Skift Take

We could all use a splurge after what we've been through. That's why upscale leisure travel is starting to sprint ahead for a phased, market-by-market recovery.

The managers of Aethos Corsica weren’t sure what to expect when debuting their nine-suite boutique hotel this month. Pandemic restrictions in many countries had quelled immediate international travel. But the owners needn’t have wondered.

“We’ve been experiencing a tremendous increase in bookings recently — especially for our larger suites,” said Ariane Chapot, the general manager of the refurbished 17th-century palazzu on the French island.

The good days appear to be coming for many travel brands that woo high-income leisure travelers. In the U.S., for example, Google search interest in the phrase “luxury hotels” is at its highest since before 2006. Signs are surely pointing to luxury travel being one of the quickest slices of the travel sector to rebound from the pandemic.

Consider properties like The Beverly Hills Hotel and Hotel Bel-Air in California — both part of Dorchester Collection.

“We are witnessing a dramatic increase in demand for our U.S. hotels,” said Helen Smith, chief customer experience officer for the Dorchester Collection. “These hotels are showing high suite occupancy and an exceptional ADR [average daily rate] of over $1,000.”

To see luxury’s coming luster, you have to look for patterns hidden in the data, spot some telling macroeconomic trends, and seek anecdotes from markets furthest along in the rebound.

While it can feel frivolous, the luxury sector is a serious business. The well-heeled spent $363 billion on luxury travel in the pre-crisis year of 2019, according to data crunched by Barton Consulting for trade show organizer International Luxury Travel Market.

We define “luxury travel” somewhat loosely. We’re not limiting ourselves to trips taken by celebrities and CEOs at five-star resorts. We’re also referring to what some might call “premium leisure” travel, such as staying at “upper-upscale” resorts, taking chauffeured sightseeing tours, and sailing on high-end cruises.

Signs of Growth for Luxury Travel

One of the first to predict the ascent of upscale travel was Bernstein Research.

“We saw this phenomenon in China in the initial recovery, where luxury led,” wrote analysts Richard Clarke and Daniel Roeska in a January report.

By April, U.S. adults who call themselves “luxury travelers” said they expected to take four trips over the next year, according to a running survey by MMGY Global, a Kansas City-based travel and hospitality marketing firm.

These American luxury travelers expected to spend an average of $3,940 on travel, while other U.S. travelers expected to spend $2,183, said MMGY’s recent Portrait of American Travelers survey.

In the U.S., there’s a cresting wave in reservations for luxury cruise brands.

“I’ve talked to some of the largest travel agencies in North America to get their thoughts and some of their data,” said Patrick Scholes, managing director, lodging and experiential leisure equity research, at Truist Securities. “Without a doubt, they see the strongest level of bookings for premium and luxury types of cruises.”

“A lot of it is older folks living their best life by splurging,” Scholes said. “They’re also enjoying the additional space luxury ships offer.”

Sixty-one percent of travelers plan to spend more than they normally would on a trip in 2021 since they could not travel in 2020, according to an American Express Trendex poll that Morning Consult conducted of adults who traveled by air in 2019 and who live in Australia, Canada, India, Japan, Mexico, the U.S., and Britain.

