Skift Take

Might 2018 be the year U.S. regulators take a hard look anew at Google's travel-business practices after declining to take action in 2012? We hope so, in the interests of fair play, although the Trump Administration has been keen to reduce government regulation of businesses, not increase it.

Google is not only feeling antitrust heat in Europe, where the European Union leveled a $2.7 billion fine against it in June over its shopping business, but now Google is feeling regulatory pressure in the U.S. over its travel-business practices, as well.

A Wall Street Journal Editorial Board opinion piece Wednesday on what it termed the Google-Hotel Travelopy called on Google to compete fairly by giving free rein to smaller online travel agencies to use hotel trademarks in their Google ads and URLs, and to stop biasing search results in favor of Google’s own flight and hotel metasearch businesses to the detriment of competitors’ businesses.

“Google ought to compete on fair terms by opening its auctions to all players and stop favoring its meta-search,” the Wall Street Journal editorial concluded. “Otherwise, regulators may soon ask if the search giant is abusing its market power.”

Google spokesman Alex Krasov said the Wall Street Journal editorial “mischaracterized” some of the ways Google’s advertising products work.

“The online travel industry is highly competitive and in fact, travel companies are some of the most avid users of Google’s advertising offerings,” Krasov said. “Unfortunately, the Wall Street Journal mischaracterized how some of these offerings work. Google auctions are open to all advertisers that comply with our policies; we do not restrict the use of trademarks as keywords, and we do not require proprietary information to run hotel ads. And since protecting users is a top priority for Google, we have detailed policies against deceptive or misleading use of trademarks in ad text and take swift action when we see this type of abuse on our platform.”

The Wall Street Journal editorial cited a Skift Research article in June about the estimated size of Google’s travel business. “The search giant’s travel business is worth $100 billion and will generate $14 billion in revenue this year, according to Skift Research,” the Wall Street Journal said.

Skift Research’s just-published report, A Deep Dive in the Google Travel Ecosystem 2018, estimated that two online travel businesses alone — the Priceline Group and Expedia Inc. — shelled out more than $4 billion on Google advertising in 2016 while North America hotel chains chipped in $1 billion to $1.4 billion in 2017.

A spokesperson for the U.S. Department of Justice Antitrust Division told Skift Thursday that it doesn’t as standard practice confirm or deny the existence of investigations before the information is released to the public. A spokesperson for the Federal Trade Commission likewise declined to confirm or deny an investigation.

The Wall Street Journal’s call for Google to cease allegedly anticompetitive practices comes five years after the U.S. Federal Trade Commission probed Google’s advertising practices and decided not to take action. The FTC declined to sue Google in 2012, the Wall Street Journal reported at the time, despite the fact that key antitrust staffers wanted to sue after concluding that Google’s search and advertising practices harmed consumers and slowed innovation.

Preview and Purchase Skift Research’s A Deep Dive Into the Google Travel Ecosystem 2018

What It All Means

Before briefly looking at the Wall Street Journal’s arguments — some of which have been aired innumerable times before — it is important to point out that when the Wall Street Journal, a powerful force in U.S. business, takes Google to task over its advertising and travel-business practices, this puts these issues into the national spotlight and places more pressure on Google to make concessions.

The Wall Street Journal alleges that Google and major hotel chains have banded together to stifle competition from smaller online travel agencies to the detriment of consumers.

“The problem is that Google is working with hotels to stifle competition,” the Wall Street Journal alleges.

The editorial cites the fact that some hotel chains and major online travel agencies have contracts that prohibit the online travel agencies from bidding on and using the hotels’ trademarks in their advertisements on Google. The use of such trademarks used to be common practice to the chagrin of the big hotel chains. Skift’s Travel Tech Editor wrote about the issue here.

The Wall Street Journal claims that despite Google’s denials, the search giant has bowed to the wishes of large chains and clamped down on smaller online travel agencies that seek to use hotel trademarks in their Google advertising, and that this harms consumers by inflating hotel rates.

“A spokesperson for Google says the company doesn’t restrict keyword ad bids, but we’ve been told by a small OTA that Google applies rules in a way that restricts trademarks in their hotel ad titles and URLs,” the Wall Street Journal wrote.

The American Hotel & Lodging Association has long called on Google to restrict online travel agencies and their affiliates from using hotel trademarks in their Google advertising because some hoodwink consumers into thinking they are booking rooms directly with hotels when in reality they may be booking on dodgy and sometimes fraudulent websites.

So it’s unclear if there would be real consumer harm if Google is indeed restricting online travel agencies from using hotel trademarks.

The Federal Trade Commission in December reached a settlement with resellers Reservation Counter and its two parents, Partner Fusion and TravelPASS Group, charging they misled consumers into believing they were booking directly with a hotel, and these websites immediately charged consumers’ credit cards after the bookings. The settlement bars the defendants from such deceptive practices and mandates remedial steps, the FTC said.

