Ctrip Leaders Say Discounts Are Killing the Chinese Travel Industry

Skift Take

With an operating margin in the red in 2014, an official from China's leading online travel agency, Ctrip, spoke candidly about competition and the land grab under way in her country.

Asked during the company's fourth quarter earnings call last week when would Ctrip get to its goal of a 20 to 30 percent margin, Jenny Wu, chief strategy officer, said: "The long-term margin is obviously very much related to our scale and also the competitiveness -- the competitive landscape in China."

With its heavy investing and coupon discounts on hotel rooms among the factors, Ctrip's GAAP operating margin in 2014 was negative 2 percent.

In the China travel market, Wu said, there "is a lot of irrationality here and over-competitiveness. But no industry can continue this kind of growth over the long run."

"So this is on industry side. We expect the industry competition will gradually go back to the rational path, and Ctrip, we're working very hard to try to drive the industry to go back to the healthy growth path also."

In other words, the cutthroat nature of the Chinese travel market can't persist forever, Wu argues.

Or at least that's the hope.

Couponing Takes Its Toll

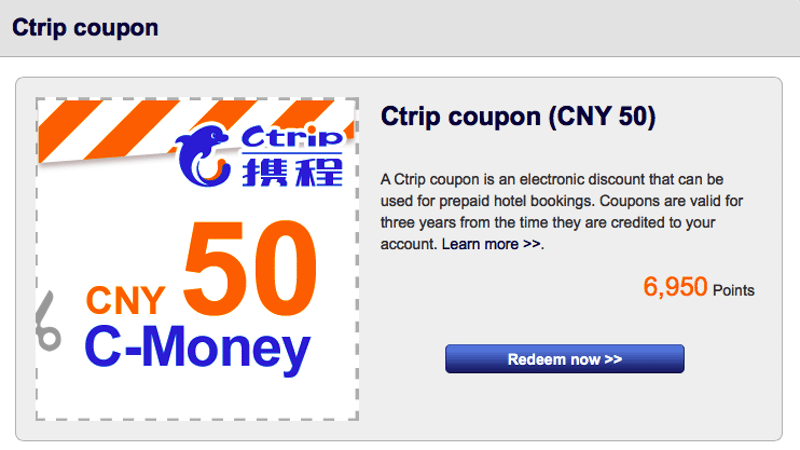

To get a feel for the competitive nature of the market involving Ctrip, Qunar, eLong, Alibaba's Alitrip and countless other travel agencies and tour operators, you only need to look at the coupons the major players provide to travelers, offering them discounts off hotel rates.

Ctrip projects that coupon expenses will account for about 20 percent of its hotel commission revenue in 2015, leading to about a 2 percent decline in its revenue per room night.

Regarding its coupon strategy, Ctrip's policy is to "decisively match competitors to ensure our customers can enjoy the best price," Wu said.

The strategy has led to accelerated growth and market share gains, Wu said.

But for now, at least, it appears to be an unavoidable race to the bottom.