Skift Take

Caesars had under-invested in the tech needed to support the hotel side of its business. Recently it has been playing catch up. Some of its experiments are innovative, such as mobile ordering for food at the lobby or by the pool.

Caesars Entertainment‘s flagship product may be gambling, but lately the company’s biggest bet has been on catch-up tech investments in hotel tech. The newsiest and most eye-catching of these has been its experiment in on-demand mobile delivery of food.

In the past three months, Caesars has been testing mobile ordering technology for food at eight properties nationwide, including the Linq in Las Vegas. The company is letting guests order food at designated locations around their properties that are public areas, such as lobbies and poolside decks, but that aren’t restaurants or casino floors.

Guests sitting at, say, a lobby lounge, can order food from a hotel kitchen to be delivered to them on the spot. A guest can order through the Caesars mobile app or else by texting a word on their phone to a particular number, which then opens a web browser with menu options.

Guests can charge the order to their room or pay by credit card or with a mobile payment service, such as Apple Pay. Runtriz, a Los Angeles-based vendor that provides hotels with mobile guest services, powers the tool.

Postmates, UberEats, Grab, and other companies have gotten many consumers accustomed to mobile ordering, and Caesars is one of the first hotels to try to put a hospitality twist on the trend.

Caesars isn’t neglecting room service, though. Later this year, it intends to roll out at selected properties a new “food order tracker,” which will let guests see the progress on their order. The animation would be similar to the pizza-making tracker pioneered by Domino’s.

If guests like the mobile-ordering and room service innovations, Caesars will roll them out to the additional properties that it manages at its 55 locations.

Taking a Hybrid Approach to Chatbots

Many hotels are experimenting with chatbots to communicate with guests. Some large hotel chains are taking a hands-on approach, with staff answering nearly all queries. Other hotel companies — usually the smaller ones — are opting for fully automated responses. They find that the robotic commentary is cheaper, even if it may be less effective.

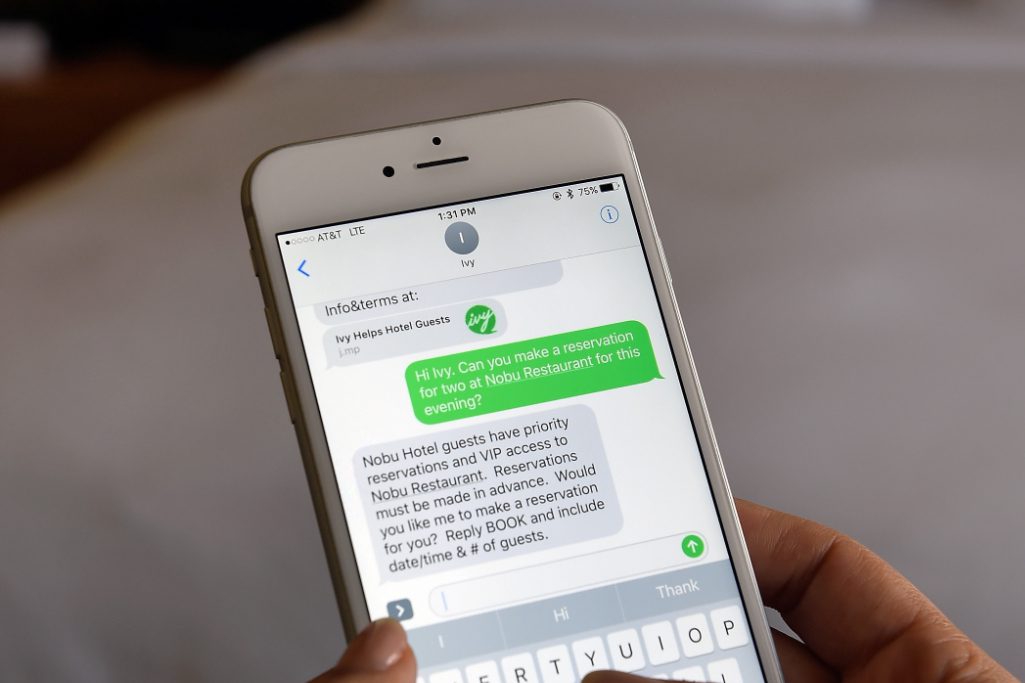

Caesars has taken a hybrid approach with Ivy, its virtual concierge text-messaging service, which is powered by vendor Go Moment.

After guests check in and provide their phone number, they receive a text from Ivy inviting them to chat if they have any questions.

About a third of the questions guests ask via Ivy are standard ones, such as about check-out times, said Michael Marino, who became Caesar’s first chief experience officer in 2016. For common questions, a bot replies with canned answers.

Yet most of the questions are more complicated, such as “What’s a good show for me to see in Vegas?” Staff in call centers, which it runs around the clock, tackle these more nuanced topics. “It takes a conversation to really help a guest figure out what they might like,” Marino said.

