Skift Take

Amazon is posing a threat. Chinese tourists are spotted everywhere and the loyalty war is getting ever more intense. Common threads? It's a disruptive phase for travel that requires nimble strategies.

Summer is here. Year 2018 is halfway through. We at Skift have written hundreds of articles covering the hot and the not-so-hot areas in travel thus far. For this short piece, we will show you a few charts extracted from a select Skift Research reports published this year. The common thread? They are all topics that travel stakeholders need to think about, deeply.

Will Amazon Enter the Travel Market?

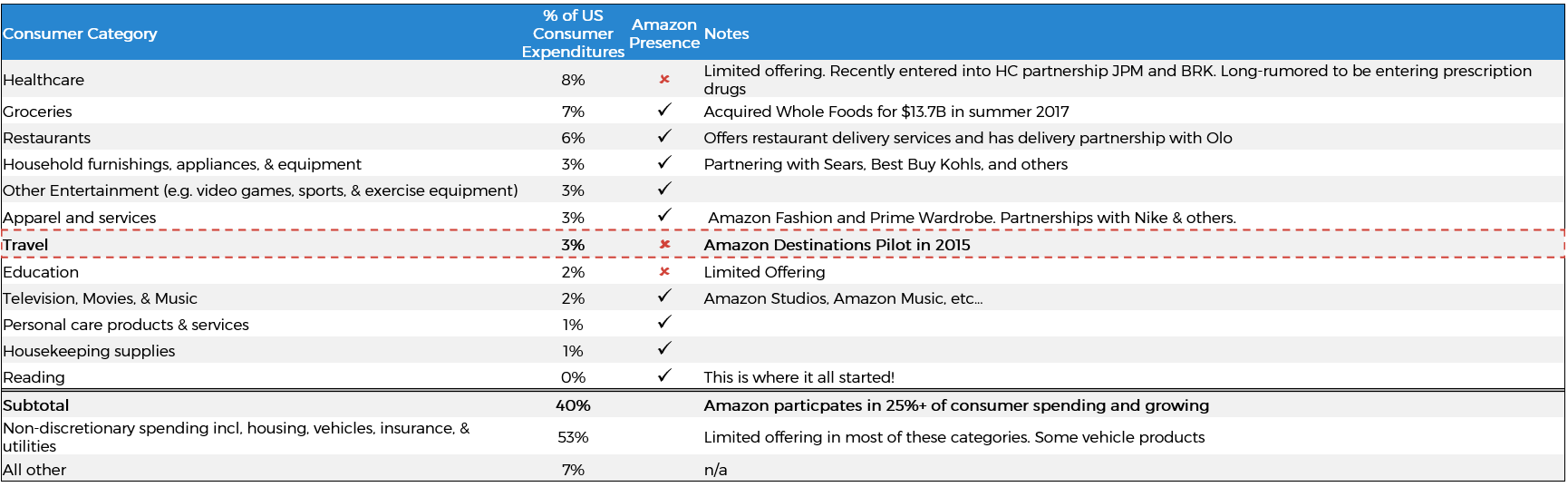

Chart reads: Amazon’s product offerings penetrate categories that account for over 25 percent of total consumer expenditures. Travel is one of the few remaining discretionary categories that Amazon has yet to expand into.

Source: Amazon: Lessons, Threats, and Opportunities for Travel

With Amazon’s track record of moving into new markets, it’s hard to believe that Amazon won’t enter the travel market. The question is not if, but when and how.

(One more evidence of Amazon’s expansion into new markets was revealed a few days ago. Barely one month passed since we created the chart, the information about healthcare is inaccurate already. Amazon announced Thursday that it would acquire PillPack, an online pharmacy that delivers medications in pre-sorted dose packaging and coordinates refills and renewals to people who take multiple daily prescriptions, a move that makes it compete directly in the healthcare sector.)

Bottom line: Amazon has a lot to teach the travel industry. Its relentless focus on anticipating and eliminating customer pain points is what it takes to create a product or service of excellence, regardless of what industry you’re in. As to its direct impact on the travel market, understanding how it operates, and its latest offerings is key to being prepared, whether from a competitive or collaborative perspective.

