Skift Take

You wouldn’t call DoorDash the world’s largest restaurant operator. So don’t make the same mistake with Airbnb — there is an important difference between distribution platforms and their suppliers.

What do you think is the biggest myth surrounding the business of travel? Towards the top of my list is this: that Airbnb is in the hospitality business. It is not. Airbnb is in the business of distribution.

As a result, it’s become a pet peeve of mine when commentators — often just as likely to be from within the industry as without — draw direct comparisons between hotel chains and Airbnb. As the hype around Airbnb’s initial public offering, targeted for December, reaches fever pitch, more of these false equivalences are sure to surface.

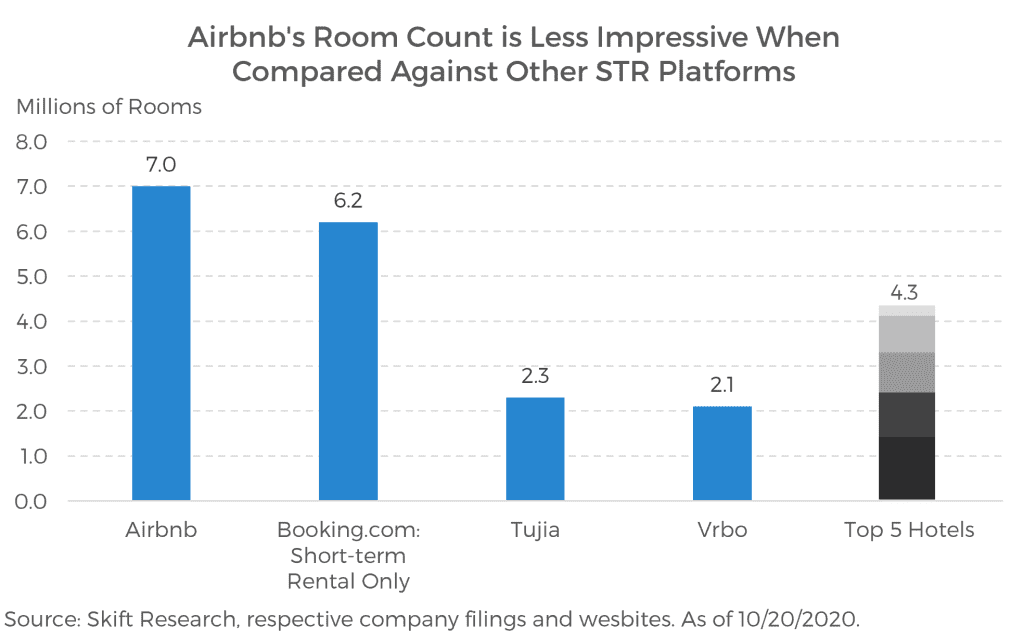

The latest commentator to fall into this trap was New York University Professor Scott Galloway who lined up Airbnb’s 7 million listings against the 4.3 million rooms on offer from Marriott, Hilton, InterContinental Hotels, Wyndham, and Hyatt combined. He is arguing for Airbnb’s competitive advantage in travel, and those numbers show Airbnb winning by a mile at first glance.

But this approach, comparing Airbnb directly against hotel chains, ignores the business model differences between running a pure online distribution platform and a branded hotel chain, and misses the difference in economics between hotel rooms and short-term rental units.

By picking the wrong set of peers, Galloway and others misunderstand Airbnb’s true place in the travel market landscape and overlook potential rivals like Booking Holdings, Expedia Group, and Trip.com Group.

Online Travel Agency Versus Hotel

The difference between an accommodation supplier and an accommodation distributor is easier to grasp if we start by looking at hotels.

A travel supplier, Marriott, for example, has a direct role in your experience each and every time you stay at one of its hotels. Everything from the price you pay, to how you pay (points or cash?), to the look and feel of the room, is controlled by Marriott.

Let’s contrast that with any online travel agency (OTA). Expedia doesn’t set a property’s rates. Orbitz doesn’t sit down with a developer to discuss a hotel room’s layout. Booking.com doesn’t negotiate with suppliers to buy linens in bulk.

But as Airbnb doesn’t work with large travel chains – its supply is mostly unbranded – it is easy for the average traveler to overlook this supplier-distributor distinction.

Airbnb was built on letting out spare rooms. And because this form of accommodation is so new, and so dependent on consumer trust in the Airbnb brand, we tend to blur the lines between supply and distribution. But make no mistake, Airbnb is still firmly a distribution company. It’s the micro-entrepreneurs, the folks who set the rates, change the linens, and pay the mortgage, that supply inventory to the platform.

Comparing a travel distributor to a travel supplier is comparing apples to oranges. They have different business models, incentive structures, and challenges.

There is also a distinction to be made in exclusivity. You can’t book a Marriott hotel through Hilton.com, obviously. But if I decide to rent out my home on Airbnb there is nothing preventing me from also listing it on Vrbo and booking.com. And in fact, according to data from Transparent, a leading provider of data analytics for the vacation rental industry, up to a third of full homes available to rent on Airbnb in the U.S. may be cross-listed on other distribution sites. This makes it possible for online aggregators to build supply much faster than a branded hotel chain ever could.

Now let’s redraw these charts, looking at how the inventory on Airbnb’s platform stacks up against other online travel agencies offering short-term rentals. Airbnb still leads but the race is much tighter than you might expect. Booking.com is not far behind with 6.2 million alternative listings in short-term rentals alone. Even the smallest competitor, Vrbo, boasts more rooms than Marriott, the largest hotel company in the world.