Caesars has only made its chatbot available for some of its properties. Yet the early word has been positive. It has been using a survey firm, InMoment, to ask a few questions of guests after a stay, such as “how was your overall experience?” and “would you recommend us?” Caesars compared responses from guests who had used the chatbot to those who hadn’t. Ivy users gave the properties approximately 10 points higher satisfaction scores.

“That’s a pretty incredible gain,” said Marino. “To get that another way, I’d probably have to double my staff on the ground or do something else extraordinary.

Aiming to Sell Smarter

Some other hotels see chatbots as an upselling tool. The Cosmopolitan of Las Vegas, for example, debuted in 2017 a chatbot made by digital marketing agency R/GA in Chicago. The Cosmopolitan found that hotel guests who text its chatbot spend as much as 30 percent more than those who don’t.

However, Caesars is steering away from the upselling via chat, for now, said Marino, to maintain the customer service focus.

The app can handle transactions, though. One of the most popular ones is the company’s recently added tool to let guests at select properties book seats at the pool. Tech vendor UrVenue helps power the function.

Caesars has also been working to fine-tune how its website greets visitors. It has been increasingly using Adobe Marketing Cloud services to semi-personalize customer messages, and it’s adding a new booking engine this year.

Presenting the right offer is a crucial concern.

“We sell $29 rooms at some destinations and $500 rooms at Caesars Palace, and we want to be careful when a customer comes to our brand-wide site to make sure we only present the right offer,” said Marino. “Otherwise, we might turn them away.”

Critics say the company is behind in centralizing in a data lake all of the information collected via all of its third-party vendors. A move like that would lay the groundwork for offering personalized offers by mobile in the future.

Today that’s difficult for mid-sized companies like Caesars because many of their systems are separated. For example, the Caesars mobile app uses OpenTable to power the reservations for its restaurants and uses Ticketmaster to handle ticket sales, but the data from each isn’t used well by the company to better understand its customers.

For now, the company remains partly hamstrung by systems that are pre-internet, pre-social, pre-mobile, and arguably prehistoric in the context of hotel retailing.

Caesars is taking steps to build a data repository. It hired consulting agency Bluewolf, an IBM company, and Salesforce, which offers marketing platform services over the cloud, for one slice of the data centralization effort. The project is pooling data from some legacy systems and databases to create unified customer profiles.

In an ideal outcome, Caesars will be able to pinpoint the music or cuisine tastes of a guest and send relevant offers and suggestions via its app or by providing the information to its concierges in call centers.

That’s a tall order, though. Critics will believe it when they see it.

By the end of 2019, chief information officer Les Ottolenghi intends to move away from the company’s current property management system, Agilysys Lodging Mangement System, with a new system, as-yet-undisclosed, that company executives hope will be more flexible. But the move, which involves everything from customer databases and hotel front-desk systems to self-check-in kiosks, will be complicated.

The company also plans to move all of the firm’s information technology systems off less-flexible mainframe systems to more nimble cloud ones by 2020. It is about 60 percent of the way there. For context on the importance of cloud, Skift Research subscribers can read “The Strategic Guide to a Modern Hotel Technology Stack.”

Caesars is putting fresh importance on its investment in hotel tech as part of its larger strategy. In June 2018, it said that it would turn four of its hotels into brands that are open for licensing in markets beyond gaming hubs like Macau and Atlantic City. In recent months it opened its first non-gaming properties (at locations in Dubai) with another nongaming resort coming in 2020 in Puerto Los Cabos, Mexico. A solid hotel tech game will support both the licensing efforts and the nongaming resorts.

Winding Road

The food-related and chatbot efforts are the latest in several initiatives. Having emerged from bankruptcy protection in October 2017, the company is now investing in tech to grow. As the company plans non-gaming properties, the hotel tech effort grows in importance.

Caesars stumbled at first. It wasn’t until 2014 that it launched a mobile app to cover all of its properties, for example.

The first app had a lot of bells and whistles. However, most users ignored a lot of the functionality, such as the lists of local events.

The company responded by changing its approach. The focus shifted from trying to generate revenue to trying to boost customer service.

“We shifted gears to create tools that help guests do what they were already doing, only in a more natural way,” said Marino. His team worked at streamlining services to help guests, say, find out what time a restaurant or pool on the property is open.

In the past year, Caesars has slowly been adding “wayfinding,” or maps, to its apps for its properties, which can often be as large as museums. The maps add “centimeter-accurate” virtual indoor models of most of its Vegas properties. LocusLabs, a San Francisco-based company, powers the maps. Caesars aims to finish with its Vegas locations by early spring.

Have a confidential tip for Skift? Get in touch

Tags: caesars, caesars entertainment, chatbots

Photo credit: Ivy, a virtual concierge text-messaging system offered to guests in Las Vegas. Customers can text a message to reserve seats at Nobu Restaurant in Caesars Palace, for example. Tech vendor Go Moment created Ivy. David Becker / Caesars Entertainment