Read more: Amazon: Lessons, Threats, and Opportunities for Travel

Don’t stereotype and understand TRAVELERS’ tastes

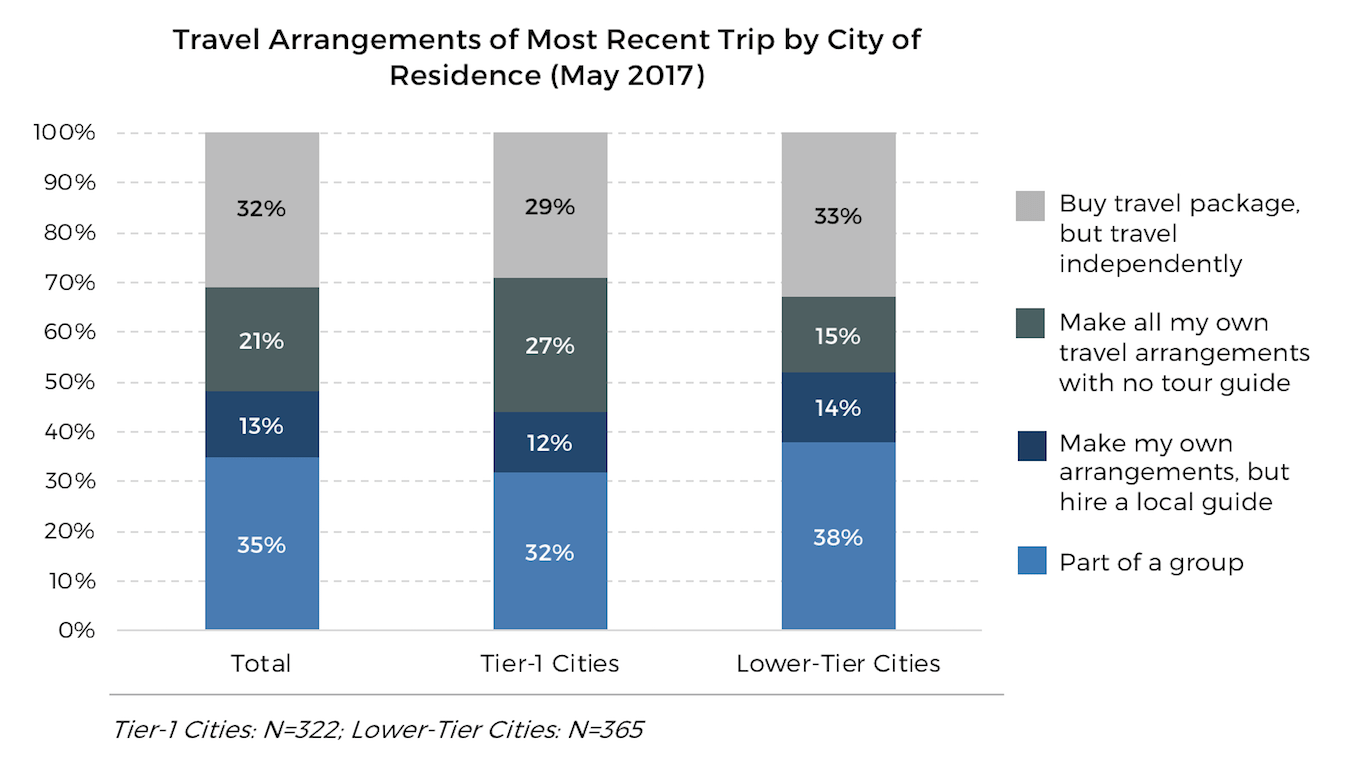

Chart reads: For Chinese travelers surveyed in a May 2017 report by China Luxury Advisors and Fung Global Retail & Technology, only 21 percent of respondents made all their own travel arrangements with no tour guide. All the others participated in some sort of travel package or tour guide activity, including 32 percent who bought a travel package, but travel independently; 13 percent who made their own arrangements, but hire a local guide; and 35 percent who were part of a group.

Source: China Luxury Advisors + Fung Global Retail & Technology

At 135 million in 2016, the number of Chinese outbound tourists equals more than 40 percent of the U.S. population and is growing rapidly. As relatively new entrants to middle-class status and the global travel market, their travel behavior is a unique blend of local Chinese consumption habits and absorption of global trends, and evolving.

Bottom line: Chinese outbound tourism is a lucrative market that nobody can afford to ignore. To attract and serve this big market, travel brands and destinations need to work hard to understand their habits and preferences and adopt relevant and compelling marketing strategies. Needless to say, the general lesson is don’t stereotype. Truly understand your consumers and provide authentic services tailored to their needs.

Read more: Best Practices for Attracting Chinese Outbound Tourists

The Loyalty War: Does It Work?

