Skift Take

In Expedia Group's efficiency drive, there's a certain logic to killing some sub-brands as their market share plummets. But what about all those customers who still love Travelocity?

A research report found that Expedia Group has lost global hotel market share since the onset of the pandemic, and all of it has come from plunging business at non-core brands, such as Hotwire, eBookers, Orbitz and Travelocity.

In contrast, Bernstein research determined that foundational Expedia Group brands Expedia.com and Vrbo are increasing market share, and that “the sub-brands’ losses look to be by design, and have already lost half of their pre-Covid share.”

The backdrop to these developments is that the Bernstein report, “Global OTAs: A deep dive into market share – not all is as it seems,” stated that “For the first time in history — Booking and Expedia have lost aggregate share through Covid.”

But lumping together Booking Holdings and Expedia Group, if ever the hotel lobby’s “duopoly” designation was ever on point, is somewhat arbitrary. The report noted that Booking actually gained a small slice of marketshare since the pandemic began while Expedia Group, and metasearch, lost ground. Google, Airbnb, Hopper eDreams, Trip.com and direct bookings (Marriott, Hilton and Hyatt) were the beneficiaries, the report stated.

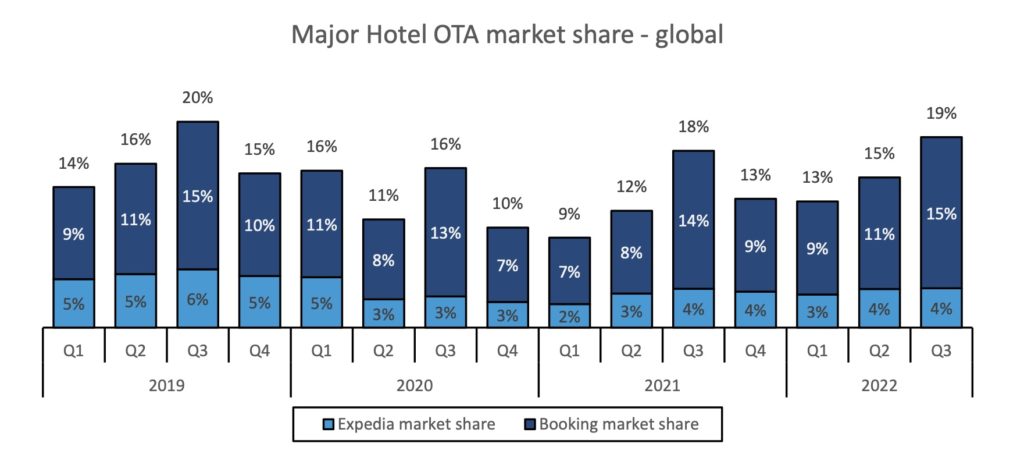

One can see from the chart that Booking and Expedia’s combined global hotel market share fell from an estimated 20 percent in the third quarter of 2019 to 19 percent in the third quarter of 2022. But, more significantly, Expedia Group’s share fell 2 percentage points during that period to 4 percent.

The Bernstein report focuses on hotel market share, and factors in their respective short-term rental businesses to derive hotel market share numbers. It found that Booking’s hotel business is four times larger than Expedia’s when considering room nights.

What Is Expedia Doing With Orbitz, eBookers and Hotwire?

The Bernstein report stated that Expedia Group’s sub-brands — namely Hotwire, Orbitz and eBookers — lost half of their market share during the pandemic, and speculated that it may have been on purpose. Other Expedia Group brands, including Hotels.com and Travelocity, saw a 40 percent traffic decline during the pandemic, the report found.

One has to wonder whether Expedia Group, which has been restructuring to simplify its operations over the past two years, has been laying the groundwork to dispose of some of these non-core brands in some fashion, either by selling them, or integrating their audiences into Expedia.com and Vrbo.

After all, over the last couple of years, Expedia Group, in the name of streamlining operations, sold or disposed of brands, including Egencia, Classic Vacations, SilverRail, Alice, Expedia Group Mulitfamily, and BodyBuilding.com. Expedia scaled back other brands like Local Expert, trimmed its global distribution suppliers, and combined teams companywide to overturn the previous brand by brand operational structure.

So wouldn’t it make sense for Expedia Group to gut Orbitz, Travelocity, eBookers, Hotwire and others in favor of more focus on Expedia.com and Vrbo?

Expedia’s Strategy Then and Now

In the span of a year starting in late 2014, Expedia Group acquired Wotif, Travelocity, and Orbitz and basically turned them into front-end shells that are today in many ways clones of and powered by Expedia in the back end. Their workforces were eviscerated over the years.

The strategy has been to cut all the costs possible from running these brands, and take advantage of their brand recognition and customer bases.

While there still is undoubtably a cost to operate and market these brands, and a certain amount of complexity involved, killing the brands — or at least some of them — may be counter-productive because some still have loyal audiences.

Travelocity founder Terrell Jones said Expedia group erred in making the Travelocity and Orbitz user interfaces similar to Expedia.com.

“We all know that customers shop many, many online sites looking for the best price but obviously if a site looks identical and produces identical results it probably isn’t worth the effort,” Jones said. “They could have normalized the back end and left the UI somewhat different and might have achieved different results.”

Similarweb ranked Travelocity the ninth and Orbitz the 15th largest travel and tourism websites in the U.S. by traffic in November, for example. They undoubtably still attract a lot of bookings for Expedia Group.

However, Similarweb ranked Expedia’s Hotwire #30 in the U.S. while eBookers, which came as part of the package when Expedia acquired Orbitz Worldwide in 2015, was 218th within the UK travel and tourism website pecking order.

Expedia wouldn’t comment on the Bernstein report.

However, during Expedia Group’s third quarter earnings call in November, CEO Peter Kern, commenting on market share shifts in lodging in North America, said things were normalizing after the company engaged in “moving” technology platforms and “pulled back on some discounting and some other things where the competition has been very heavy.”

Citing market share declines at Orbitz, Hotwire, Wotif and Travelocity, the Bernstein report said Expedia Group may be more than half-way toward stemming its market share losses, adding “and Expedia’s performance may well trend more toward the performance of core brands Expedia and Vrbo.”

Report author Richard Clarke of Bernstein said he expects Expedia Group may opt to have sub-brands like Orbitz, Travelocity, Hotwire and eBookers “keep ticking along” because it would be a waste to lose their customers. They can be retained with zero brand and performance marketing costs as long as Google still shows them love in its free listings, he said.

When Expedia Group announced last year that it plans to debut a unified loyalty program across brands in 2023, it cited Expedia.com, Hotels.com, eBookers, Travelocity and Vrbo as being part of that vision.

Another research analyst, who declined to be identified, said he doesn’t think Expedia Group would sell these sub-brands, but could merge them into bigger brands like Expedia.com, similar to the way Expedia killed the HomeAway brand in favor of Vrbo a few years ago.

Whether Expedia decides or not to further diminish or wipe out its long-tail of brands, it’s clear that the focus is on Expedia.com and Vrbo, and perhaps with a dash of Hotels.com mixed in.

Note: This story has been updated to add comments from Travelocity founder Terrell Jones.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, ebookers, edreams, expedia, expedia group, future of lodging, google, hilton, homeaway, hopper, hotels, hotels.com, hotwire, hyatt, market share, marriott, online travel newsletter, orbitz, short-term rentals, travelocity, trip.com, vrbo, wotif

Photo credit: Former Expedia Group CEO Dara Khosrowshahi held aloft Travelocity mascot the Roaming Gnome when Expedia Group acquired Travelocity in 2015. Should Expedia Group keep Travelocity? Expedia Inc.