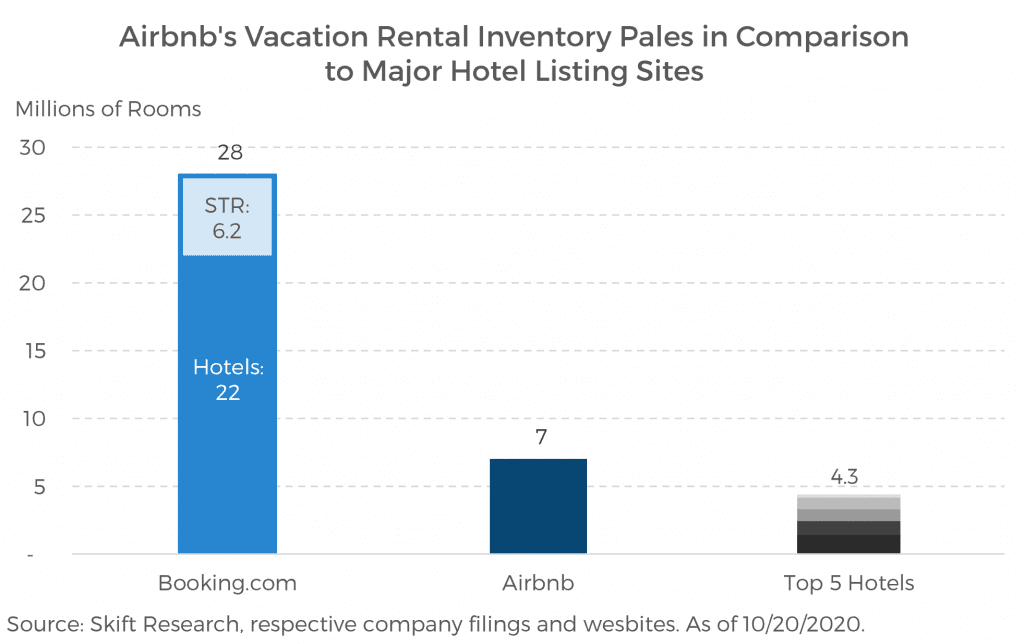

And now, let’s add in booking.com’s hotel listings. In Galloway’s comparison to the hotel brands, Airbnb seems to have an overwhelming advantage. But Airbnb’s 7 million listings are less than a third of the 22 million hotel rooms that Booking.com boasts.

We would argue that this disparity represents one of Airbnb’s greatest potential avenues for growth after its IPO. The company began offering boutique hotels at a small scale in 2018, but took a major leap forward into the traditional hospitality space with its March 2019 acquisition of HotelTonight for $400 million.

Clearly, Airbnb has headroom to grow in the hotel market.

Listings Don’t Equate to Revenue

Here is the other issue: comparing listings, or any measure of volume like room nights or google search activity, misses the difference in economics between the forms of accommodation. Hotels generate much higher revenue-per-available-room (RevPAR) than short-term rentals.

Full-year occupancies tend to be much lower at alternative accommodations with, for example, alternative accommodations in Europe posting an occupancy rate of 30 percent versus 80 percent at traditional accommodations.

This problem is even worse at Airbnb where many rooms can be temporary, with people listing their apartments only for a special event or when they are traveling out of town. At Airbnb too, which rents far more apartments than whole homes, the average room rate charges tend to be lower than at a hotel.

All in all, we believe that revenue per room can be anywhere from 2-5x greater at a hotel than at a short-term rental. In Europe, traditional accommodations generate 4x the revenue per bed that alternatives do.

Let’s revisit that initial Airbnb vs. hotels listings comparison. The five large hotel brands have three million fewer rooms between them than what Airbnb can boast on its platform. But those hotels may well be generating twice as much room revenue as all of the supply on Airbnb despite having 40 percent fewer listings.

Eagerly Awaiting Airbnb’s IPO

Airbnb will be the most important travel IPO of the past decade.

It helped define and popularize the short-term rental market as we know it today. Airbnb has positioned itself as the leader in a growing ecosystem made up of property managers, real estate owners, tech suppliers, and marketers.

The company, which managed to turn a profit in past years, has been working towards smoothing over government relationships and was eyeing new growth opportunities in hotels and experiences.

But Airbnb is not without challenges. In 2019 its profits disappeared as the company was forced to ramp up marketing spend in the face of intense competition. And though short-term rentals have been significantly outperforming hotels during COVID-19, Airbnb was still deeply wounded by this crisis. CEO Brian Chesky had to lay off a quarter of his staff and scale back his ambitions to expand outside of short-term rentals into hotels and tours. Those new markets were to be a lynchpin of Airbnb’s future plans and it is unclear how Chesky will position his company’s long-term plans nowadays.

Precisely how Airbnb has been hurt or grown during Covid, what its profit margins are, what its marketing budgets are, just how big its China, Experiences, and Hotel businesses are — these are key questions that matter to the travel industry. There’s a lot up in the air, awaiting answers from Airbnb’s first-ever public filings.

This commentary was written by Seth Borko, a senior analyst with Skift Research.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, ipo

Photo credit: Airbnb's homepage is the most popular vacation rental site for now, but competition is growing. Airbnb