If Expedia Was Too Powerful for Hotels, Consider Booking.com's Plans

Skift Take

If hoteliers were once worried that Expedia and Hotels.com had too much power over their businesses, just consider what the Priceline Group, including its largest brand, Booking.com, have in the works.

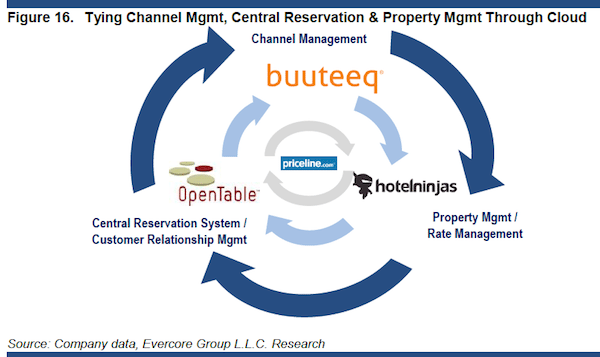

Fresh off its acquisitions of Buuteeq, Hotel Ninjas, and OpenTable this year, the Priceline Group is in the process of integrating Hotel Ninjas' property management system with hotel digital marketing company Buuteeq, according to a report, Google’s Travel Plans in a Post-Atomic Era [embedded below], written by Ken Sena of Evercore.

With the integration of the two cloud-based systems for hotels, the Priceline Group "has the ability to handle property management, channel and rate management, and CRM, all of key consideration to hotelier," the Evercore report states. "In return, Priceline receives subscription revenues on some of the services provided in addition to keeping these hoteliers' semi-tethered to its Priceline traffic channel from the standpoint of ease an efficiency, given Priceline’s leading scale as an OTA."

"We understand from our industry conversations that the integration of its new PMS (property management system) with the channel and marketing services of Buuteeq would bring Priceline that much closer to providing hoteliers with a full enterprise hospitality stack, in which customer folios and housekeeping services can be managed through a single cloud delivered web interface," the report states.

In so doing, the Priceline Group would find itself competing with the likes of Sabre Hospitality Solutions and Trust International in enterprise solutions for hotels.

Evercore also believes that some of OpenTable's mobile payment features, such as Pay with OpenTable, which enables dining customers to pay their checks from the OpenTable app, could be tied into Hotel Ninjas, and possibly Buuteeq, prior to the launch of Priceline's B2B play for hotels.

Opportunities and Challenges

There are abundant challenges and opportunities in all of this for Priceline/Booking.com. Booking.com has created a data wall between its enterprise business and its distribution business for hotels, Evercore states, but some properties may be concerned about sharing data with the online travel company in case that data gets in the hands of competitors.

On the other hand, the Priceline Group could create compelling bundles of its distribution and enterprise services for hotels, and if the enterprise piece happens to be very effective, it might be an offer that's difficult to refuse.

Another consideration is that the Barcelona-based Hotel Ninjas is just a little more than two years old, and its property management system is largely untested.

Would hoteliers want to hand over their internal systems to such a fledgling property management system company? And the Priceline Group itself has little experience in that end of the hotel business, as well.

Still, one thing is clear: If people expected Priceline Group CEO Darren Huston, who took up the top post on January 1, to tip-toe around for a year or two without shaking things up, they were totally wrong because Huston is reinventing the business.

[gview file="https://skift.com/wp-content/uploads/2014/09/Evercore1.pdf"]