Skift Take

The pandemic caused massive disruption for travel industry financials, decimating balance sheets and driving large debt loads. Yet travel demand is coming back more quickly than expected, and companies that take advantage of strategic financial opportunities now will be in a position to control their own destinies through the recovery and beyond.

This sponsored content was created in collaboration with a Skift partner.

As Covid-19 vaccination rates increase and travel demand is starting to come back, the worst of the pandemic is probably behind us. But the road to recovery will not be smooth, and some travel brands may still have to fight for their survival. The pandemic led to massive financial disruption in travel and tourism, impacting balance sheets and business models in ways that will linger for years. Given those challenges, ramping back operation simply won’t be enough.

The sheer scale of financial disruption offers forward-looking organizations an opportunity to rethink how they operate, manage their financials, and create value for investors. Smart leadership teams have already begun to think through these issues, and there is significant risk for those that focus only on harvesting short-term demand.

“Companies have a window of opportunity over the next 12 to 18 months to take proactive steps to manage debt, increase their operating leverage, invest to build the business, and proactively communicate with investors,” said Pallavi Kansal, managing director and partner at Boston Consulting Group. “That’s an ambitious agenda, but it will put companies on a dramatically stronger foundation as demand resumes.”

Boston Consulting Group and SkiftX have compiled this analysis on the impacts of financial disruption across the travel business and have highlighted five key priorities for travel CFOs that will enable their companies not only to survive in 2021, but also to thrive in the years beyond.

MARKET HEADWINDS SIGNAL A BUMPY JOURNEY AHEAD

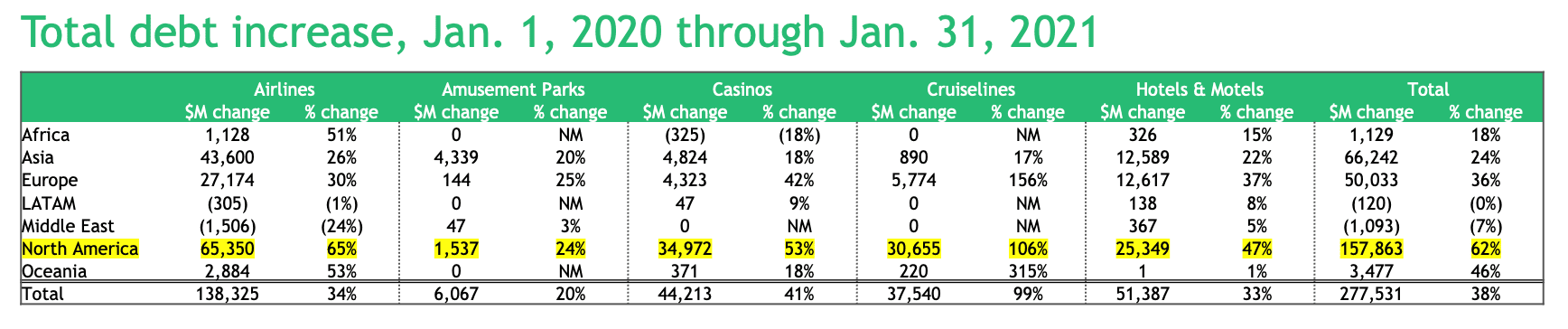

BCG research shows the staggering level of financial disruption. For example, travel companies in North America took on more new debt than other global markets. In 2020 and the first month of 2021, the North American travel industry increased its debt load by 62 percent, totaling nearly $160 billion in absolute terms. These numbers were even greater for asset-heavy segments. For example, airlines increased their debt load by 65 percent, and cruise lines more than doubled their debt levels in just 13 months.

The increased leverage will put a significant burden on companies in the recovery phase, as many will need to prioritize debt service over reinvestment in the business. That could have cascading implications, potentially affecting areas such as employee compensation, fleet investment and upgrades, route expansion, and other areas with a direct impact on the customer experience. Debt-burdened companies will also be vulnerable to new competitors and those who emerge from bankruptcy, which have the advantage of a clean slate and can take aggressive steps to seize market share.

