect Amazon to continue to explore ways to expand the boundaries of its hotel business, and to seek to find a different value proposition for hotels and consumers than the rest of the pack.

Bringing Hotels On Board

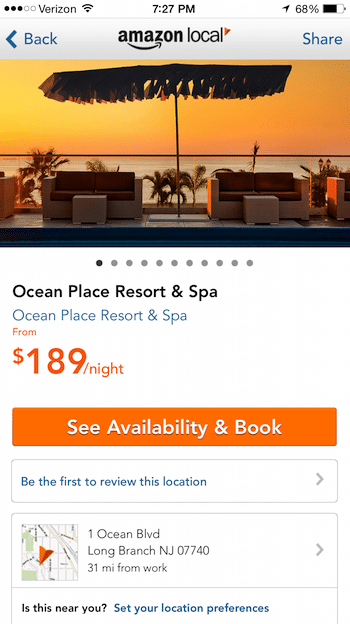

Among the hotels that have loaded their published rates, availability and photos through the Amazon Local extranet over the last week or plan to do so in the coming days are sister properties Ledges Hotel and The Settlers Inn in Hawley, Pennsylvania, as well as Ocean Place Resort & Spa in Long Branch, New Jersey, and Salishan Spa & Golf Resort in Gleneden Beach, Oregon.

Unlike the vast majority of properties in Amazon Local, the hotels cited are seeing their rooms displayed at published rates without a strike-through price indicating the amount of the discount.

Despite steadfast denials that the global retailer was doing anything new in hotels since Skift broke the story in November about its plans, Amazon is clearly looking to broaden the way it works with hotels to find a way to provide additional value for independent properties. There is no indication from Amazon, however, that it has plans to take on Booking.com, Expedia or Hotels.com.

For now, at least.

Hoteliers involved the the fledgling published-rate program, though, aren't buying Amazon's supposed low-key approach.

"They are pretty good at selling other stuff so why not hotels," says Mike Taylor, the general manager at the 255-room Ocean Place Resort & Spa in Long Branch, New Jersey, which began participating in Amazon Local for the first time last week, offering a published rate of $189 per night. "They are going to go toe to toe with Booking.com."

Taylor says Amazon reached out to the property last Fall, and the hotel can basically offer published or discounted rates.

As an independent hotel, "we didn't want to be left behind," says Taylor, noting that the property also uses Booking.com and Expedia for distribution.

The Business Model

The business model that Amazon is using with these new hotel clients is precisely the one that Skift reported it would roll out when we exclusively published A First Look at Amazon's New Hotel Contract November 28.

Instead of taking huge margins for deeply discounted rooms Amazon- or Groupon-style, Amazon is taking a commission of 15 percent or so and compensating the properties in two payments for the prepaid rooms.

Linda Monahan, who is the online manager for the 20-room Ledges Hotel and 23-room The Settlers Inn in Hawley, Pennsylvania, says the properties have been talking to an Amazon representative since December and can offer a variety of rates as long as they don't breach rate parity agreements.

Ledges Hotel went online on desktop and mobile with Amazon last week and The Settlers Inn should do so shortly.

Given Amazon's vast database of customers and high-profile global brand, Monahan believes her hotels "will definitely get some business" out of the new relationship.

Mark Sanders, director of sales and marketing at Salishan Spa & Golf Resort in Gleneden Beach, Oregon, also confirms that the property recently went live with Amazon Local, adding it to its distribution lineup, which includes online travel sites such as Travelzoo, Expedia and Booking.com.

New Platform

Despite Amazon's previous denials that nothing new was under way in its hotel business, Skift had repeatedly been hearing information to the contrary from hoteliers and we even saw an email from an Amazon Local salesperson promising that a new "platform" would be ready by the end of the first quarter of 2015, which is March 31.

The on-boarding of the published rate hotels that appears to have begun in the last couple of weeks seems consistent with that timing.

At least one hotelier claims to have seen a salesperson's presentation showing a redesign of Amazon Local that would host Amazon's expanded roster of hotel offerings, emphasizing independent properties close enough to several big cities to be ideal for weekend getaways.

Scaling Up?

It is difficult to gauge what the salesperson meant when referring to the launch of a new "platform," whether it would be a significant new technology platform or just an incremental change to the way Amazon Local has done business.

To be sure, upper management at Expedia Inc. and Booking.com, with their hundreds of thousands of properties in the fold and mammoth, global hotel businesses, is not losing any sleep over the very modest beginnings of Amazon's new published rate hotel program.

In November, Expedia Inc. CEO Dara Khosrowshahi welcomed Amazon to the party but noted Amazon would have a lot of catching up to do.

Scaling the new business one hotel at a time won't get Amazon Local anywhere fast in the travel business, which has never been Amazon's strong suit.

Still, Skift spoke with one hotel aggregator who met with an Amazon official several months ago and got briefed on Amazon's ambitions, which seemed substantial.

Amazon's real intent in the hotel business isn't known. And perhaps Amazon officials themselves don't really know at this point as they see what sticks.

But it is clear that Amazon is exploring its opportunities in the hotel business and will continue to expand its boundaries.