“Google will kill Airbnb,” tweeted Nick Huber, who writes about business and real estate, owns a self-storage company, and has 247,000 followers on Twitter.

Two people independently messaged me about the tweet, which has generated a few thousand “likes,” and hundreds of retweets since Sunday.

One Skift colleague said of the tweet: “Everything this guy says in his tweet thread is wrong.”

Conversely, a superhost in Europe messaged me about Huber’s tweet: “I would have to agree. Everybody loves a direct booking (both hosts and guests), with no whopping service charges.”

Hosts Just Need to Put Links to Properties in Google … Hmmm

If only it were that simple.

Huber argues that hosts and guests can avoid Airbnb’s substantial fees, and both can save money with direct bookings. Actually, he claimed that Airbnb takes 25 percent of the transaction, mostly from guests, in the form of fees, which seems excessively off the mark.

After this story posted, travel industry veteran Drew Patterson tweeted that Airbnb revenue was only 13 percent of gross bookings in 2021.

One of the silliest things Huber tweets is, “All it takes is folks putting a little link to their software in the Google listing. Management co manages that directly. Way more revenue to owner and less cost to guests.”

Alas, graveyards full of startup companies from Palo Alto to Madrid and Mexico City are testimony to the fact that you can’t merely put a link on a Google business listing, and expect millions upon millions of customers to discover it, and then use it. It takes a mammoth amount of resources to attract direct bookings and for a vacation rental business to build their own brands.

Hey, direct bookings would be mostly great for hosts and, to a lesser extent, guests, but how can property owners and managers attract them?

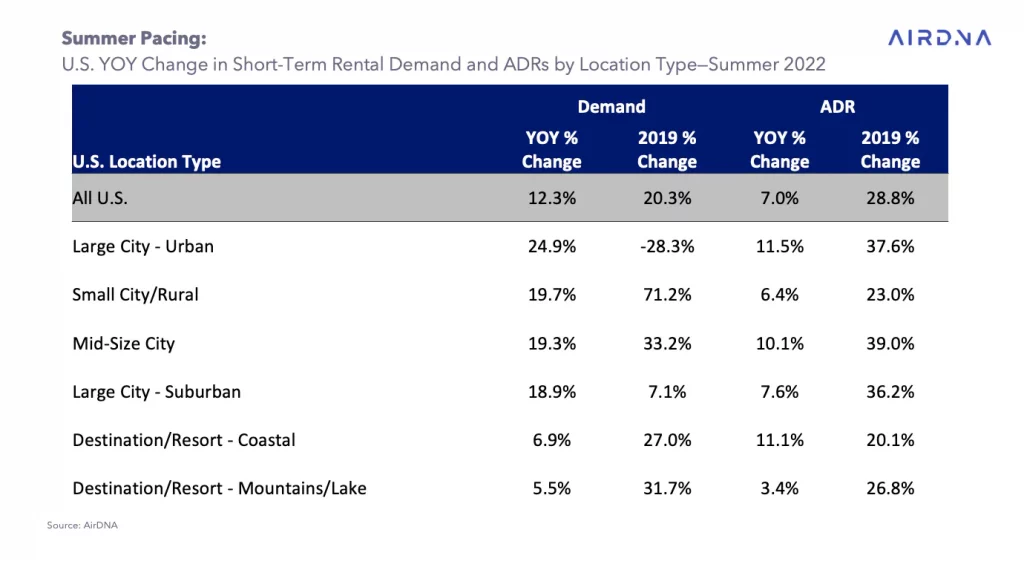

If you look at the global hotel industry, it has done an admirable job over the last few years, spending huge sums in advertising to urge customers to book directly on their own websites, where they have the lowest rates, instead of using online travel agencies.

Hotels have made significant strides in this regard in attracting direct bookings, but the vast majority of them still rely on online travel agencies to attract price-conscious consumers who care little about whether they are staying in a Marriott or a Sofitel.

