Skift Take

The 10-year anniversary of the Lehman Brothers bankruptcy reminds us that travel was ravaged along with other industries in the ensuing global recession. How the industry coped and rebounded is instructive for the next downturn.

Ten years ago this week Lehman Brothers declared bankruptcy, still the largest such filing in U.S. history. In many ways, the failure of Lehman marked the tipping point when the crisis metastasized from a collapse in subprime mortgages to a global financial crisis. Businesses and consumers are still living with the fallout of Lehman and the global financial crisis today.

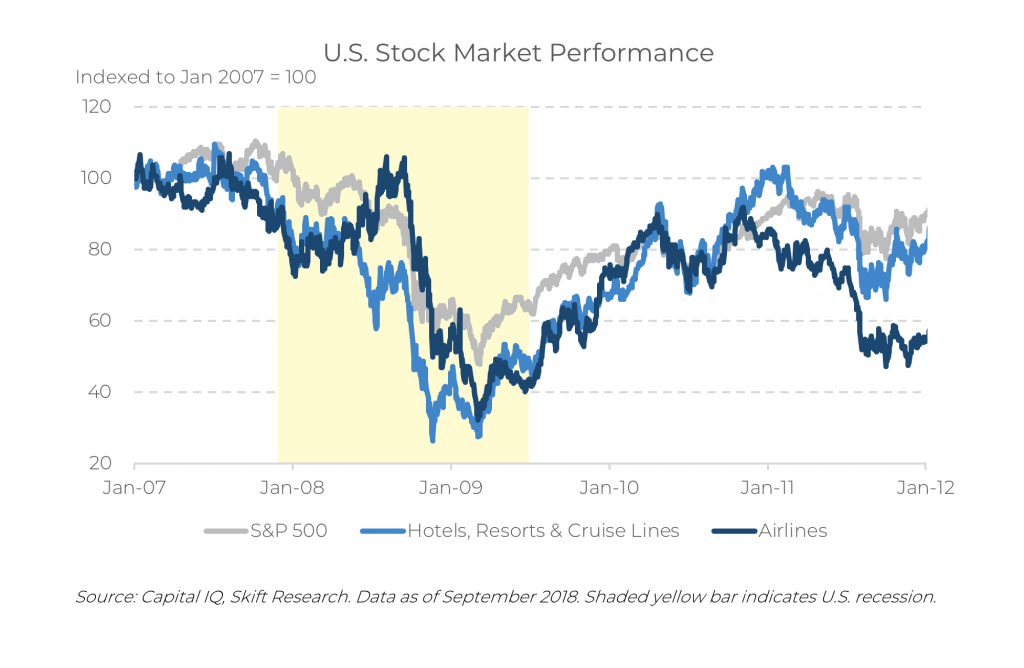

Much has changed in the travel industry since 2008. In the immediate aftermath of the crisis, consumers pulled back on discretionary spending, cancelling or downsizing planned vacations; businesses tightened their belts and cut corporate travel expense accounts. An investor who bought the S&P 500, a widely followed stock index that tracks the 500 largest U.S. businesses, in January 2007 would have lost half of their money by March 2009, the low point for stocks. Travel stocks got hit even worse. Over the same time frame, airline stocks declined 68 percent while hotel, resorts, and cruise lines fell 74 percent.

But in the years after, some industries, such as hotels and airlines, have seen cyclical recoveries in-line with the broader U.S. business cycle. While other areas of travel have experienced new growth — such as online bookings or emerging market outbound travel — that took place seemingly uninterrupted by the Great Recession. On the other hand, some sectors, such as offline travel agents, are in a broader decline. Lastly, there are entirely new startup-led markets, like apartment sharing, that only sprung up in the aftermath of the crisis.