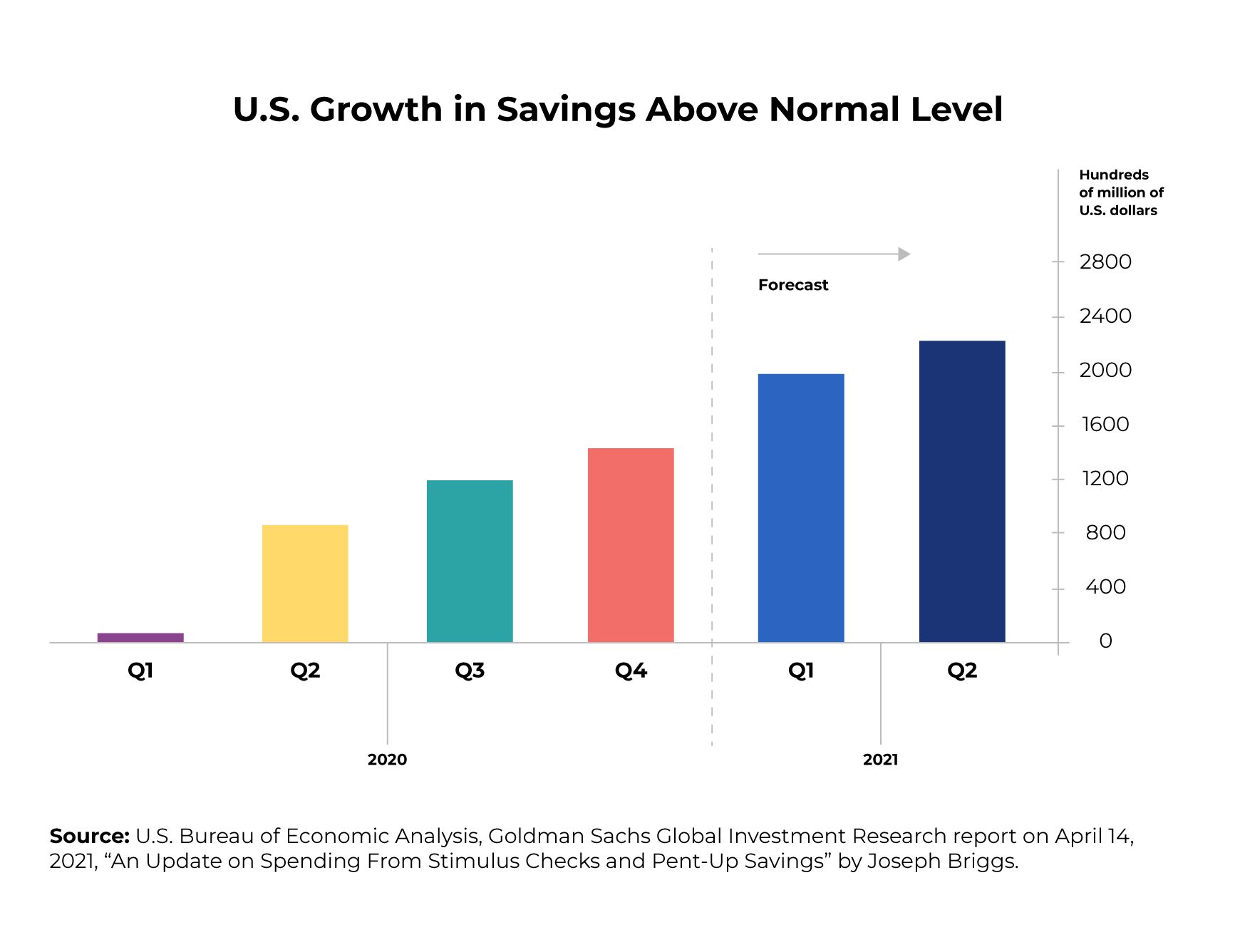

Savings Glut From High-Earners

A pile-up in savings during the stay-at-home restrictions is one of the likely sources of a luxury travel boom. Worldwide, households have saved $5.4 trillion above their expected average levels of saving.

High-income households hold a hefty chunk of the excess savings, wrote economist Joseph Briggs in an April Goldman Sachs report.

The richest 40 percent of Americans hold almost two-thirds of the more than $2 trillion in U.S. household savings above the normal trend, Briggs said.

Americans will invest a lot in the stock market and in real estate. But many have saved so much that they will spend more freely, too.

“Many people have seen their net worth go up, given that the stock market is pretty much at an all-time high,” said Scholes, the Truist analyst. “Many have also saved a tremendous amount from staying at home. So people are ready to let loose and spend some more than they normally would on travel.”

Only 18 percent of American travelers said concern about their personal financial situation would greatly impact a decision to travel in the next six months, according to an April 14-19 panel of 1,000 adults matched to be representative of the U. S. population done by market research firm Longwoods International.