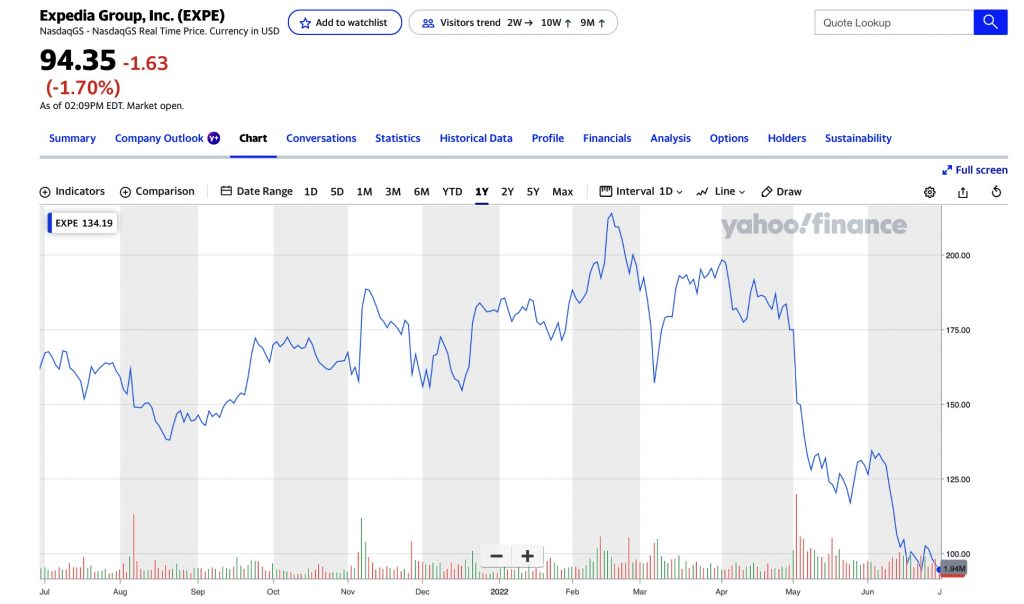

Hotel direct bookings haven’t killed Expedia or Booking.com. Travel, it is often said, isn’t a zero-sum game. There is ample room for multiple winners.

Property owners use Airbnb for a reason: Airbnb has a great brand, and attracts legions of guests who start searching for places to stay on Airbnb instead of beginning their trip-planning on Google.

How does the host with one or a handful of properties compete with that kind of market power?

Direct Bookings Have Risks, Too

And although guests can avoid Airbnb’s fees by booking direct with the host, they run the risk of having no one to turn to if the host or property turn out to be a nightmare. Whether or not they work as well as advertised, Airbnb has some insurance protections in place for both hosts and guests.

Airbnb critics will be quick to say that Airbnb’s customer service for guests can be challenging, but it’s often better than dealing with hosts who have no brand or track record to stand behind them.

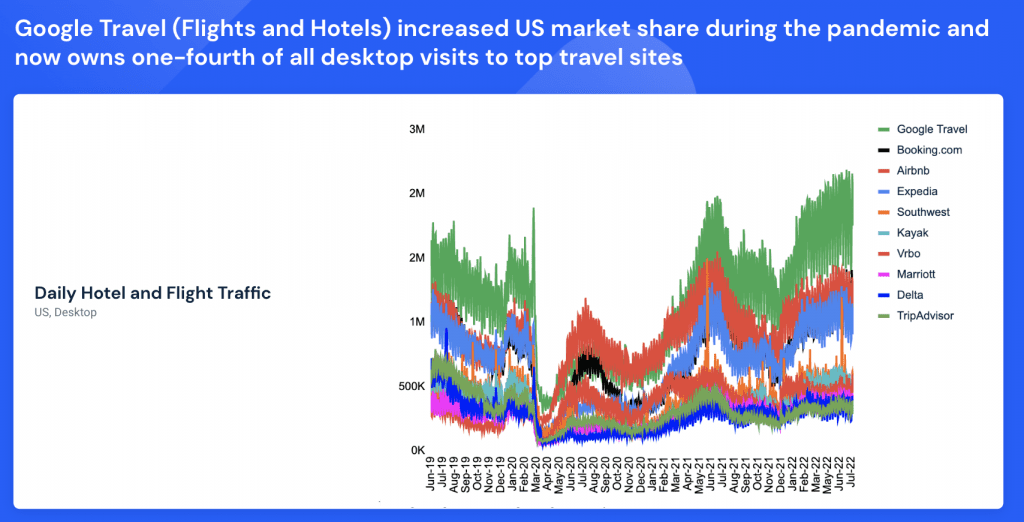

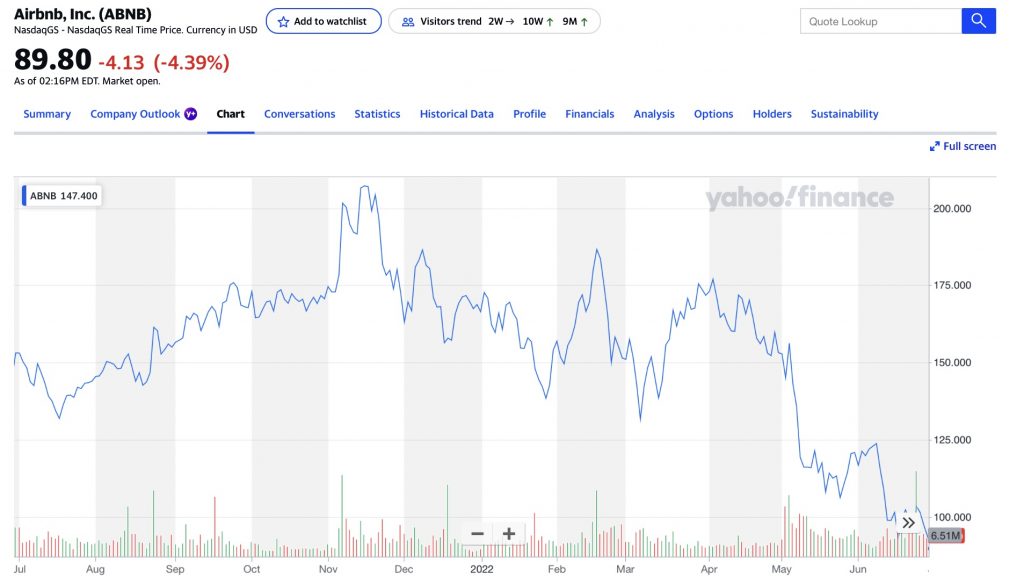

On the question of Google “killing” Airbnb, the latter has for the past couple of years been able to grow while keeping the percentage of the revenue it spends on marketing — and Google — relatively low and stable.