Employment

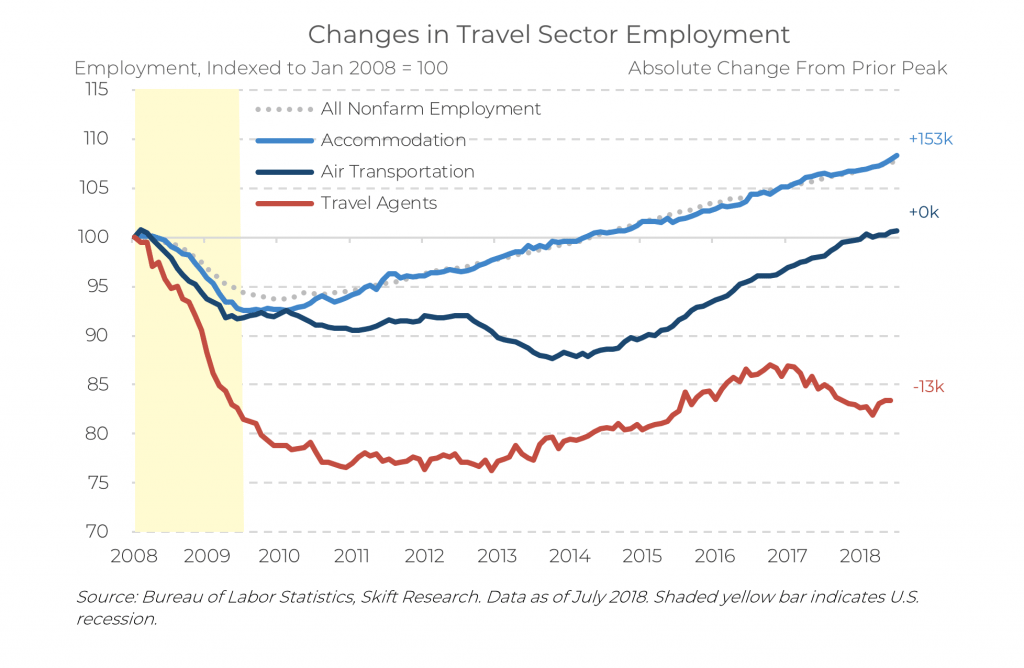

After shedding thousands of jobs in 2008, it has been a slow slog back to full employment for the travel industry. The jobs recovery has been strongest in the accommodation sector. Hotels, motels, and casinos collectively shed 144,000 workers in 2008 and 2009. But the hospitality sector has been steadily recovering and now, net of losses during the recession, employs 153,000 more people than it did before the recession in 2008.

Hospitality hiring trends picked up at about the same rate as the broader national workforce. Some travel-adjacent sectors, like restaurants grew even faster than the nationwide rate, but in other core travel sectors, job growth has stalled.

Take the U.S. airlines. They went through a wave of restructuring and consolidation in 2010-2013, which slowed hiring. That industry only just regained its pre-financial crisis payroll levels in November 2017.

Or consider travel agencies and other reservation services that never truly recovered from the crisis. Today, it employs 13,000 fewer individuals than it did in January 2008. It should be noted, however, that while the traditional travel agent will not disappear, this decline in jobs is part of a structural decline playing out since the mid-90s.

Hotel Top-Line

In 2007, U.S. hotels generated $66 in sales for every room they offered travelers. This metric, revenue per available room (RevPAR), is used by many hoteliers as a short-hand to measure overall performance since it is a function of both how many available rooms a property can book (occupancy rate) with how much it charges for those rooms (average daily rate, ADR).

In the depths of the recession, U.S. hotel financial performance plummeted, generating an industry-wide $54 of sales for each available room, down 18 percent. But the U.S. industry has since recovered, growing revenue per available room at a 5.7 percent compound annual rate since the 2009 low and now commands $84 in sales for each room it operates.