“We’ve done 35 waves of this survey throughout the crisis, and at no point did more than 25 percent of travelers say personal financial worries would hold them back,” said Amir Eylon, president and CEO of Longwoods International Traveler Sentiment Study.

The savings glut is not just a U.S. phenomenon, either.

“As of the first quarter of 2021, we estimate the excess saving across the globe to equal more than 6 percent of GDP [global gross domestic product],” said Mark Zandi, chief economist at Moody’s Analytics, in a report. “The U.S. has the world’s most excess saving, equal to 12 percent of GDP, with the UK a close runner-up at 10 percent of GDP.”

Australia also has been saving up, and it is now seeing that savings translate into higher-priced trips. Flight Centre, the largest travel agency brand in Australia, said at a Citi Research conference on April 20 that its retail luxury travel brand had been seeing an average transaction size that was higher for domestic holidays than it had seen pre-Covid.

Hopeful and Positive Signs for Luxury

Some early forward-looking data hints that higher-end hotels will claw back pricing power in the next year or two.

On the supply side, the percentage of room nights spent in luxury hotel chains in the U.S. has hovered around 3 to 4 percent over the past several years, according to the Shifflet Performance/Monitor.

If you add luxury independent properties to the chains, you get a larger group. The percentage of room nights spent in that larger group of luxury accommodations had been very consistent — around 6 to 7 percent, year-over-year. But then in 2020, that group of U.S. luxury accommodations rose to 9 percent.

“If this increase in paid luxury accommodations is sustained, this could be an indication that there will be increased spending in the luxury market as a whole,” said Chris Davidson, executive vice president, MMGY Travel Intelligence. (MMGY bought DK Shifflet & Associates in 2016.)

On the demand side, bookings for upcoming travel in the most expensive tier of hotels — the top 25 percent of price points — were trending upward in March compared with February, according to Adobe Digital Insights, which helps travel brands convert bookings online.

It’s not just hotels. Vacasa, the largest professional property management company in the U.S. for vacation homes, has also noticed an urge to splurge. Vacasa highlighted a 28 percent spike in average dollars spent per reservation when comparing reservations booked in March 2021 with ones in March 2019 — looking at the same rentals, with four-plus bedrooms.

Meanwhile, Onefinestay, an Accor brand that runs luxury vacation rentals, has seen its larger villas with a high price point be firmly in demand.

“Demand is especially high in the Caribbean — where we have seen that our average booking value is up 80 percent,” said Amanda Dyjecinski, chief brand and marketing officer of Onefinestay. “The demand demonstrates that the appetite for long-overdue friend and family reunions has great growth potential.”

Cautionary Notes and Headwinds

We’re not saying every five-star hotel in the world is booming today. We’re talking about a phased recovery, which will vary by market, property type, and location.

A good summary of the situation came from the CEO of Mandarin Oriental, James Riley, during an earnings call in March.

“I’m really excited about the prospects for 2022 and beyond,” Riley said. “But in 2021, we will continue to experience difficult conditions.”

A lot of industry data — though not all — points toward positive trends for luxury. Here are some of the caveats.

The biggest headwind is whether a hotel is dependent on business travel. The loss is particularly acute for many upscale hotel and resort brands as well as city hotels.

“Higher-end hotels usually have corporate group business, incentive travel, and so forth, but it’s gone,” said Amanda Hite, president of STR, the authoritative hospitality data and analytics company.

That’s a key factor why upper-upscale chains and luxury chains in the U.S. are still below 2019 averages in occupancy and rate, Hite said.

Average rates at luxury hotels are down by about a fourth. More precisely, for the week of April 4 through 10, luxury class hotels in the U.S. had an average revenue per available room of only $172.13, compared with $233.81 in the same week in 2019, STR said.

Worse, far too many rooms are empty. STR’s last three weeks of occupancy data on U.S. hotels, through April 13, showed that luxury class hotels in the U.S. remained below most other classes, against the comparable weeks in 2019.

