The potential merger of Avianca and Viva Air took a small step forward Wednesday when the former partially accepted the conditions laid out by the Colombian government for the combination of the country’s largest and third largest airlines.

While Avianca accepted regulator Aerocivil’s passenger protection provisions, including guaranteeing refunds for all travelers affected by Viva’s closure, it asked for “clarifications and minor modifications” to other conditions. The Star Alliance carrier asked that the remaining provisions, which include giving up slots at Bogotá’s congested El Dorado airport and committing to operating certain routes, reflect the “reality of the current market and to the operating conditions currently available to Viva.”

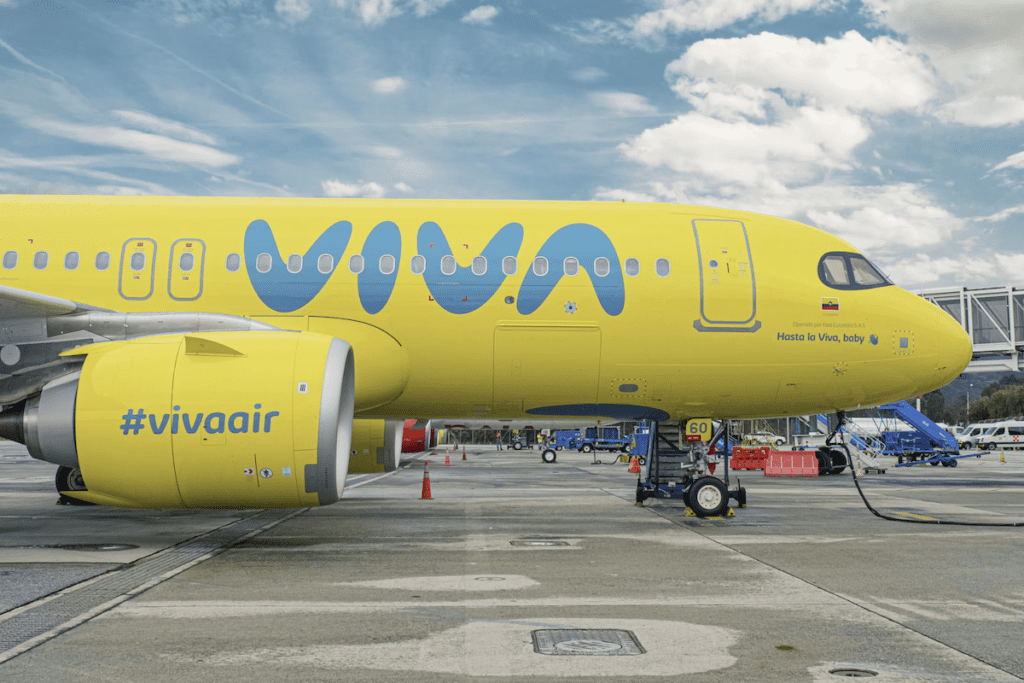

The latter point referred to Viva’s shutdown in February and subsequent repossession of several of its planes aircraft leasing companies. Then in March, budget competitor Ultra Air also shutdown, which upped pressure on the government to bring some budget airline capacity back to the Colombian domestic market, which had fully recovered to 2019 traveler numbers by October.

Avianca and Viva have called for “quick solutions” from Aerocivil in its response.

Competitors JetSmart and Latam Airlines, however, have appealed Aerocivil’s tentative approval of the merger. Both have previously expressed interest in acquiring the assets of Viva, which would give JetSmart its first domestic operation in Colombia and Latam a larger presence.

Latam, Avianca’s main competitor in South America, said Tuesday that it is seeking additional slots at the Bogotá airport from the merger. It added that, since Viva and Ultra shutdown, it has added five aircraft to its Colombian operation and increased the number of seats by 20 percent. Latam is backed by Delta Air Lines and Qatar Airways.

JetSmart, for its part, received a local operating certificate in March to begin domestic flights in Colombia. The Chilean discounter’s owners include U.S. private equity firm Indigo Partners and American Airlines.

The responses this week are the latest in what has turned into something of a soap opera over the future of the Colombian aviation market, which is the third largest in Latin America. Avianca, in the course of its takeover, may have violated local antitrust law after it took economic control of Viva last year and then, reportedly, installed a board to oversee the business that had its interests in mind. The airlines first sought approval to merge in August, a request that Aerocivil denied in November, and then reopened in January.

The Avianca-Viva merger is separate from Avianca’s plan to merge with Brazil’s Gol to create the new Abra Group.