Skift Take

Oracle and Skift’s 2021 report, Back to Hospitality: Getting Smarter and More Profitable in a Post-Covid World, offers a playbook for the industry to come back better and stronger. In this article, we take a closer look at the report’s findings regarding the hotel environment in Latin America.

This sponsored content was created in collaboration with a Skift partner.

After last year’s dramatic shock to the hospitality ecosystem, the industry is welcoming growing signs of recovery in 2021. But as hotels and operators try to capitalize on the awakening demand, they’re also acknowledging that new efforts need to be made if they’re to stay relevant and profitable in the transformed landscape.

What lessons were learned over the past year? What does the consumer experience demand in today’s market? And amidst fierce competition, how can hotels evolve, adjust, and re-prioritize for greater efficiency and profit — and what changes are the most crucial?

To answer these questions, Skift and Oracle collaborated on a global research study during spring 2021 to examine current thinking from hoteliers and guests on the post-Covid hotel experience, the results of which are published in a new report: Back to Hospitality: Getting Smarter and More Profitable in a Post-Covid World.

To help further explore geographic differences in the recovery, and better understand the needs of hoteliers and guests in key regions, Skift and Oracle are also releasing three regional spotlights. In this spotlight, we examine key industry and consumer trends from the hospitality recovery in Latin America.

Overview

There are signs of good news emerging for the hospitality industry in Latin America. Executives in markets such as Mexico report a healthy start to 2021, suggesting a renewed period of tourism growth.

“We’ve seen very fast recovery,” said Eduardo Segura, managing director of The Cape, a Thompson Hotel, in Los Cabos, Mexico. “If we compare this point in 2021, I would say we’re better off than the 2019 results.”

With its close ties to other recovering economies in North America, Latin American hotel executives and travelers shared a relatively optimistic picture as their region looks for ways to innovate its hospitality offerings in the near future.

Here are some key highlights from Latin American hotel executives and guests from this year’s Skift and Oracle research.

Non-Room Revenue

The business environment of 2020 created new momentum among hotel executives to rethink their notions of profitability and seek new sources of revenue diversification. As hotels looked for ways to make up lost room revenue during the pandemic, many discovered an emerging strategy focused on exploring new ways to monetize and market existing hotel products and services.

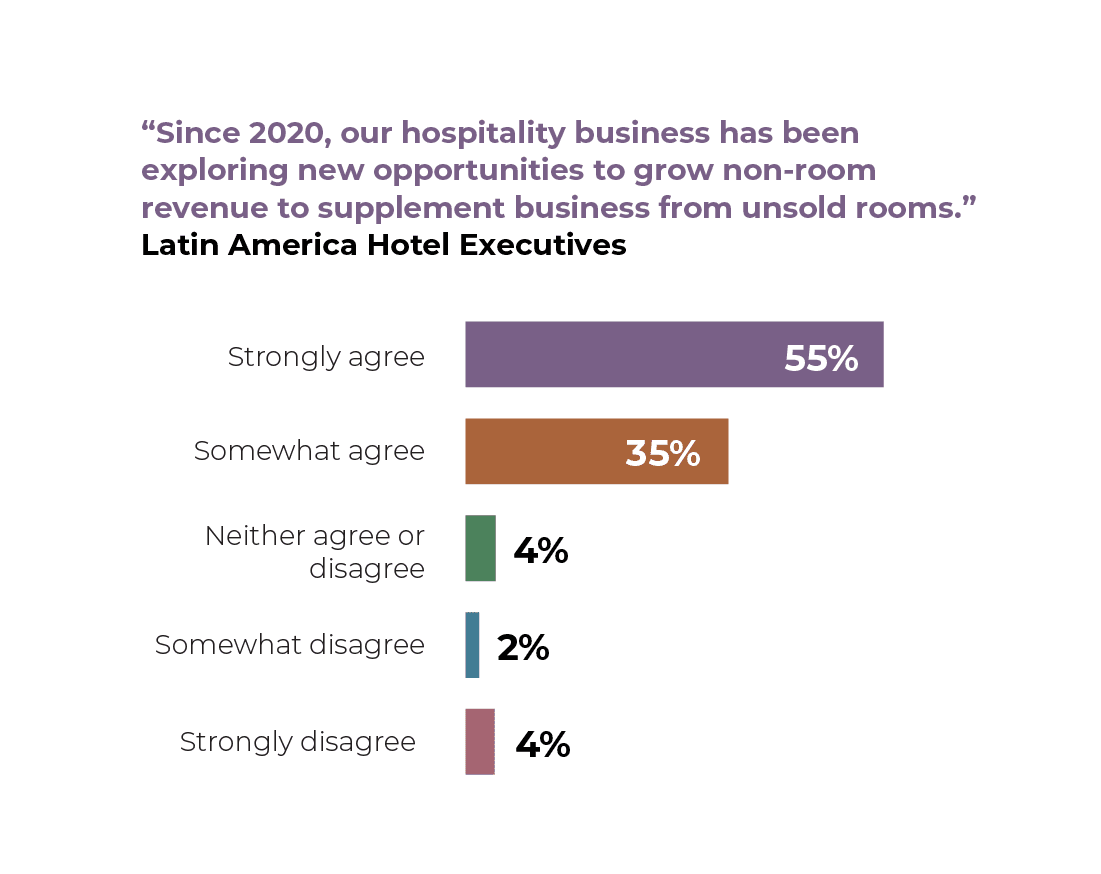

On the topic of non-room revenue, 90 percent of Latin American hotel executives strongly or somewhat agreed in its potential — 14 percentage points higher than respondents worldwide. Additionally, businesses in this region have been focusing on exploring these new potentials, more so than their global counterparts.