Up in the Air

When it comes to the airlines, you have to work to find promising news.

“One of the trends we are seeing is that travelers are more likely to select more expensive airfares than the cheapest on offer, versus the same period in 2019,” said Hugh Aitken, vice president flights at Skyscanner, a price-comparison search engine.

That said, the loss of business travel hurts. The cratering of international travel hurts just as much.

“Obviously, if people are booking first-class international tickets to Hong Kong, they cost a lot more than first-class tickets to Indianapolis,” said Steve Squeri, CEO of American Express, on a call with investment analysts on Friday.

Tickets issued in the U.S. in March for international departures in business and first-class for all future travel were at around 40 percent of the levels of comparable sales in March 2019, said ForwardKeys — which analyzes air ticket data that it sources from hundreds of online travel brands and airlines.

Russia, for instance, has reached 35 percent of 2019 levels for luxury air ticketing, ForwardKeys said.

It’s only for rare cases in Russia that the average booking value for international travel has risen lately. It’s up 30 percent for trips to the Maldives, compared with pre-crisis 2019 levels, and it’s up 44 percent for the Seychelles, according to bookings via online travel search site Aviasales.

Structural issues in the commercial airline industry may undermine a surge in luxury leisure demand in most markets.

Budget and low-frills carriers, such as Ryanair in Europe, entered the crisis with stronger balance sheets than the traditional network carriers that often sell business-class and first-class seats, wrote fund manager Ed Legget of the Artemis UK Select fund. Large state-supported carriers are so loaded with debt and often expensive cost structures that they’re unlikely to be able to profit from any emergent demand from luxury travelers.

Some carriers, such as Qatar Airways, are seeing luxury travelers fill some seats in the front of their planes that were previously sold to business travelers, said Madhu Unnikrishnan, editor of Airline Weekly, a Skift brand. But today’s leisure luxury travelers usually aren’t as profitable or numerous as yesterday’s corporate flyers.

Some travelers are shifting budgets ordinarily spent on standard international trips to luxury domestic travel. Staying in one’s home country can avoid pandemic-era costs for testing, proofs of vaccination, or flexible trip cancellation insurance — any of which authorities may require for some overseas trips. Travelers can use the saved money on perks instead.

At the high end of the market, one can hear a rising buzz around shared and private aviation services, which are touting a boom in demand. Membership-based private aviation services got a toehold during the pandemic’s start by touting uncrowded flights.

Exhibit A is Aero, which offers premium semi-private jet connections to scenic and glamorous destinations, such as its Los Angeles to Aspen route. In March, Aero raised $20 million in funding.

Aero owns the planes and flies them out of private terminals, and it matches up small groups of flyers going to the same airports at the same time. For more context, see Skift’s earlier story on private jets.

Worldwide, business travel may rebound over time. That will also help the luxury travel sector.

Disciplined Luxury Lodging Brands May Gain

Not every brand will be well-positioned to take advantage of a surge in demand. Yet some experts see a long-term future where domestic leisure luxury travel anticipates a worldwide sector recovery that savvy hoteliers and resort owners can capture.

“The high-end tranche of the market just keeps growing long term,” said Joshua Caspi, principal at Caspi Development. “But it’s truly an art to run your operations to support the five-star experience while driving out unnecessary expenses.”

A case in point: Caspi Development plans next year to open the first U.S. outpost of the Paris-based Hotel Barrière Le Fouquet brand in Tribeca, New York. Workers had to dig 28 feet below the Hudson River to build a spa with an “aqua trail pool,” meaning a circuit of jetted water and steam rooms, and a separate, underground 100-seat screening room for movies.

Ownership structures can also make profitability more elusive.

“When you look at the five-star brands internationally, there’s a wide array of brand missions,” Caspi said. “Some brands are all about top-line revenue growth and their top-line fee base for operations. So revenue share is very low in those scenarios.”

“It’s rare to push room revenue up from, say, a 20 percent range of revenue share and push up into the 30s,” said Caspi.