Google’s Preferential Displays of Its Own Products

Where the Wall Street Journal arguments may have more merit is in the travel industry’s longstanding criticism that Google has buried organic search results in favor of paid advertisements, and the fact that Google biases search results to favor its own travel metasearch products, including Google Hotels and Google Flights, to the detriment of the competition and consumers.

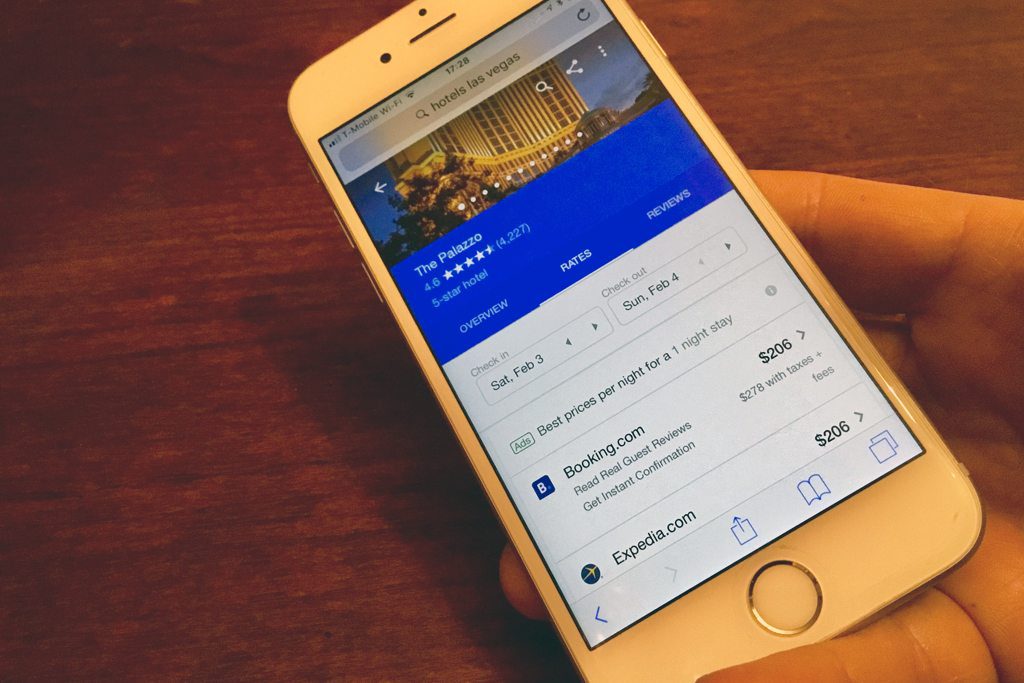

For example, a Google search for “Philadelphia hotels” Thursday produced search results with paid ads from Hotels.com, Expedia.com, TripAdvisor and Kayak on top of the initial search results page. Underneath these Google AdWords placements was a prominent colored map of Philadelphia with hotel rates, and a boxy image of three hotel search results with rates, review scores, star ratings, hotel descriptions and photos, all leading after a click to Google’s hotel-metasearch business.

Free search results from online travel agencies or hotels aren’t visible on the first screen of the Google page on desktop or mobile. Companies that rely on such organic search results from Google are now hard-pressed to attract site visitors from the search engine.

In its defense, Google says that the hotels featured in the map and box are triggered organically. But clicking on the results bring users to a Google Hotels page, featuring advertisements from online travel agencies and hotels. Competitors get no such prominent display for their businesses.

Free search results aren’t visible on the first screen of the Google page on desktop or mobile.

The Wall Street Journal says that Google is thus unfairly steering consumers to its own businesses. “But competition and choice will decline if Google exploits its market dominance to squeeze rivals,” the Wall Street Journal said.

What’s Next?

It’s been widely reported that the European Union is examining Google’s travel practices after having slapped Google hard for the way it runs its comparative shopping business.

It’s unclear if the Trump Department of Justice or Federal Trade Commission would have an appetite to probe Google’s travel-business or advertising practices or to subject Google to new regulation when the President has issued an executive order to reduce government regulation and has made reduced government regulation a key talking point.

It’s true that Google and Silicon Valley in general haven’t been ardent Trump supporters so tearing into Google could be seen as fitting retribution, but Google knows how to play both sides of the Washington lobbying and regulatory game and has ample resources and friends in government.

For its part, the Department of Justice under Trump-appointed Attorney General Jeff Sessions has initiated just half of the antitrust cases in 2017 that the Obama-led Justice Department did in 2016.

Still, the Wall Street Journal editorial gives hope to many in the travel industry who have demanded that Google be taken down a notch in the interests of fair competition.

One observer, Sally Hubbard, senior editor, tech antitrust enforcement for The Capitol Forum, said “scrutiny of Google’s role in the travel space will almost certainly increase when Joe Simons ultimately replaces Maureen Ohlhausen as chair of the FTC.”

2018 could indeed get more interesting on the Google regulatory front.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: antitrust, google, hotels, online travel agencies, otas

Photo credit: Pictured is a Google Hotels display on iPhone. A Wall Street Journal editorial on December 27 alleged that Google steers consumers to its own businesses to the detriment of competition. Skift