Skift Take

Technological advancements have allowed for new entrants into the property management systems space to offer a viable alternative to incumbent legacy systems. Those systems might be scrambling for now, but they'll catch up. All this can only be a good thing for the PMS and hotel tech space in the long run.

Simply put, the property management system (PMS) landscape is a tale of two halves. Legacy systems, those that have been around since the early 1980s, were built for on-premise mainframes and physical infrastructure in hotels. Conversely, new entrants over the past years have been able to build using the latest cloud-based infrastructure. Legacy systems are now working hard to roll out cloud-based products and convert their customers onto these systems.

Cloud computing has had a major impact on the PMS sector, as it set in motion a number of developments and brought to the forefront issues that have plagued the sector for decades.

Integrations to the PMS is one area that has seen anything from despair to anger among hoteliers and integration partners. Many tech companies need information that is stored in the PMS, requiring to connect (i.e. integrate) with the PMS for access. This has long been an arduous process and still has many shortcomings today. Different technological advancements, however, have made it somewhat easier to do this and have given new entrants an opportunity to shake up the sector.

In The Hotel Property Management Systems Landscape 2020, we discuss the history, current state, and future outlook of the PMS sector, as well as main topics like integrations, marketplaces, and middleware layers. For this report we interviewed over 30 industry experts and surveyed a further 62 PMS vendors.

Skift Research last week launched its latest report, The Hotel Property Management Systems Landscape 2020. Below is an excerpt from this report. Get the full report here to stay ahead of this trend.

The Move to Cloud

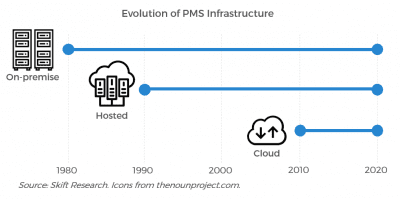

The history of PMS infrastructure can be broadly divided in three stages, as illustrated in Exhibit 7. At its origin, operating systems were aplenty, and hardware was large and clunky. Before IBM introduced its first PC in 1981, there were over 50 different computer types according to Hospitality Upgrade magazine, and the hardware needed a special air-conditioned room in the hotel and two full-time IT staff on hand 24/7. Hardware costs came down drastically with the advent of the PC, and HIS was one of the first property management systems to write to the new MS-DOS operating system. Still today, DOS-based Fidelio 6 systems are used in hotels around the world, although the majority of hotels are using Windows-based OPERA v5, which requires an on-premise database.

On-premise remains the most popular approach to hosting the software and databases for legacy players. For the initial installation of the PMS, or for upgrades, the PMS vendor sends out an engineer and/or representative to visit the hotel to install the software and train the staff. According to documents seen by Skift Research, the Choice Hotels Comfort Inn brand, for example, charges a hotel a one-off fee between $10,750 and $14,750 for a PMS software license and training, which includes a trainer visiting the hotel and training staff for a week.

In the 1990s, hosted systems started to gain popularity. These were in essence similar to on-premise installations, but rather than having the physical hardware in the hotel, these worked with application service providers (ASPs). The hotelier will pay a data center to host the PMS software, removing the need to have physical hardware at the hotel property. Hyatt is one major hotel chain that requires its hotel owners to use an OPERA hosted system.

It was not until the 2010s that cloud systems started to gain traction in the PMS space. Hetras was one of the first companies to offer a fully cloud-native system, swiftly followed by players like Clock PMS and StayNTouch. Hetras got acquired by Shiji Group in 2016, as was StayNTouch. Cloud property management systems are generally sold using the software as a service (SaaS) model, where hoteliers subscribe to the use of the software, as well as data storage in the cloud. The PMS vendor hosts the data and software in the cloud, and there is no need for physical hardware at the property.

Hybrid models continue to exist where hoteliers can have some aspects of their software and data storage on-premise, with others in the cloud.

Does Cloud Promote Integrations?

With the move to the cloud also came an increased focus on simplifying integrations. We will discuss integration in more detail later, but it’s important to note this here, as it is a major feature of the growth of cloud-native players. It’s hard for young startups to compete with behemoths like Oracle, Protel, or Infor in terms of features, simply because these companies have had a head start of many decades. This has thwarted serious competition in the past, but with improving reliability and speed of connections, integrations offer today’s startups an opportunity to add features quickly by integrating with other specialist vendors.

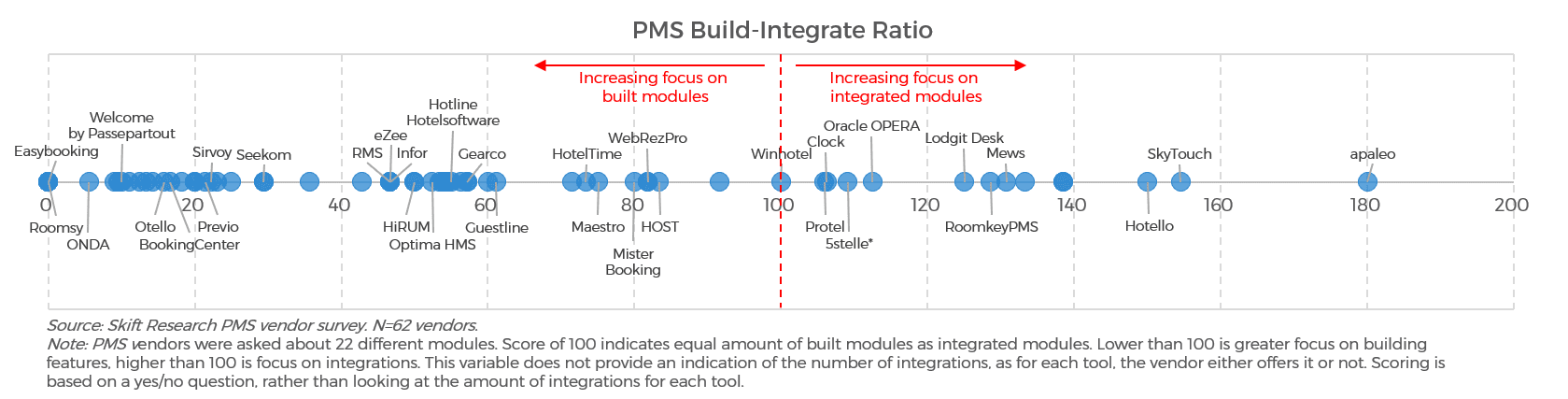

It’s too simplistic, however, to say that younger players are predominantly integrating while older players are predominantly building. Using our vendor survey, we correlated the in-house built features with third-party integrations to compile a “build-integrate ratio” for the 62 PMS vendors that took part in our survey. The results are shown in Exhibit 8.

Vendors were asked about 22 different modules, and a ratio score of 100 indicates that a PMS player has an equal amount of built modules as integrated modules. A score lower than 100 indicates a greater focus on building features in-house, while a score over 100 highlights a focus on integrations over building features.

PMS vendors like Easybooking, Roomsy, or ONDA have very few integrations, while at the other end, Apaleo stands out for its focus on third-party integrations over building proprietary features. Market leaders Oracle OPERA and Protel are clustered together around the midpoint, both offering a strong proprietary feature list and extensive integrations. Another interesting cluster includes PMS vendors eZee Technosys (recently acquired by Yanolja), InforHMS, and RMS, having a relative focus on building over integrating, with a score of 47.

Click image to enlarge

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Have a confidential tip for Skift? Get in touch

Tags: hotel tech, hotel tech stack, pms, skift research

Photo credit: Front desk hotel clerks serve a guest. Antonio Diaz / Adobe