Travelzoo's Hotel Transformation Is Slow and Painful

Skift Take

So you want to launch a hotel booking site? It isn't easy -- just ask the people who work at Travelzoo.

The New York-based deal publisher, which now has 24.5 million members, has been laboring away over the last year, adding hotel-booking capabilities so it can supplement its "push" capabilities of inspiring people to take an unplanned vacation with the "pull" acumen of enabling customers to search for hotels when they need them.

"We have been very successful in the past 15 years to inspire our users by telling them about great deals at quality places," said Holger Bartel, Travelzoo's executive chairman, during the company's first quarter earnings call April 16. "We will tell them, for example, to take a five-day trip to Iceland at an amazing price, but when they are simply looking to find a deal for an upcoming weekend getaway in New York, we offer little help. We believe there is a great growth opportunity to serve our members better by helping them find deals when and where they need them."

In some ways, Travelzoo, despite its seeming slow pace of scaling up its hotel business, is further along than Amazon, which is taking tentative steps toward expanding beyond deals into a more well-rounded hotel-booking service.

It's Complicated

Three months ago, Bartel told analysts that building a hotel booking engine was a lot harder to do than he initially anticipated.

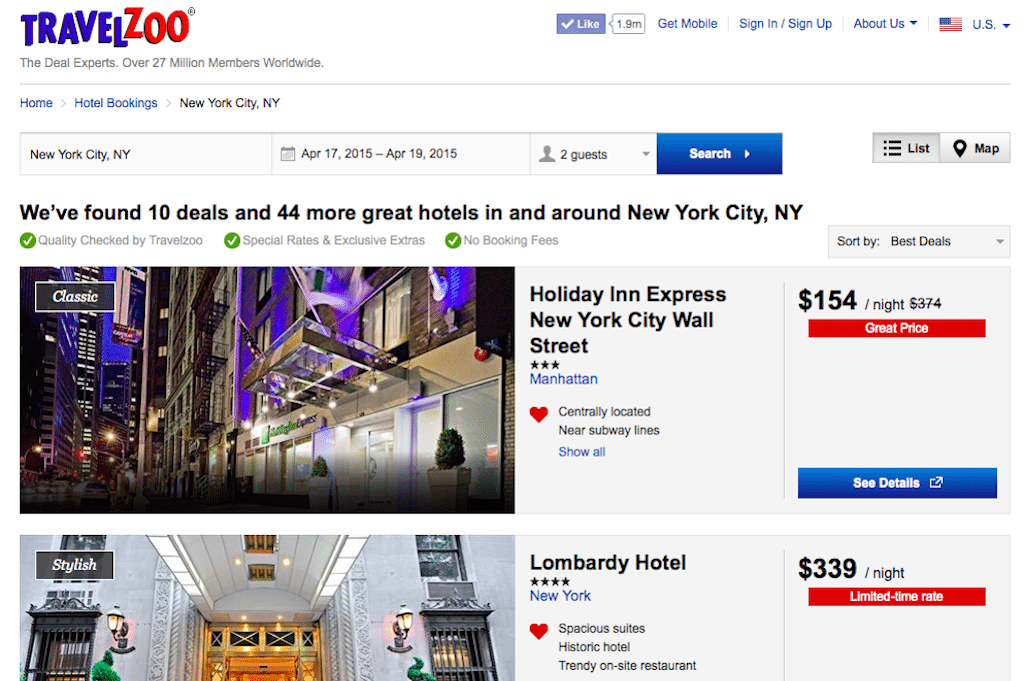

After having acquired hotel-booking site Perfect Escapes in 2012 as the foundation of its new platform, Travelzoo relaunched its hotel-booking engine in late February, focusing on about a half dozen top markets in North America such as New York City, Las Vegas and Chicago.

Travelzoo hasn't promoted its hotel-booking capabilities to its customers yet and you won't find it on the homepage because it is still experimenting and working out the kinks but here it is.

"Anyone can book a hotel but as I said, we haven’t promoted it yet and we still have fairly weak content in some destinations," Bartel said. "We focus on those destinations that are most important.

"And then regarding the content, yes, we have very good coverage now in sort of the top 10 destinations for North America but I think we need another couple of quarters to really bring in more hotels in areas where what I would call secondary markets."

With an eye on turning a profit, which it did in the first quarter with net income of $1.9 million, a 59 percent decrease compared with the year-earlier period, Travelzoo fired 28 employees, or 6.4 percent of its workforce, mostly in North America.

[Update: Travelzoo CEO Chris Loughlin said April 20 that although 28 employees left the company, the majority left voluntarily, and the company chose not to replace them in the first quarter. Travelzoo is hiring now, Loughlin said.]

Europe Next

Travelzoo has been increasing its online marketing spend in North America to acquire new customers, and in the next six months will extend that to Europe, where a rollout of the hotel-booking platform is slated.

"There’s quite a bit of groundwork that needs to be done prior to launching that booking platform into the markets as well," said Travelzoo CEO Chris Loughlin, referring to Europe.. "So I don’t want to use the word distracted, but the team has to get that work done in order to get the booking platform live in those countries.

"I mean, you can’t just go into Germany with the New York hotel written in English, for example. That needs to be written in German. It needs to be priced in euros and you got to contract with those hotels in those markets. So all of that work is being done."

The scaling up process will be slow but Travelzoo argues that hoteliers are looking for alternatives to Booking.com and Expedia.

A financial analyst asked Bartel how all the mergers and acquisition activity in the travel industry might impact Travelzoo.

"I would say it’s probably more of a good thing for us, because particularly in hotel distribution you now just have two massive players," Bartel said. "And when I speak with consumers, they say, oh, great, I’m using a Web site called Trivago. They compare all these prices from Expedia and Hotels.com and Orbitz and Travelocity. And I tell them, well, are you aware that all these sites are owned by the same company? Oh, no, I didn’t know about it.

"And then are you even aware that Trivago is even owned by the same company? No, of course. Well, so they basically in essence compare their own products against other Web sites that they own themselves. So you really have massive concentration there and I think when we speak with the hotels, they are quite relieved to have some additional players in this space. And we are one of the remaining independent players here. And I think right now that’s a good position to be in."

Travelzoo will have to figure out how to expand its content in the face of those huge booking sites out there throwing their weight around.

The advantage that Travelzoo has that other new entrants don't is those 24.5 million registered members/newsletter subscribers.

If Travelzoo can tweak its hotel booking engine and get it going, then at least it already has an audience.