Executives in the region also believed that non-room revenue would make up a higher share of their profits in the next five years, with 42 percent expecting it to account for as much as 50 percent of revenue (eight percentage points higher than the global average).

Hotel leaders also reported having already explored sales of certain types of non-room offerings at rates that were significantly higher than their global peers, including takeout food (64 percent versus 57 percent globally), and package deals (75 percent versus 65 percent globally).

The enthusiasm to expand non-room offerings appears to be backed up by strong traveler demand as well. Sixty percent of Latin American travelers say they are open to upgrades or special offers at the time of check-in, compared with just 49 percent of respondents worldwide.

One potential area of non-room opportunity mentioned by Latin American hotel executives is in-room dining. “The only big change I would probably say in our three-meal restaurant is that a lot of people would, instead of going down to the restaurant, ask for in-room dining,” said Segura. “This is huge because it’s about 30 percent more than what we had in the past.”

Short-Term Rentals

As the hospitality industry navigates out of the pandemic, they’ll also need to look for opportunities to differentiate themselves from competitive threats like short-term rentals. With the growth of short-term rental demand in 2020, the urgency of a response has increased considerably.

In Latin America, the region’s travelers expressed significant interest in short-term rental products over the past year – with 81 percent of respondents mentioning they had stayed in one versus 60 percent globally.

Which factors are more likely to draw consumers towards short-term rentals instead of booking a hotel room? Sixty-two percent of guests in the region highlighted privacy as a key incentive; six percentage points higher than the global average. The ability to social distance more effectively at short-term rentals was also a draw. Sixty-seven percent cited it as a benefit — significantly higher than the global average of 43 percent.

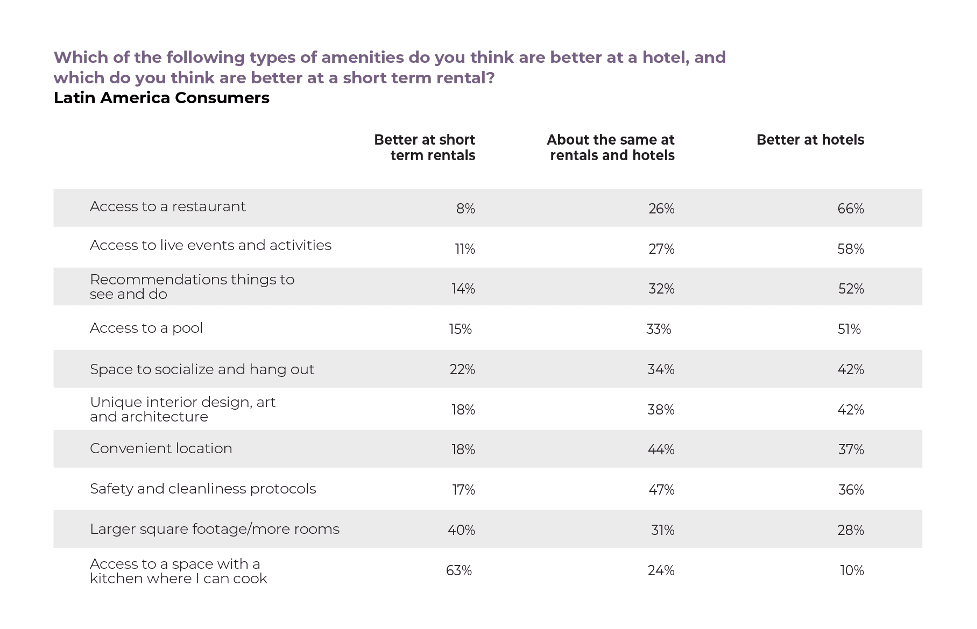

Nonetheless, certain aspects remain in the favor of hotels, especially around events and food and beverage offerings. Consumers in the region indicated they would likely choose a hotel over a short-term rental based on the availability of on-site restaurants, with 66 percent preferring the access to a hotel restaurant as a key perk (ten percentage points higher than the global average). Additionally, 58 percent of Latin American guests said that live events tend to draw them towards hotels over short-term rentals — 18 percentage points higher than the global response. Sustaining and highlighting such offerings could help court business from new and existing clientele.

Interestingly, Latin American consumers also chose hotels based on a perception of superior customer service more so than in other regions of the world. Sixty-one percent said they would choose a hotel over a short-term rental based on its customer service — 17 percentage points higher than the global average.

In response to consumer preferences highlighted above, hotels in Latin America are evolving their offerings to blunt the impact of short-term rentals. Eighty-nine percent of local executives said they plan to develop new products and services to compete with the short-term rental threat — nine percentage points above their global peers.

