Skift Take

We can shop for TVs and clothes on our phone, but booking flights remains stubbornly old school. Skyscanner is one of a few online players working with airlines to fix that.

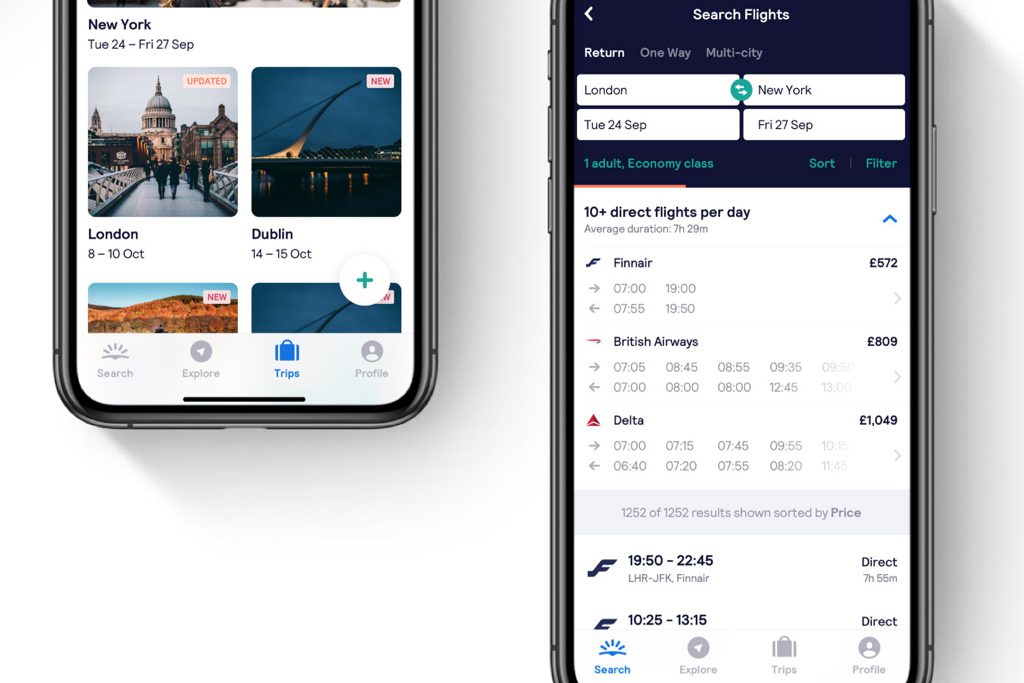

Online flight shopping has been stuck in the doldrums. A case in point is Skyscanner, which just updated its logo but continues to essentially show the same drop-down menus and limited information on flights today as it did five years ago.

But change is in the works. In the past year, more sophisticated flight shopping has shifted from airline talking points to actual practices at business travel booking services like TripActions. So why are the Skyscanners, Expedias, Googles, and other travel sellers of the world slow to catch up?

Airline industry disagreement over what data to show, the high upfront costs of building new tools, and haggling over commissions have kept the flight shopping interfaces stuck in the past. Yet several industry players are now pushing to bring new flight shopping approaches within reach of many larger household-name online travel agencies.

Skyscanner, the price-comparison search service owned by Ctrip — soon-to-be-renamed Trip.com Group — appears to be moving the fastest to change among the global giants.

By December, Skyscanner plans to begin displaying the airfares for five airlines in the same way those airlines do on their own sites, said Piero Sierra, vice president of product. Expect to see branded fares, such as American Airlines’ so-called main cabin extra product that offers extra legroom. Look, too, for more efforts to upsell customers on seat upgrades and other products.

The look and feel of Skyscanner’s display will be similar to what TripActions has been offering its customers for many American Airlines, Delta Air Lines, and United Airlines flights since February. Both Skyscanner and TripActions are using data standardized via a so-called next-generation storefront initiative launched last year by the airline-owned airfare clearinghouse and tech partner, ATPCO, formerly known as the Airline Tariff Publishing Company. Sierra made the comments Tuesday at the ATPCO Elevate conference in Washington, D.C.

Instagram as a Benchmark

Skyscanner believes flight shopping has to get more visual, descriptive, and branded in an era when “a lot of people shop for clothes on Instagram and [Alibaba Group’s] Tmall,” Sierra said.

“Here’s how far off we are from the target,” Sierra said. “I challenge an airline executive to pull out their phone and look at all the flights available on a route like Washington to London, compare all the inventory on all the important factors, and purchase a flight with their face. Not possible. But if I asked you to buy a TV in a similar way, you would be able to do it. You’d be able to compare all of the TVs and have one ordered to arrive on your doorstep using facial recognition.”

Google Also on the Move

Skyscanner isn’t acting alone. Google, for example, is experimenting, though more quietly. In the U.S., Google has begun displaying some “branded fare families” from U.S. three airlines, said Gianni Marostica, managing director, global business development.

“We made a few mistakes along the way,” Marostica said. “The outcomes so far have been positive, and we’ve learned a lot. It’s so difficult to standardize the output in a way that’s consumable and understandable by users.”

Pictures of aircraft amenities also convert shoppers from merely looking to actually booking at significantly higher rates than written descriptions do, Marostica said. But airlines have been slow to provide visual content. That delay is risky. Instagram has popularized the power of visual search on mobile.

Airline Domineering?

Executives from both Skyscanner and Google cautioned that the airline industry needed to understand that a one-size-fits-all approach won’t work.

“There’s a perception among airlines that they’ll figure out what the right path and everyone will go build it,” Sierra said. But the reality is that experimentation needs to be the watchword, he said.

When Skyscanner their first began showing consumers which flights offered wi-fi on board, it saw its conversion, or purchase, rates tank. The mistake was showing the information on the initial site results page, Sierra said.

“An initial search is a place where people have all these variables [or factors in picking a flight] in their head,” Sierra said. “If you add one more variable, they break.”

Airlines need to be flexible in how they want their content displayed, Marostica of Google agreed.

“It’s very difficult to predict what’s going to work,” said Marositica. “We want airline partners to be willing to try it this way, try it differently, and be open to lots of trial-and-error.”

Skyscanner, for its part, has been attempting to innovate in airfare selling in other ways, too. In the past year, about 10 million shoppers used its so-called eco feature, which highlights flights that spew less carbon. The company said last month it planned to add more sustainability-related tools.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airline retail, amadeus, ATPCO, expedia, flight search, google, google flight search, google flights, skyscanner

Photo credit: An image of Skyscanner's mobile app after the September 2019 rebranding of the company. Skyscanner