But despite the need for operational smarts, there are many favorable winds for luxury travel.

“It certainly seems like many would want a less dense setting, with higher standards, and greater capability to manage the unexpected — perhaps as a substitute for what would have been an international trip,” said Aran Ryan, director, lodging analytics at Tourism Economics, a consultancy that’s part of Oxford Economics.

“Plus, the chance to have a real reward after all this craziness,” Ryan said.

Luxury Doesn’t Cure All Problems

Here’s another headwind for luxury travel: Some regions of the world will take much longer to recover than others.

In Latin America, many luxury and standard travel businesses are family-owned or modestly capitalized. The prolonged revenue crisis has forced many entrepreneurs and their talented employees to leave the sector.

“We’re talking less about ‘the recovery of travel’ now and talking more about ‘the reconstruction of travel,'” said Rogerio Basso, head of tourism at IDB Invest, the private sector institution of the IDB Group. Basso points to an online analytic tool, the international tourism demand model, which enables destinations to estimate when demand will return for their markets.

International travel drove pre-crisis spending on luxury travel. Think of the scene from Netflix’s reality series “Bling Empire” where the daughter of a tech billionaire said, “My horses fly Emirates.”

Sadly for Jaime Xie and other crazy rich millennials, the resumption of international travel is coming in fits and starts.

“It really matters a lot how you define ‘luxury travel,” said Ulf Sonntag, head of market research at the Institute for Tourism in Hamburg. “Right now for Germans, ‘luxury travel’ is doing any travel at all.”

In Africa, many nations depend on foreign visitors to feed their tourism market. The luxury safari tourism market, in particular, had been valued at about $1.18 billion in 2018. It may take a couple of years to recover to that level.

But even on the river deltas, there are green shoots for luxury travel.

“We’re encouraged as we look to the return of luxury travel,” said Hadley Allen, chief commercial officer at Wilderness Safaris.

“We’re seeing a 40 percent increase in guest spend from 2019 on average bookings for 2022 trips,” Hadley said.

Adding to its portfolio, this month Wilderness Safaris opened the rebuilt DumaTau, a seven-unit luxury camp in northern Botswana by the Linyanti Wilderness Reserve.