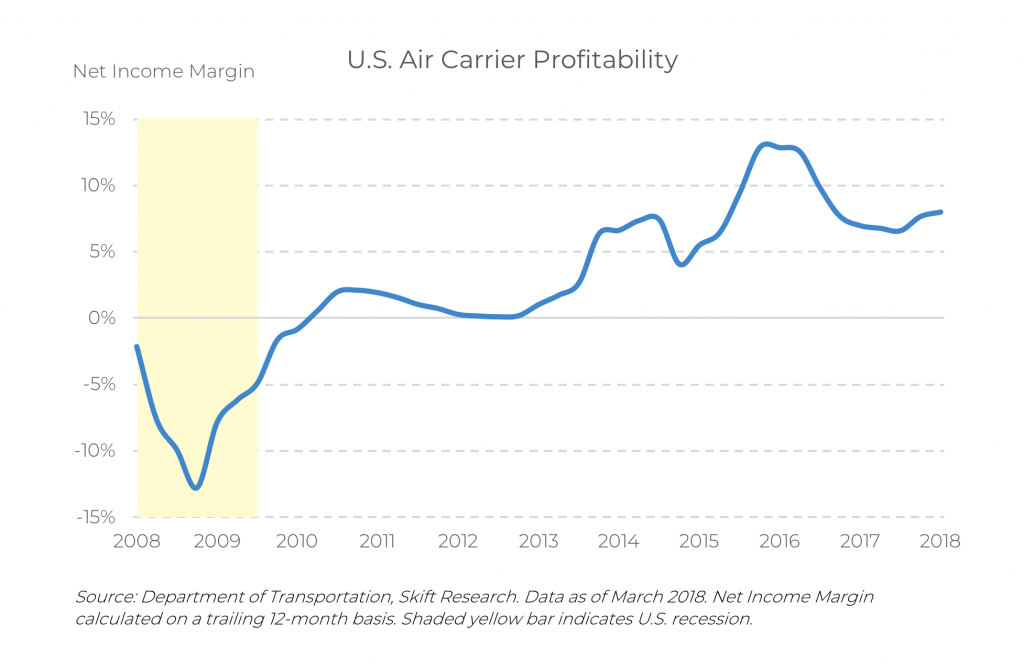

Airline Profitability

Airlines are a notoriously unprofitable business. In fact, they were barely profitable before the Great Recession. Of course, the global financial crisis did not help and in the depths of the recession, the U.S. industry lost a collective $24 billion, a margin of negative 13 percent. Carriers stemmed their losses in 2010, but still struggled to make money as they were faced with near-record high oil prices, low-cost carrier competition, legacy labor contracts, and a tepid consumer recovery. This ultimately led to a wave of bankruptcies, restructurings, and consolidation in 2010-2013.

The industry has finally been able to earn a profit in recent years aided by a record number of U.S. airline passengers (849 million in 2017), lower costs, and benign oil prices. Over the last 12 months, U.S. airlines generated profits of $18 billion, an 8 percent margin.

Even legendary investor Warren Buffet, who used to ridicule airlines, seems to have taken notice. His firm, Berkshire Hathaway, has invested in all four major U.S. airlines: Delta, American, United, and Southwest. While times seem good for airlines, climbing fuel prices are re-emerging as an area of concern. It remains to be seen if airlines will be able to pass on these growing costs.

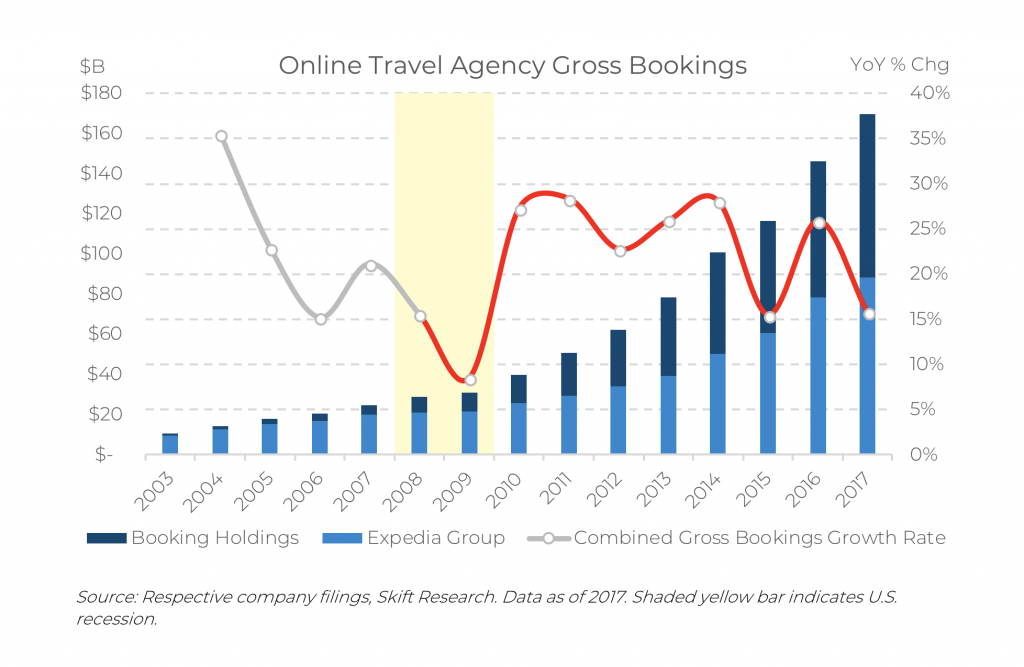

Online Travel Agencies

The shift to online, away from offline, travel bookings is a long-term trend that was slowed, but uninterrupted, by the global financial crisis.

In 2004 Expedia Group and Booking Holdings processed a collective $15 billion in gross bookings. In 2009, the peak of the recession, these two sites did $31 billion in gross bookings. True the yearly growth rate slowed from double-digit increases to just nine percent. But that growth rate quickly regained its prior highs. Admittedly, some of these increases were fueled by M&A, such as the 2015 acquisition of Orbitz by Expedia. Nonetheless, the move to online travel is secular in nature and by 2017, collective gross bookings at the two leading sites had increased over five-fold from the recession to $170 billion.