In addition, BCG’s annual analysis of value creation shows significant differences in total shareholder returns (TSR) — including key drivers such as growing revenue, increasing profit margins or valuation multiples, and dividends. Overall, the travel and tourism sector has underperformed most other industries in terms of five-year average annual returns (2016 through 2020), but it also shows a higher variability in performance, meaning that top performers can far exceed the average.

“As of early 2021, valuation multiples — or the median stock price against future earnings — was perhaps surprisingly higher for travel and tourism than any other industry,” said Hady Farag, partner and associate director at Boston Consulting Group.

The steep valuation is due in part to low projected earnings — which are admittedly difficult to predict, especially now. But it’s also due to high expectations from investors, a warning sign that improved financial performance is already priced in. Over the short-term, it’s possible that investors may reallocate capital to more promising sectors within or outside the travel and tourism space.

“Individual travel segments show a wide range of outlooks and value-creation patterns over the past five years. For leadership teams, this variability should be heartening — every company has an opportunity to outperform,” Farag continued.

THE FINANCIAL AGENDA FOR 2021 AND BEYOND

The coming years will see both winners and losers in the travel industry. While every sub-sector will face unique challenges, companies that prioritize these five strategic imperatives will be able to exercise much more control over their fate.

1. Manage Debt

Excessive leverage will serve as an anchor on performance, and companies may manage debt aggressively, including through bankruptcy. The U.S. airline industry in the 2000s and 2010s is one such example — virtually all players went through bankruptcy and emerged with leaner balance sheets and a more competitive business model. Many other companies will need to manage through financial headwinds without the cover of Chapter 11. They will need to balance debt holder and rating agency demands with the protecting the health of business and being ready to benefit from the recovery.

2. Build Operating Leverage

The goal is not simply to cut costs — most travel and tourism companies have already aggressively done that in order to survive. Rather, the goal now is to be smart about bringing costs back. Travel companies should seek to keep fixed costs as low as possible, while still investing in areas that will fuel profitable growth, such as digital and anything that creates a differentiated customer experience — both in the short term and longer term. “History has shown that companies that restructure their cost base during a crisis are able to accelerate quickly and deliver a step change in profitability,” said Kansal.

3. Invest In Long-term Growth

Rather than mainly struggling to resume profitability, companies should focus on investing to build the business for the long term. Research from Boston Consulting Group’s series of Covid-19 Investor Pulse Checks has consistently shown that the vast majority of investors believe financially healthy companies should prioritize building key business capabilities. Doing so can position companies to emerge stronger from Covid-19 and help deliver on the expectations for financial recovery and post-Covid momentum that are reflected in today’s valuations.

4. Understand Changes In Demand

As the industry recovers, demand will look different. In corporate travel, a shift to remote work may mean that some companies in travel-heavy industries will scale back, while the same trend may drive others to travel more. Leisure travel will see changes in demand as well, with domestic trips dominating the initial surge. International travel will likely recover more slowly, but some people may be more likely to splurge on high-end “bucket list” trips as soon as travel restrictions are lifted. Companies that operate heavily in these markets will enjoy the influx of increased bookings, but they will have to invest quickly to mitigate staffing shortages and other operational challenges.

“Given the growth imperative and this uncertain demand recovery, companies need to invest in a market-sensing capability so they can quickly pivot resources such as marketing, sales, and even fleet and network,” explained Kansal. “Being truly agile has never been more important. Travel companies that do this well will see both stronger topline recovery — and market share increase — as well as more efficient use of spend.”

5. Engage With Investors

Communicating with analysts and institutional investors is critical right now. The massive disruption from this black-swan event means there is far more uncertainty than in the past. There’s no precedent and no model for how the recovery is going to play out. Most investors have hypotheses, but they can vary widely. In this environment, travel companies have an opportunity to shape and inform those hypotheses — provided they are deliberate and proactive in how they communicate with investors.

As the travel recovery gathers momentum, many companies are understandably tempted to focus on external factors like demand projections and government restrictions. Those factors are important inputs, but they lie outside of a company’s control. Leadership teams must focus on what’s in their control — strategic and financial decisions that drive the economics of their business models. With significant pent-up demand, companies can take advantage of the opportunities at hand to reframe their financial positions and capitalize during and after the recovery.

This content was created collaboratively by Boston Consulting Group and Skift’s branded content studio, SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: financial services, SkiftX Showcase: Consulting, travel recovery