New American Airlines won't repeat Pan Am and TWA mistakes, official says

Skift Take

The new American Airlines will have a formidable network, although it remains to be seen whether the merger transition will be characterized merely by a few bumps, or whether there will be significant turbulence.

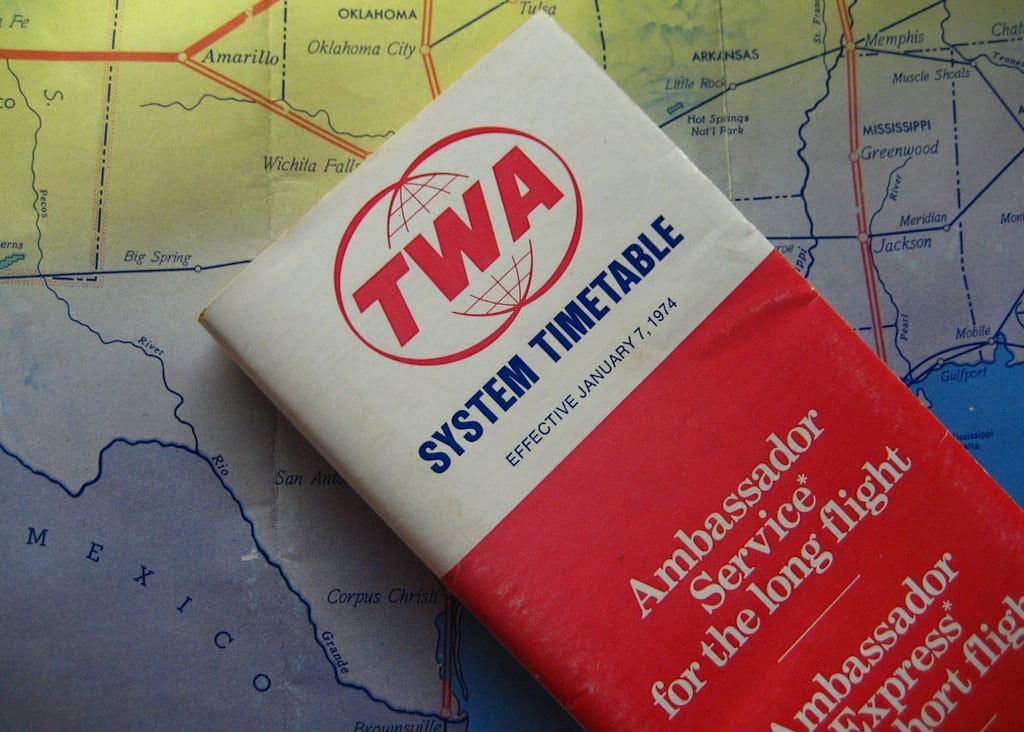

Pan Am and TWA, two iconic airlines that were grounded for good in 1991 and 2001, respectively, got "out-competed" domestically by rivals such as United, American, Delta, Continental and Northwest, and that contributed to the duo's demise.

To be sure, the reasons Pan Am and TWA went bust are complex, but US Airways president Scott Kirby, a key member of the US Airways-American Airlines transition-planning committee, seized on the weakness of the Pan Am and TWA domestic networks as the beginning of the end despite the fact that they were the "preeminent" carriers of their era.

The importance of d