Skift Take

HomeToGo's move to go public is a validation of the booming vacation rental sector. It's also a rare accomplishment for a German-based startup. Europe had been playing a catchup game with Silicon Valley, but no longer.

HomeToGo, a travel startup focused on vacation rental price-comparison for consumers and software for property managers, announced on Wednesday its planned merger with blank-check company Lakestar SPAC I, via a regulatory filing in Germany.

The planned $1.41 billion (€1.2 billion) transaction, including debt, would give Berlin-based HomeToGo an enterprise value of $1.01 billion (€861 million). The companies expect the merger to occur in the third quarter and list their merged entity on the Frankfurt Stock Exchange under the ticker “HTG.”

Lakestar SPAC I investors and founders are expected to retain 25 percent in the combined company. The deal depends on the okay of its shareholders. The current HomeToGo shareholders, convertible lenders, and holders of virtual options are expected to retain 69 percent of the post-transaction equity in aggregate.

Lakestar’s SPAC, or special purpose acquisition company, is controlled by European venture fund Lakestar, which has previously invested in HomeToGo. Lakestar has joined other investors, including European family offices specializing in tech investments and European tech entrepreneurs, in committing $88 million (€75 million) in private investment in public equity (PIPE).

“Joining forces with Lakestar SPAC I to bring HomeToGo to the public markets presents a great opportunity to fuel the next level of growth,” said Dr. Patrick Andrae, co-founder and CEO, in a statement. Andrae will continue to lead the company when it goes public.HomeToGo claimed a strong revenue stream thanks to surging domestic travel interest in vacation rentals in the past year. The startup said it generated a gross booking value of $1.53 billion (€1.3 billion) in 2020. In the first half of this year, bookings look even better. The company has already generated a gross bookings value of $1.069 billion (€904 million).

The startup, founded in 2014, has never made a profit. But despite the pandemic, it improved its adjusted earnings before interest, taxes, depreciation, and amortization to a loss of approximately $2.3 million (€2 million) in 2020. The startup is targeting breakeven profitability “within two years.”HomeToGo’s Ambitious Trajectory

The company’s $1 billion enterprise value is premised on ambitious growth rates. Its targeted 2021 revenue of approximately $150 million implies an enterprise-to-sales multiple of 6.8 times. That falls to around 4.4 times, a more reasonable mark, based on the company’s 2023 revenue projection of approximately $233 million. But that in turn requires hitting a breakneck compound annual top-line revenue growth rate of 53 percent year-over-year compared with a 21 percent year-over-year revenue growth rate during the pandemic boom.

The transaction will give the startup approximately $415 million (€350 million) in capital, which it will use for mergers and acquisitions and speeding up its growth.

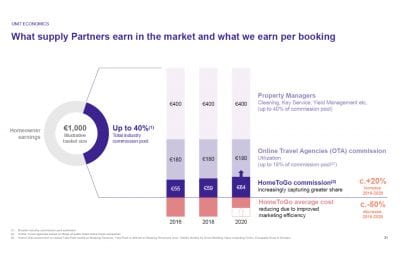

Traditional metasearch brands have sold advertisements on a cost-per-click, or CPC, model. If a user clicks on the ad, the property pays — even if the user doesn’t ultimately book.HomeToGo said that it instead generated 74 percent of its revenue last year by using a different model, called cost-per-acquisition (CPA), where a property only pays a commission for confirmed bookings.

HomeToGo said it had a take rate of 6.4 percent. A take rate is a measure of revenue that essentially divides booking revenues for rentals by gross booking value. The startup forecasts it will push its take rate to 7.7 percent in full-year 2022.

The company also sells subscriptions to its business-to-business software services, which contributed 10 percent of the company’s revenue in 2020. For more context, see Skift’s February profile of HomeToGo, and see our June profile of Lakestar’s venture arm.

HomeToGo Joins the SPAC Trend

HomeToGo is the latest company to explore going public via a SPAC. Some startups see SPACs as a quicker, less risky way to go public than a traditional bank-led initial public offering (IPO). SPACs sell stock on listed exchanges first and then find companies to merge with.

Earlier this month, Grab, the Singapore-headquartered superapp that evolved from ridesharing into food delivery and financial services, agreed to merge with Altimeter Growth Corp. 2 at around a $39.5 billion valuation. Accor Hotels entered the SPAC market last month. Sonder’s SPAC deal will take the hotel and short-term rental company public later this year at a $2.2 billion valuation. Inspirato may go public in a $1 billion deal, Rosewood Hotels is looking to do a SPAC listing, and other travel companies are exploring SPACs.

HomeToGo’s leadership will largely remain intact when it goes public. Co-founder Wolfgang Heigl will remain chief strategy officer. Other key executives will include Valentin Gruber, a newly appointed chief operating officer, and Steffen Schneider as chief financial officer. Martin Reiter, vice president, Europe, at Wayfair, who previously built Airbnb’s global presence while leading their international operations, will join the supervisory board. Reiter will also invest in the combined company.

UPDATE: Here’s the investor presentation released on Wednesday:

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: hometogo, lakestar, spac, spacs, vacation rental tech, vacation rentals

Photo credit: A chalet from Interchalet available for booking on HomeToGo, a vacation rental metasearch brand HomeToGo