Skift Take

With 500 million additional new international trips expected over the next decade, it's unlikely that the average traveler in 2029 will look like the traveler of today.

Travel has the potential to be a powerful force for good, inextricably linked with shifts in global demographics and economics. It strengthens economic ties across borders and can shape the public perception of outside lands and people.

Based on both historical and forecasted data, it’s one of the most remarkably consistent worldwide trends. But the source of departures shifts over time, and it is important for travel business leaders to have a view into where the next generation of visitors are coming from.

We believe that the next wave of international travelers will not look like the last, and this means that established travel players — hotels, airlines, cruises, and travel agents — seeking growth will have to shift their focus to new markets. It’s also an opportunity for new local organizations to establish themselves on the world stage.

Last week, we launched the latest report in our Skift Research service, Global Travel Economics 2019–2029.

The report provides a forecast for outbound international tourism in 2024 and 2029. Our forecasts cover international departures for five major regions as well as many individual countries. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Travel Growth a Worldwide, Secular Trend

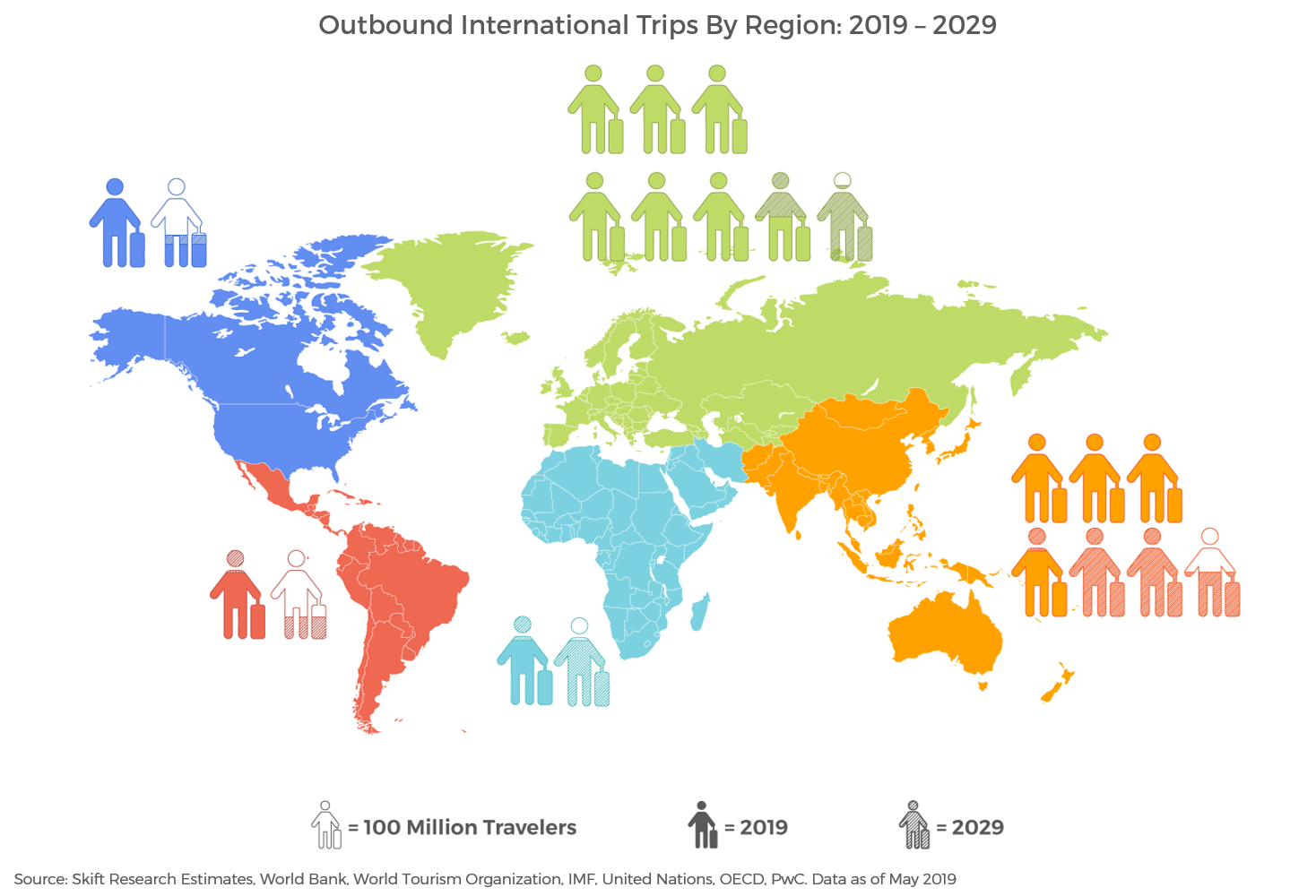

Our forecasts suggest that international travel will continue to grow at a healthy clip in all regions across the globe. In fact, based on both historical and forecasted data, international travel is one of the most impressively steady and sustainable trends we have observed across a variety of economic data. Skift Research estimates, based on historical data from the World Tourism Organization that was accessed through the World Bank, that there were 494 million new international traveler departures over the last 10 years. Further we forecast that the world will add another 507 million new traveler departures in the decade to come.

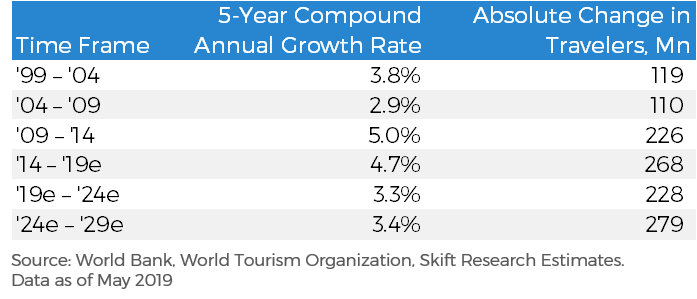

We expect the growth rate for international travelers to slow somewhat. After posting a 5 percent compound annual growth rate (CAGR) between 2009–2014 and a 4.7 percent rate from 2014–2019e we see growth decelerating to a 3.3 percent CAGR for 2019e–2024e and to 3.4 percent from 2024e–2029e. However, these relatively slower growth rates compounding off a higher base should still lead to record increases in the absolute number of international travelers for the decade to come, as mentioned above.

Moving down to the regional level, Europe and Central Asia is the largest source of outbound tourists today, and we expect it to remain so over the next decade. However Europe and Central Asia’s margin of leadership will be eroded by growth in other areas, and we expect Europe and Central Asia to fall from 50 percent of worldwide departures today to 41 percent in 2029.

The greatest number of new international travelers over the next decade will depart from the Asia-Pacific region to the tune of 273 million additional outbound trips, 54 percent of all growth worldwide.

The 500-pound gorilla here is China, which we expect, with its combination of both population and GDP per capita growth, will contribute 120 million departures to that regional growth figure. The Chinese numbers are impressive. But according to our estimates, the percent growth rates will be higher elsewhere, for instance in India and Southeast Asia.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: asia pacific, china, departures, outbound tourism, skift research estimates, tourism

Photo credit: A China Eastern Airlines flight takes off at Beijing Capital International Airport, the largest airport in China and second largest in the world. China is expected to create a significant amount of new international travelers over the next decade. Shimin Gu / Airliners.net via Wikimedia Commons