Changing Needs of Luxury Travelers

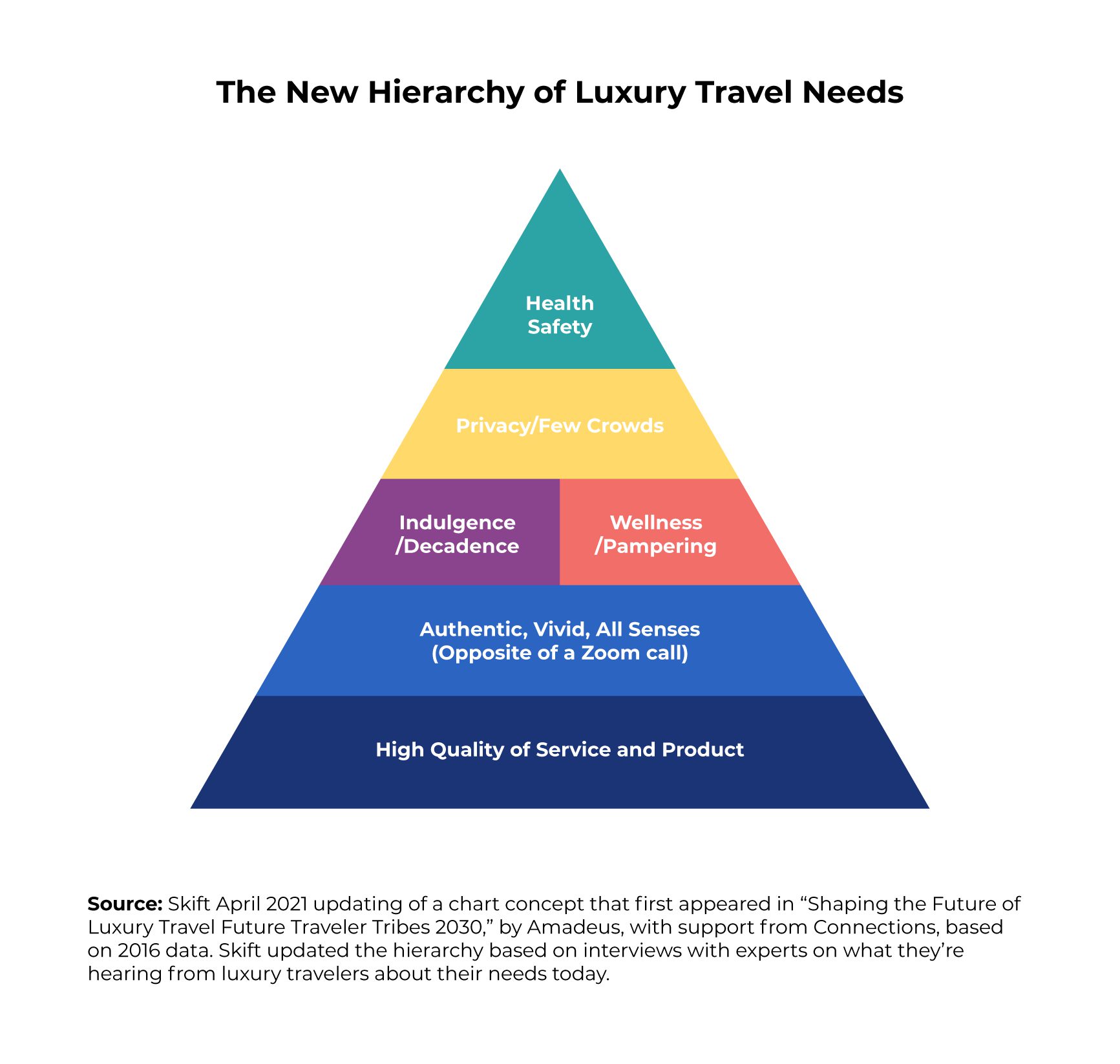

The needs of luxury leisure travelers have morphed through the pandemic. To explain this, we’ll borrow from the hierarchy of needs, a theory by psychologist Abraham Maslow that says people have basic needs related to their bodies, safety, love, esteem, and self-actualization.

In 2016, travel technology firm Amadeus drew on industry expertise to create a “hierarchy of needs for luxury travelers” in its report, Shaping the Future of Luxury Travel Future Traveler Tribes 2030.

In homage to that concept, we’ve updated Amadeus’s inspired pyramid — making some tweaks to reflect what experts are now saying about the shifting needs of luxury travelers.

Proper health protocols have obviously gained importance as a desirable luxury.

“Our guests are still mindful about social distancing and want to continue to spend more time in the home than usual,” said Dyjecinski of Onefinestay, which manages luxury vacation rentals. “So we’re having conversations with guests about upgrading their home amenities and coordinating new, special experiences while they are there. Options could be anything from a private mixology experience to a personalized yoga session or in-home beauty treatments.”

More broadly, physical vitality has taken on a renewed value — given how stay-at-home restrictions made many people feel sluggish.

“Now, more than ever wellness is at the forefront of travelers’ priorities and that has translated into a significant rise in spa appointments,” said Torsten van Dullemen, general manager and area vice president of Mandarin Oriental, Washington D.C. “We’re also experiencing much of the same at our other hotels in Boston and New York City.”

Before the pandemic, half of the respondents in a 2019 survey said they believed “that the relaxing experience of luxury travel has a more marked effect on their health than watching their diet or staying active.” The result, from a survey of 2,000 high-income Americans by research firm Mintel, underscored how “wellness” has already become a broader concept, and that “luxury” no longer equaled mere “decadence.”

“In my conversations with hoteliers and other people crafting high-end experiences, there’s always a recurring talking point: the need for discovery and fellowship,” wrote Skift On Experience columnist Colin Nagy right before the crisis. The pandemic has amplified the need.

