Skift Take

Be wary of everybody’s favorite word at the moment: pent-up demand. Your typical leisure traveler can book a trip and pack their bag in minutes, but companies will keep employees on a tight leash for years to come.

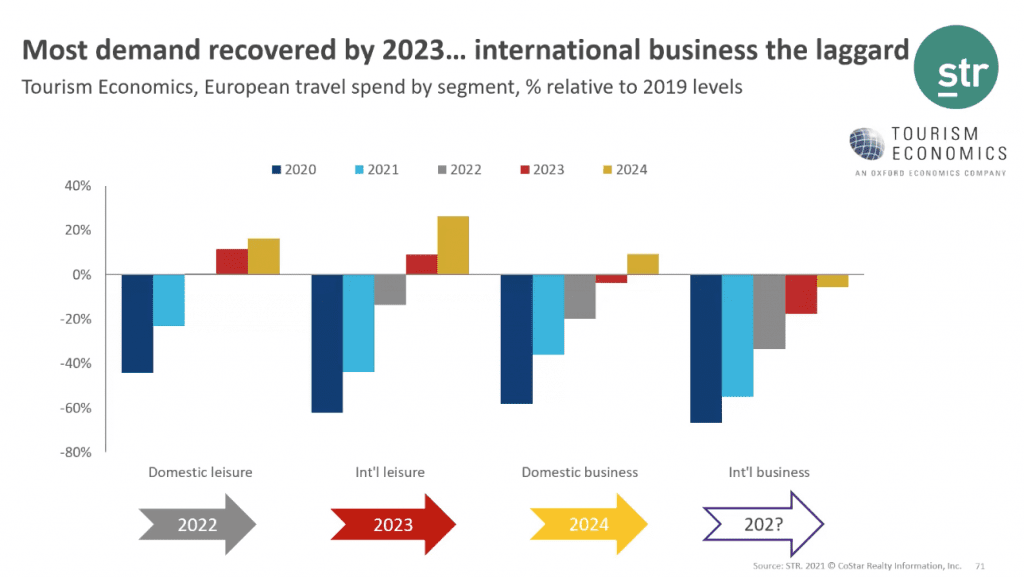

Hotels in Europe that rely on international business travelers face a painfully long wait until recovery that could stretch to more than four years.

Domestic and international leisure travel spend is likely to recover by 2022, according to hotel data tracker STR, but its latest forecast shows corporate spend will lag considerably.

“There’s no doubt people want to travel, but the question is will their businesses let them travel,” said managing director Robin Rossmann. “This may seem a little conservative, but we don’t have international business travel recovering by 2024 yet.”

Corporate travel spend, in Europe, will be trailing 2019 numbers for some time yet, based on research conducted with Oxford Economics, which also underpinned STR’s own findings. There’s even a question mark over what year it could come back.

Yet optimism prevails. All eyes are on the Delta variant, which could prove short-sighted when it comes to forecasting any form of business travel recovery. Marriott International CEO Anthony Capuano, for example, said this particular Covid-19 strain would probably have a short-lived impact on hotel bookings. Other hotels CEOs are thinking along the same lines.

And there is a willingness to start boarding planes again. Seven in ten company travel buyers in Europe felt their employees were “willing” or “very willing” to travel for business in the current environment, according to a Global Business Travel Association poll last week.

The ‘Big Drag’

But speaking at a webinar on Friday, Rossmann outlined a number of reasons why business travel will take time to bounce back, which correlate with actions travel managers are already taking.

“The people who control the purse strings are going to be slow,” he said. “That’s going to be the big drag.” As well as the obvious pandemic-related health and safety concerns, and red tape, travel budgets have disappeared. “People didn’t spend on travel in 2020 and 2021, and they’ll be reluctant to push that back straight away.”

Meanwhile, there’s the big sustainability push. The drop in demand over the next four years will coincide with overly ambitious targets to reduce emissions. Insurer Zurich, for example, wants to reduce the amount of emissions from flights by 70 percent next year.

“This means there’s a ‘why’ businesses can use, beyond money, as to why they’re reducing travel,” Rossmann added. He also noted how companies were getting “smart” with solutions and automated checks to stop people traveling before trips are explored as an option, which tallies with recent statements from companies including Pfizer and Cognizant.

“We’re building some of the framework around what is purposeful travel, and giving colleagues the tools to help them define what is the reason; what is the return on investment on the trip?” said Tina Quattlebaum, Pfizer’s director of global travel operations.

From next year, Cognizant will introduce a pre-authorization requirement for all travel. “Right now, behind the scenes, we’re building the travel approval form, and code, and getting ready for it,” said Drew Mitchell, regional travel director for the Americas.

However, STR’s Rossmann said changes in work habits and patterns could offset any decline. “What’s not on (the chart) is the new types of demand that may come, because people have more flexible working. That’s a big unknown, but a big positive upside to these forecasts,” he said.

Marriott’s Capuano has also pinpointed that a more permanent blend of business and leisure travel could be a long-term legacy of the pandemic, and one which could ultimately benefit the hotel industry.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus, corporate travel, europe, gbta, hotels, marriott, str, travel management

Photo credit: Domestic and international leisure travel spend is likely to recover by 2022, according to hotel data tracker STR, but corporate spend will lag considerably. Felipepelaquim / Unsplash