In fact, Google’s travel vertical has a vacation rentals feature, and it hasn’t really distinguished itself or put much of a dent in Airbnb’s growth precisely because Airbnb, and other big vacation rental brands, have shunned offering their homes and apartments through Google vacation rentals. So Google is hardly usurping Airbnb on that front.

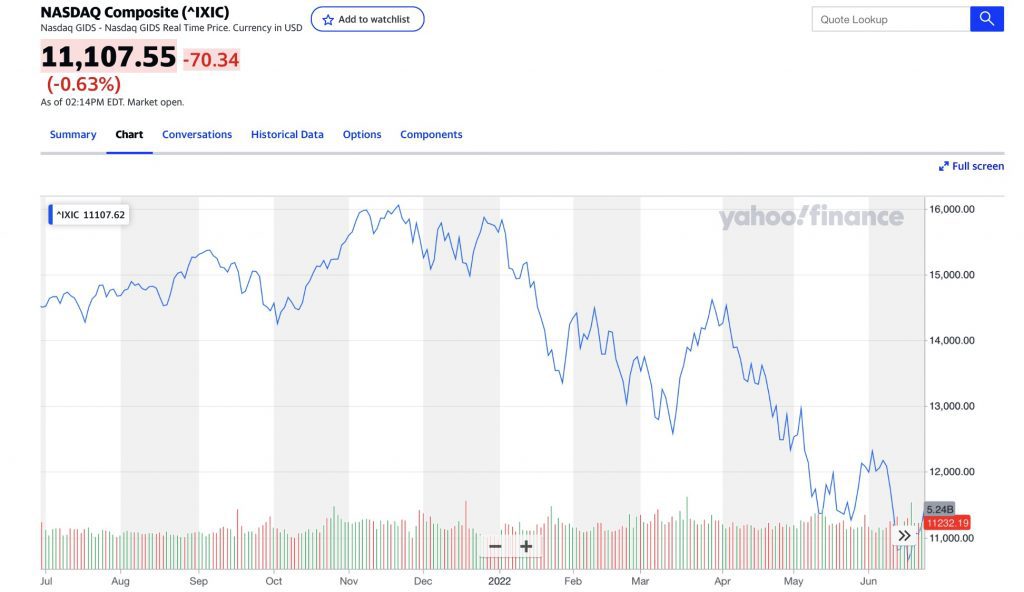

Google has certainly damaged the businesses of innumerable travel companies because of its near-monopoly in search and the way it preferences its own travel advertising features. Curiously, although most of the far-out theories about Google taking over the travel industry tend to say that Google will transition from an advertising to a booking platform and would become an online travel agency — a switch that Google has shown little appetite for — Huber isn’t even making that argument.

Instead, he’s arguing that Google will serve as a listing platform, and build advertising around it, and that hosts, with an assist perhaps from property managers, would see direct bookings flow like lava down a hillside because these offers are inherently the best and cheapest deals for both hosts and guests.

Both Google and Airbnb Face Headwinds

Google killing Airbnb begs the question of which of the two has momentum versus the other. Both face big antitrust or regulatory challenges, and it’s hard to choose which one has the more daunting obstacles.

A little deeper into his twitter thread, Huber retreats a bit from his Google killing Airbnb opener, and pleads for “nuance.”

“Of course Airbnb will always have users,” he tweeted. “But over time many guests will go on google, find a vacation rental in an ideal location, click through to that website & book w/o paying hundreds in fees. 20 yrs from now ABNB will be a glorified lead generator.”

When it comes to predicting the future of companies two decades from now, I’ll pass on that one, considering it is difficult to look even two or three years ahead to see what the business world would look like.

So, alas, in Huber’s view, his talk of Airbnb’s death was apparently bombast.

When a twitter user tells Huber he downplayed the importance of factors like trust and reliability when considering direct bookings versus reservations through Airbnb, Huber retreats a bit further, tweeting:

“I think there will be an increased number of guests going directly. You can do all of those things without giving a huge chunk to Airbnb.”

Finally, that’s something we can agree with: There are many hosts doing everything they can to generate direct bookings, and they’ll likely have a degree of success. But I don’t believe “Google will kill Airbnb,” or that Airbnb will close shop anytime soon.

Note: This story has been updated to include additional information on Airbnb’s take rate. It also clarified Google’s role in the travel industry.