Another factor to consider in Latin America with short-term rentals is the growing popularity and availability of private villa inventory at hotel resort properties. Interest in these private villas could provide another strategy for hotels in the region to compete more effectively with short-term options.

Technology Upgrades

For hotels, the pandemic reinforced the importance of using downtime in 2020 to revitalize their technology systems, prepare for new consumer expectations, and upgrade their business for the future.

This interest in technology investment also extended to Latin America. Executives in the region expressed a big appetite for technology upgrades moving forward.

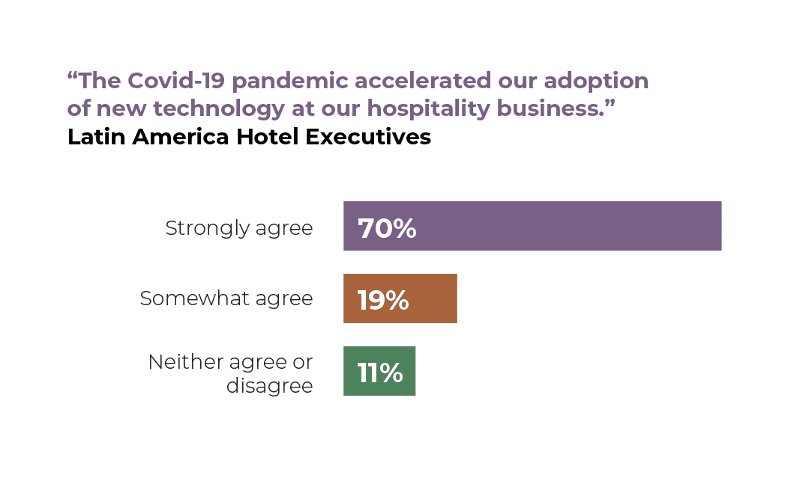

Eighty-nine percent of Latin American hotel executives said the pandemic accelerated their adoption of hotel technology (compared to 76 percent globally). And 89 percent also mentioned they were exploring cloud solutions specifically (versus 72 percent worldwide) as a potential technology upgrade.

Interest in marketing and advertising software ranked especially highly with hotels in this region: 83 percent have already upgraded, or are considering upgrading, their campaign systems and delivery — 16 percentage points higher than global peers. Sixty-four percent also said they had upgraded, or were considering upgrading, their software for revenue management (19 percentage points higher than globally).

The upgrade trend was also evident with point-of-sale (POS) devices, with 82 percent of the region’s executives considering upgrading, or having already upgraded, their POS devices (25 percentage points higher than the global average).

The renewed interest in technology investment appears to be well matched with consumer demand, as a growing number of Latin American travelers reported a desire for more contactless and message-based communications as part of their future hotel experience.

Operational Changes

The previous sections describe hotel strategies for boosting revenue, repositioning against short-term rentals, and investing in technology. But for hotels to implement these strategies, they will also need to take a closer look at how to run their properties most efficiently and profitably.

That’s why many hotels used 2020 and the early months of 2021 to focus on streamlining their business operations to prepare for recovery.

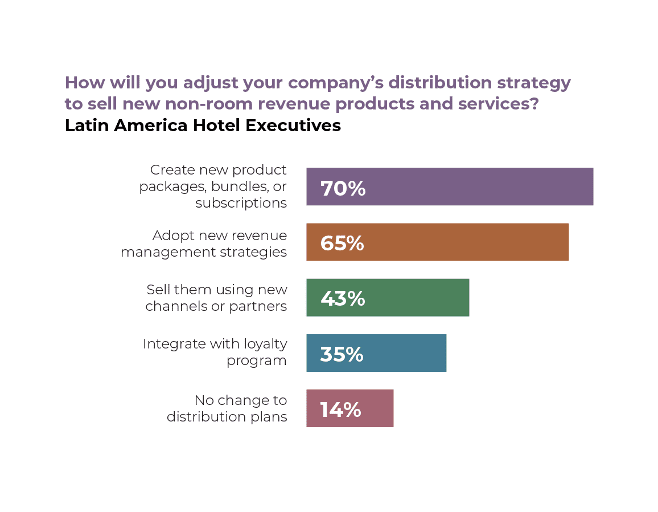

In Latin America, new distribution strategies to sell room inventory are front of mind, with 70 percent of Latin America executives reporting they were working on creating new product bundles and packages to attract clientele — thirteen percentage points higher than the global average.

This dovetails with the fact that hotels are focusing more on targeting new clientele (64 percent compared with 54 percent globally). It’s a move that may prove essential, as early signs suggest business and group travel will likely take longer to recover than the leisure market.

To learn more about how hotels are evolving their recovery strategies in 2021 and beyond, make sure to download the full Skift and Oracle report.

This content was created collaboratively by Oracle Hospitality and Skift’s branded content studio SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: ancillary revenue, contactless, covid-19, hospitality, hotel distribution, hotel operations, hotel technology, latin america, Oracle Hospitality, short-term rentals, SkiftX Showcase: Hospitality, SkiftX Showcase: Technology