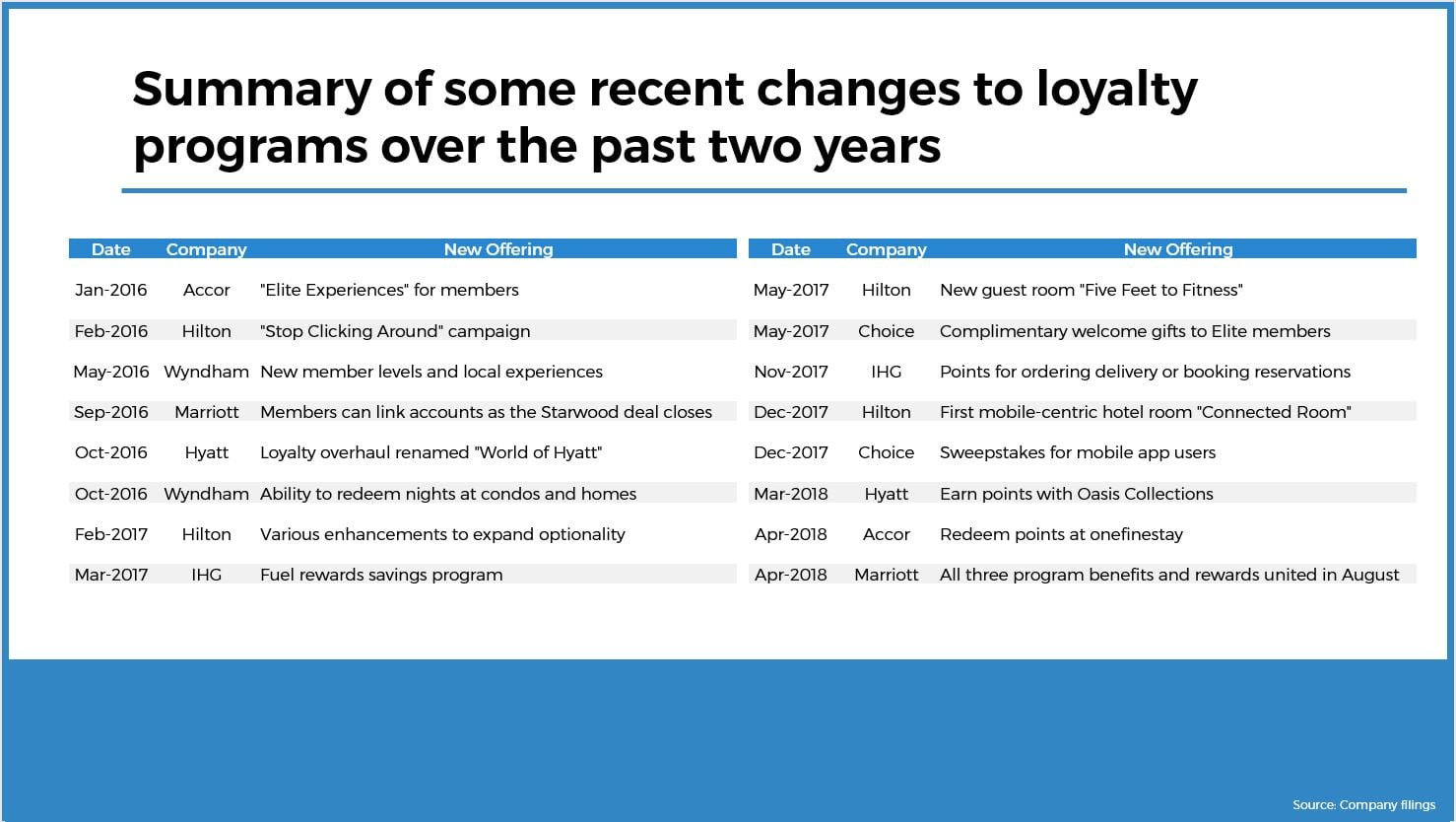

Chart reads: Major hotel brands are constantly changing their loyalty programs to get consumers to stick with their brands and increase sales.

Source: Perspectives on Hospitality Loyalty Programs 2018: A Challenging Road for Real Customer Loyalty

A loyal customer is every marketer’s dream. They cost less to market to, spend more with you, and act as your brand ambassador. It’s a great marketing effort that hotel brands are constantly updating their programs to cater to evolving consumer needs. Creating more personalized services and offering more experience-based benefits for loyalty members are nicer perks than simply accruing points. Yet, the question remains: Can these moves help generate true loyalty?

Bottom line: True loyalty starts with trusting that you can get a consistent and superb-quality service. A higher level of trust is emotional, resonating with what a brand represents. Perks are easy to earn and give away, but trust should be the lofty goal for which to strive.

Read more: Perspectives on Hospitality Loyalty Programs 2018: A Challenging Road for Real Customer Loyalty

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: amazon, china, loyalty, research, research reports, skift research

Photo credit: Chinese outbound tourism is a lucrative market that nobody can afford to ignore. Zoetnet / Flickr