After a year of Zoom calls, many discerning travelers define luxury travel today less by the thread count of the bedsheets and more by access to the places and experiences that represent all that is authentic about a place, said premium tour operator Abercrombie & Kent.

Post-crisis, many travelers crave the sensory side of travel, which can include tented experiences or other visceral treats.

A year of remote work has also made people of all ages more comfortable with online shopping and digital communication. Luxury brands need to blend their high-touch approach with digital tools.

Marriott Solaz, a Luxury Collection Hotel in Los Cabos, Mexico, conducts pre-arrival video calls with guests to introduce the person who will be their contact throughout their stay. Travel concierge services like Embark Beyond, John Paul Group, and Virtuoso all use a blend of text-based chat and machine-learning software. The goal is to help advisors, agents, and concierges engage with clients the way some customers want to be reached.

Helping Luxury Travelers Reconnect

Exclusivity, visceral experiences, and community are very appealing today.

“We’re offering guests unique experiences, like our private jet package with evoJets, and exclusive brand collaborations, including our in-room shopping program with Intermix,” said Jacqueline Volkart, dual general manager at The Ritz-Carlton, South Beach, and The Ritz-Carlton Bal Harbour, Miami.

If there’s one type of travel supplier that’s well-placed to enjoy a rise in luxury travel, it’s all-inclusive resorts. This category blends and balances many of the above-mentioned needs for privacy and community.

A case in point: Karisma Hotels & Resorts said it has seen “a large uptick” in resort bookings for summer. The Miami-based company runs multiple all-inclusives worldwide, including El Dorado’s Palafitos Overwater Bungalows, which has private residences and infinity pools.

“As travel confidence continues to rise, we have also seen a demand for groups — with many guests booking celebration vacations to make up for a year of lost time,” said Elizabeth Fettes, chief marketing and sales officer at Premier Worldwide Marketing, which operates Karisma Hotels & Resorts.

For more on the segment, read Skift’s Deep Dive: Why the Business of All-Inclusive Resorts Will Never Be the Same.

Brands and destinations seeking to appeal to luxury travelers may need to adjust which demographics they’ll emphasize or target.

One example is LGBTQ+ luxury travelers.

“With the uncertainty of how restrictions will play out, and also because of over-bookings in popular hotspots, many travelers aren’t necessarily able to return to their favorite haunts this year,” said Uwern Jong, co-founder and editor-in-chief of London-headquartered travel journal OutThere.

“At the moment, we have a significant number of people – a notable proportion of which are new visitors to our site – researching places like the Maldives and Seychelles,” Jong said.

Brands could target the LGBTQ+ segment with exclusive itineraries and with digitally marketing tactics that are savvier and more relevant.

“It’s becoming clear that LGBTQ+ travelers will be the first to return to the city destinations and urban centers to access cosmopolitan culture and food, at a time when the mainstream is leaning more towards seclusion elsewhere,” Jong said. “So luxury providers in city centers should pay heed to this.”

Regardless of the demographic a brand has in mind, the highest end of travel had the most momentum going into the crisis. That means that catering to the ultra-luxury traveler is a relatively safe bet.

“Any place that has a five-star resort, whether it’s St. Barts, Deer Valley, Aspen Seychelles, Mauritius, etc., you used to go and spend $800 a night and think you’re really throwing it down,” said Caspi, the hotel developer. “Now it’s a minimum of $2,000 or $2,200 a night.”

Cautious Optimism

On balance, things are looking up for luxury brands. The mood music about luxury travel was summed up well by Chapot, the general manager of the new hotel Aethos Corsica.

“One of our most recent guests said it better than I could,” Chapot said. “‘After what we’ve been through, all we wanted is to get pampered, enjoy delicious and healthy food, and be away from it all.'”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: deep dives, international luxury travel market, luxury, small luxury hotels

Photo credit: Luxury travelers like this one in an infinity pool are the client base helping to drive the recovery. guillermo fernandez balbastre/EyeEm / Adobe