Why Travel Booking Sites Are Still Pushing Pop-Under Ads

Skift Take

TripAdvisor will talk about how its transition away from hotel search through pop-under windows to metasearch was driven by the need to improve the customer experience, and that indeed was part of the reason. But, the bottom line is it was mostly about the bottom line i.e. the economics.

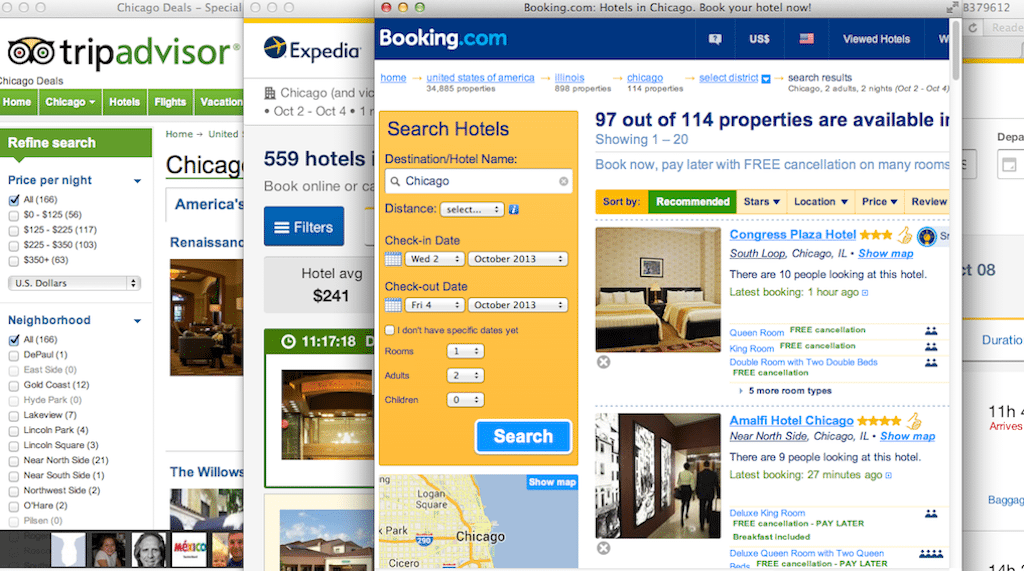

Booking Buddy, which is now owned by TripAdvisor, pioneered pop-under ads in travel, and for travel websites and their online travel agency and hotel advertisers, it's a gift that keeps on giving.

This model is still omnipresent on sites such as Kayak, where travelers may decide not to view airfares side-by-side metasearch-style for a Newark to San Diego flight, but will opt instead to use the BookingBuddy-inspired feature, labeled "Choose Sites to Compare vs. Kayak (new windows)," which appears under the main search tool.

To be sure, this is not Kayak's most lucrative search feature. Kayak earns a lot more money on a cost-per-click basis through its primary business, metasearch, when users choose the Find Flights option, land on the Kayak flight search results page where the airfares are shown, and then book their flights.

That's because the customer landing on Kayak's flight or hotel search results page, which show the supplier and the rate, is much more likely to convert into a booker than the users who are just starting to search and are opening a bunch of browsers with no idea of the price through the Compare vs. Kayak (new windows) feature.

Kayak prefers that customers use its core hotel and flight metasearch tools, but is happy not leave money on the table when site visitors choose the "compare" feature instead.

That's where the BookingBudd