Outbound Travel From Emerging Markets

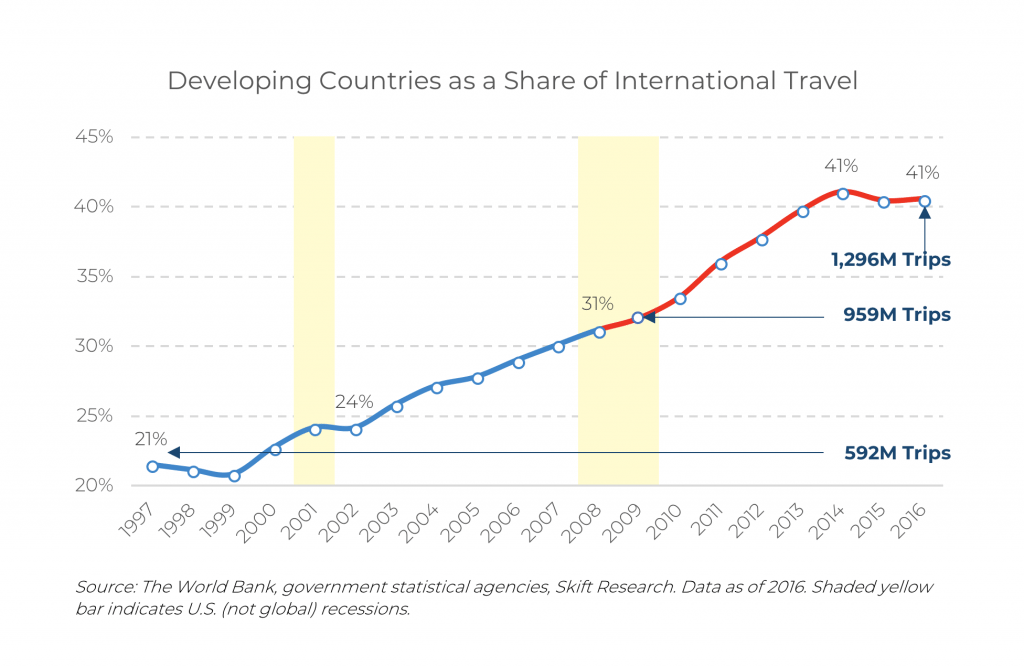

One of the greatest shifts in the travel industry of our generation has been — and will continue to be — the rise of travelers in developing countries. Developing countries now account for 83 percent of the world’s population, yet just 35 percent of GDP and 41 percent of outbound travelers.

The emerging market consumer is growing in both number and purchasing power. According to the World Bank, travelers from mid- and low-income countries made 1.3 billion trips in 2016, 41 percent of the global total. That ratio has been climbing nearly uninterrupted, from a 21 percent global share 20 years ago.

As these travelers continue to expand their horizons, they will determine the future course for the travel industry. At present, some of the most important developing regions for outbound travelers are China, India, and Latin America.

Airbnb and the Travel Startup Boom

Airbnb was founded in late-2008 and raised a Series A venture capital round in November of 2010. Though founded after the financial crisis, Airbnb was still deeply shaped by those events. The consumer that emerged from the great recession is more frugal and prefers experiences to material goods. Airbnb emerged at the right time and with the right product to tap into that zeitgeist.

The company has since exploded and now boasts, over five million online listings and $2.6 billion in gross bookings. Yes, vacation rentals existed before Airbnb, but it’s hard to deny the impact that Airbnb had on that formerly sleepy, and mostly offline, industry. It’s gotten to the point where Booking Holdings and Expedia Group are now both racing to offer online bookable vacation rentals.

Plus, inspired by the success of Airbnb, which has now raised a cumulative $3.3 billion of capital, a new generation of startups have entered the vacation rental market. The startup-focused website AngelList has tracked 400 new vacation rental startups since 2011 and we suspect that number is an underestimation.

The mindset of startup-led innovation seems here to stay, having spread beyond vacation rentals and now impacts nearly every sub-sector in travel.

Have a confidential tip for Skift? Get in touch

Tags: global financial crisis, skift research

Photo credit: In the depths of the recession, the U.S. airline industry lost a collective $24 billion, margin of negative 13 percent. lanier67 on VisualHunt.com / CC BY-NC-ND / VisualHunt