Skift Take

This report explores the impact of Google across the travel supply chain, from rivals in the metasearch space to uneasy allies at the online travel agencies and brand clients that can use Google tools to reach their audiences.

In our latest report, Skift Research takes a deep dive into Google and its impact on the travel industry. Google is easily one of the largest businesses that influence how travel companies and consumers behave.

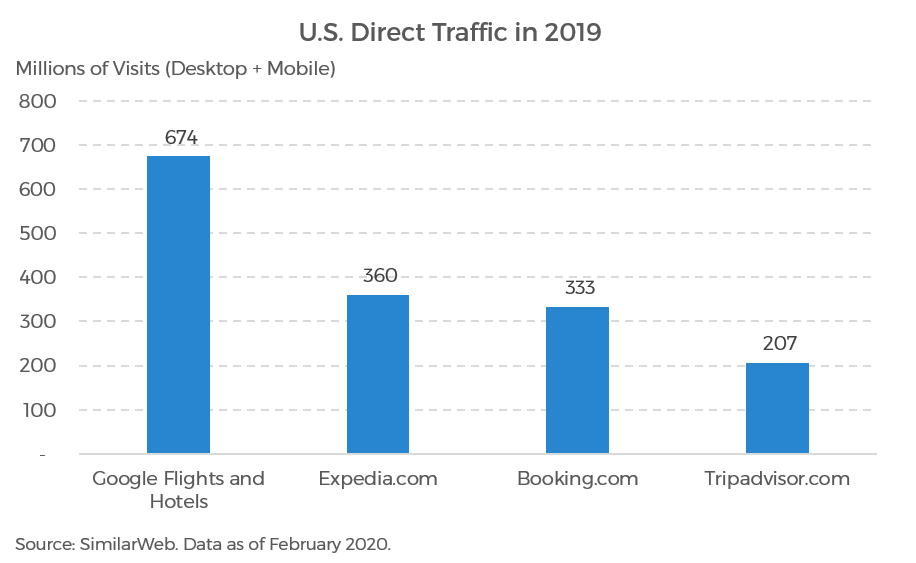

The company has a strong position at the top of the funnel, able to reach customers considering travel through its products that run the gamut from YouTube to the traditional blue search links. It’s travel-specific vertical search modules generate nearly as much traffic as expedia.com and booking.com, combined, do in the U.S. We estimate that its any ad offerings may have raked in as much as $16 billion from travel companies in 2019.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Google’s Vertical Search Products

Google’s horizontal search products are a long-time staple of the internet. But Google has in the last few years dramatically increased its impact on the travel industry by debuting new vertical search features for the sector.

Rather than the one-size-fits-all blue links and text descriptions that come with horizontal search, the vertical search modules have been customized to display additional relevant search information specific to individual travel segments. The three travel segments Google currently operates in are: flights, hotels, and short-term rentals.

A Google spokesman said that, “at a high level, we want to create more opportunities to connect our partners with travelers at the right moments of intent, whether that’s driving demand for a brand at the top of the funnel when someone is looking for trip inspiration, or capturing a booking when someone is further along on their travel journey.”

These vertical travel search offerings have grown rapidly in prominence, both as a function of their convenience to travelers and due to strong promotion by the Google algorithm (though the vertical search units rank organically on results pages and do sometimes rank below other organic blue links, more often than not, the industry module ranks towards the very top of the results page).

SimilarWeb data shows that Google travel vertical search products (Hotels + Flights) received 674 million visits in the U.S. in 2019. To put that figure into perspective, that is practically as much traffic as Expedia.com and Booking.com combined received.

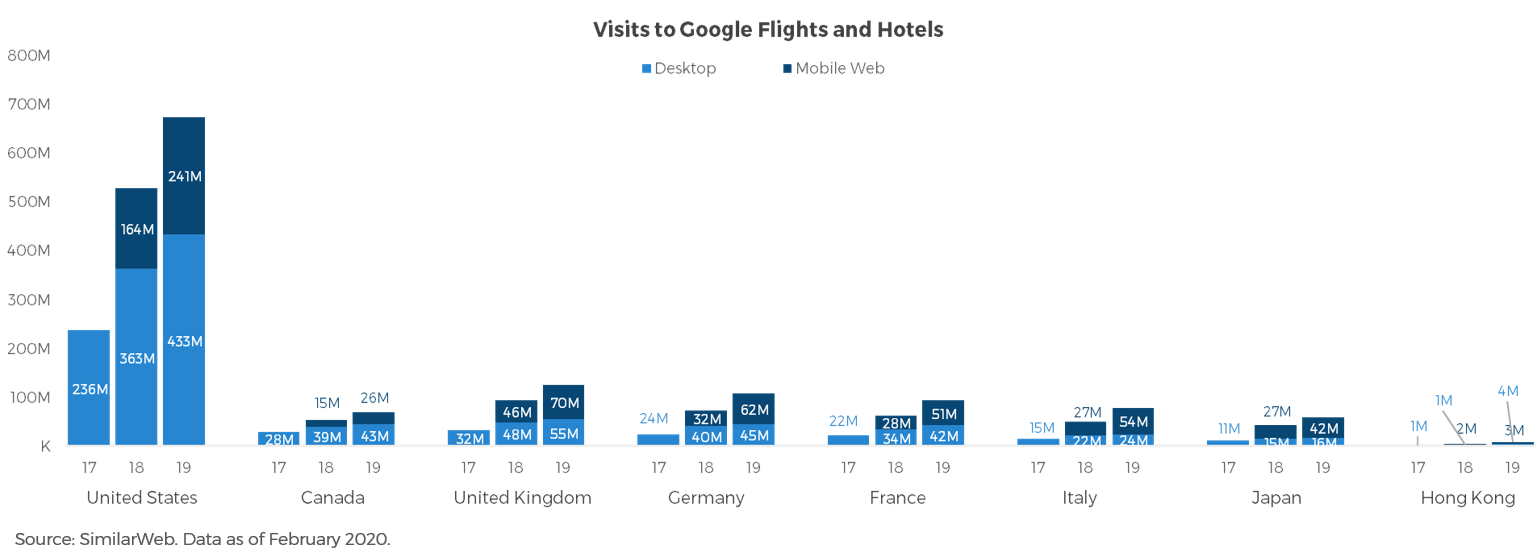

The U.S. visitation figure is not just big, but growing quickly: up 28 percent from last year. That double-digit growth rate comes off an even more impressive 54 percent increase in desktop traffic the prior year (SimilarWeb did not track travel mobile visits before February 2018).

The U.S. is by far the largest market for Google Flights and Hotels, receiving more than five times as many visits as the UK, the second largest user of the vertical travel search products. But offsetting this lower base in international markets is higher traffic growth rates. We are seeing 30–40 percent-plus year-on-year increases in volumes in major European markets — the UK, Germany, France, and Italy — as well as in Japan.

Clearly these vertical search modules are an important part of Google’s role in the travel ecosystem. We will examine each examine sub-industry unit – Flights, Hotels, and Vacation Rentals – more closely in the full report.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: google, google flights, Google Hotels, google travel, metasearch

Photo credit: Google integrates powerful hotel search functionality, including the ability to filter by location, dates and price, into its Maps mobile application. Seth Borko / Skift