Skift Take

There will be a stronger domestic and regional focus in the travel industry in 2025, and given that some of the world's biggest source markets will be in Asia (think China, India and Indonesia), Asia looks set to be the key beneficiary. But can the unbeatable beauty of Bryce Canyon in Utah, the pull of London's West End, or Parisian street life really keep Asians close to home for long?

In January 2021 we released our annual travel industry trends forecast, Skift Megatrends

. Because of the havoc that the pandemic triggered, we wrote Skift Travel Megatrends 2025 as a vision of how travel industry dynamics could play out five years from now. You can read about each of the trends on Skift, or download a copy here.

It’s 2025 and all the talk about Asia continuing to be the travel powerhouse has not only come true, but it has busted expectations.

Asia-Pacific and the Middle East, tourism regions that generated the highest arrivals’ growth in 2019, and welcomed 364 million and 64 million visitors, respectively, are well on the way to exceeding those levels by the end of 2025.

Recovery started in 2021, with China as the driving force. The Lunar New Year holiday that year turned out to be a golden week for mainland Chinese traveling overseas, just as National Day in October 2020 was a milestone for the recovery of domestic travel in China. Pent-up demand broke through its restraints thanks to vaccine availability and Covid-19 containment in key Asian destinations.

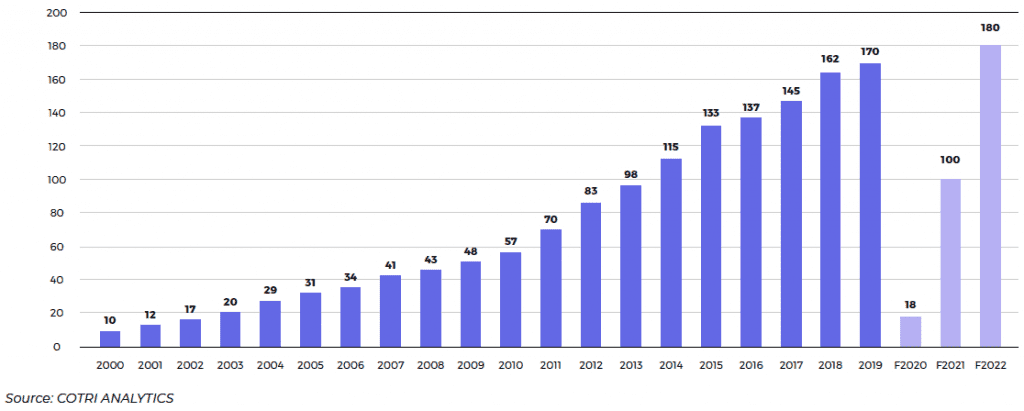

Around 100 million mainland Chinese traveled overseas in 2021 as the China Outbound Tourism Research Institute had predicted in November 2020. By 2022, that number had been forecast to reach 180 million, surpassing 2019’s mark of 170 million, as seen in the chart below.

Other big Asian outbound markets such as South Korea, Japan, India, Hong Kong, Singapore, Indonesia, Malaysia and Thailand also started bouncing back from 2021, albeit at a bit of a slower pace than China.

The biggest change is that Asian outbound travelers have become less global-thinking. To compensate for the reduced number of foreign trips in 2019 and 2020, and the tendency to vacation domestically, Asian travelers from many countries are taking more trips annually, which helps to stretch budgets, to rather than splurging on one or two long-haul journeys.

Airlines and Tour Operators Think Domestic

Asia’s low-cost carriers wear their badge of agility more earnestly than ever, launching services and adding frequencies, which drive Asians to rediscover local destinations and countries closer to home, where they can spend time with friends and family.

To a degree, travelers are prizing familiarity over novelty. Moreover, most Asian countries, having learned the perils of depending too much on overseas demand, are continuing to exhort the virtues of vacationing at home, and helping local businesses grow. Governments are continuing to incentivize domestic travelers with vouchers. Hotels and tour operators are also keeping pace, creating unique local experiences to satisfy a market that knows its backyard well. That’s something Covid-19 has forced tour operators and hotels to learn, and they are taking advantage of the trend.

Border Crossings from Mainland China in Millions

At the same time, massive investment in local roads, highways and railways throughout Asia is improving the infrastructure, a boon for regional and domestic travel. This takes place as Asians in many markets have found a new love for road trips and train journeys, spurred by the pandemic.

All this has led to a continuing weakening of the power of Western-focused travel companies while destinations from Indonesia to Dubai are grabbing market share.

Download Your Copy of Skift Travel Megatrends 2025

Counterpoint: Many travelers from Asian countries have returned to Beverly Hills and the Grand Canyon, as well as Harrods and Buckingham Palace. London Partners and Brand USA are doing just fine, thank you.

No other continent had more countries impose lockdowns, mask-wearing and social distancing than Asia in the immediate wake of the pandemic.. But this isolation created a feeling of psychological imprisonment and with it, the deepest longing for “space” — meaning the outdoors, nature, and fresh air.

But China and India, the two most populous countries in Asia, are also its most polluted, while rapid urbanization in the region leads to excessive traffic snarls and a sense of crowdedness, especially in overburdened cities.

Pollution and congestion were factors that led to European countries such as Switzerland, Sweden, Finland and the Netherlands becoming the fastest-growing nations for Chinese travelers pre-pandemic. Post-pandemic, the yearning for “space” has only intensified.

So the attributes that made Europe the second largest destination for Chinese tourists after Asia pre-pandemic because of the outdoors, nature, fresh air, culture, and even shopping, have made the continent only more attractive after Covid-19 as Asians go about fulfilling their appetites for freshness, space, different cultures, and new adventures worldwide.

Looking back from our 2025 lens, we can say Booking.com was right in its October 2020 report on the future of travel when it predicted that travelers would not write-off their love of long-haul getaways. Its survey found that 21 percent of respondents “intend to travel to the other side of the world by the end of 2021, compared to only 6 percent by the end of 2020.”

The Demographic Factor

Demographics play into the resurgence of long-haul travel from the region. In many parts of Asia, the average age is 28 years old, compared with 38 in the U.S., and older than 40 in Europe. Young, mobile and digitally accomplished, many Asians readily embrace contactless travel and are fearless about flying post-pandemic. While Asia has lots to offer, cosmopolitan cities such as New York or Paris have not lost their luster. Asians, whether Chinese or Singaporeans, prize the novelty of visiting new destinations, be it Saudi Arabia or Brazil, over familiar vacation spots in the region.

Do you remember, almost five years ago now, the sensational numbers that came out of China’s National Day Golden Week of October 2020? Members of post-1990s and post-2000s’ generations accounted for more than 60 percent of travelers, according to Trip.com Group.

Destination marketing organizations, from Brand USA to Switzerland Tourism and Abu Dhabi Tourism, having grasped new ways to inspire travelers during Covid-19, and are now more inventive as they use computer-generated imagery and other marketing tactics that speak to younger, tech-savvy Asian travelers.

And lastly, at times, it’s geopolitics in Asia-Pacific that tilts the balance toward the West. Before Covid-19, China used its giant outbound travel market as a card to strengthen its political positions, be it with South Korea, Palau, or others. In 2025, some Asian governments have become comfortable with imposing travel restrictions — and it’s not always based on health and safety needs.

Download Your Copy of Skift Travel Megatrends 2025

Skift Megatrends 2025 is made possible by our parters: Abu Dhabi Convention & Exhibition Bureau, Accor, and American Express.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch