Skift Take

After pouring over third quarter earnings results and investor calls, it’s clear the big hotel chains have embarked on a new, but potentially arduous road.

In the following piece, Skift Research Senior Analyst Rebecca Stone examined public hotel companies and cruise lines’ financial results from the September quarter, and identified key financial trends that will help these industries’ outlooks for the rest of 2017, into next year and beyond. Subscribe to our Research service to get deep these deep sectoral and company deep dives.

To grow and survive as digital platforms, the big hotel chains are unequivocally moving away from the hotel owner model and more towards branding, marketing, and technology-related functions.

In the long run, this should translate into accelerated global growth, sweeter margins, and cash flow from asset sell-offs, but it’s also uncharted territory in many respects. Being excellent at branding, ecommerce, and enterprise IT is a big job; competition is fierce on all fronts. Branding is a tricky business these days, especially for globally fragmented businesses, and the hotel companies will need more than loyalty points to keep customers coming back. Hotel enterprise IT is messy and entrenched, and travel is a hard ecommerce category in general.

Nevertheless, it’s the road that they’ve chosen, and now investors will gauge them on their ability to deliver. Here are Skift Research’s eight key themes that we see playing out in Q4 and beyond.

The shift to “asset light” continues

We continue to see hotel companies increasingly pursue asset-light strategies via franchising or managing hotels rather than owning real estate. These asset-light models typically have higher margins, higher returns on invested capital, low capital intensity, and low volatility in earnings compared to owning hotels.

Subscribe to Skift Research Reports

Hyatt, which previously had a stated strategy of being an “asset recycler” where it was willing to sell owned assets to reinvest in better properties, officially changed its tune during Q3 earnings by announcing a plan to reduce its owned real estate portfolio by $1.5 billion over the next three years by selling and entering long-term management or franchise agreements for the assets. The plan allows Hyatt to monetize high multiple assets whose cash flows are not being accurately valued by investors, in management’s view, and provides funds to return capital to shareholders. The company has already sold approximately $300 million of the $1.5 billion and expects the fee business (which includes management and franchise) will be 60 percent of earnings by 2020.

Hyatt is just the latest to join the march toward asset-light. Hilton spun off its real estate into a Real Estate Investment Trust (Park Hotels and Resorts) as well as its timeshare business (Hilton Grand Vacations) at the beginning of 2017; Marriott has approximately $400 million more assets it plans to sell in 2018 as part of its $1.5 billion Starwood asset sale plan; La Quinta plans to complete the spinoff of its real estate business into a publicly traded hotel REIT in 1Q 2018; Wyndham is separating its asset-light hotel business and its more capital intensive timeshare and exchange business into two publicly traded companies; and the Extended Stay 2.0 plan involves selling a significant number of hotels over the next 18 months as well as building out a franchise and management business.

According to Skift Research, the high growth potential of being asset-light will continue to be attractive to hotel companies, as the model can help drive strong earnings growth via additional franchise and management contracts regardless of the overall RevPAR growth environment.

Investments in tech improve owner profitability

One of the key discussions on many of the earnings calls centered on investments in technology. Rather than investing in technology for the sake of technology, management teams highlighted the purpose is to not only enhance the guest experience but also provide operational benefits to hotel owners. Hyatt CEO Mark Hoplamazian noted the company is “focused on functionality in the hotel that is enabling colleagues to actually better engage with guests and simplify their interaction with hotel systems.”

Choice is in the process of implementing a new state-of-the-art global reservations system which is expected to be completed 1Q 2018. Intercontinental is partnering with Amadeus to develop its cloud-based reservation management system with plans to have the system in 100 hotels by the end of 2017. Wyndham has completed 4,300 installations of a new, integrated, cloud-based, central reservation system, which it cites is one of the “first truly automated yield management system in the economy segment,” according to CEO Geoff Ballot.

Skift Research believes these cloud-based systems should provide hotel owners more flexibility, as well as better data analytics, and are more adaptable than previous systems.

Hilton also discussed plans to launch its “Connected Room” in 2018, which will allow loyalty members to control room lighting, HVAC, and entertainment solutions including preloaded and streaming content all via the mobile app. These new capabilities should create a more seamless experience and drive increased loyalty.

Direct booking campaigns are here to stay

Hotel companies’ push to increase direct bookings is not just about lowering distribution costs, although important, but also enhancing the overall guest experience. When a customer books directly with a hotel company, the hotel “owns the customer” and has data which with it can better understand guest wants and needs and engage with them in a deeper, more impactful way. This, in turn, should create more loyalty and result in additional future bookings.

While several companies, including La Quinta and Extended Stay, noted during earnings that the online travel agency cost pressures continue to rise, Hilton CEO Chris Nassetta summed it up best when asked on the earnings call about the impact he is seeing from the company’s booking direct campaign:

“… We’ll be talking about [booking direct] for years and years to come. This will never end. It wasn’t sort of a one-time surge. It’s about making sure that we’re always offering our customers the best value and delivering the best experience, …[and] engaging in a deeper, more frequent way with them… We think that’s important. That doesn’t mean we don’t want to have relationships with distribution partners. We do… There is a certain segment of our business where it’s very helpful to us to work with them as long as we have reasonable economic terms…

“But the more that we can add those direct relationships, the better, not just because of the cost of distribution. That’s obviously an element of it, but just… [so that] we can have much more control over the [customer] experience.”

Corporate customers not loosening purse strings

Despite key indicators such as non-residential fixed investment and corporate profits all continuing to look favorable, corporate travel demand continues to be tepid with business showing caution in their willingness to increase travel spend. While, in our view, this is due to ongoing policy and economic uncertainty, Skift Research expects that, as additional details related to potential policy changes are rolled out and if trends continue to look positive, we should see a loosening of corporate purse strings in 2018.

Hyatt CEO Mark Hoplamazian noted on the earnings call “persistent cautiousness” amongst corporate customers, and Hilton CEO Chris Nassetta indicated corporates may be waiting for things to stabilize more before incrementally spending on travel.

Both Hyatt and Host Hotels did recognize that group bookings for 2019 and beyond are coming in stronger, particularly from associations. While this is likely a good indication that associations and certain corporate groups are feeling comfortable booking events and/or conferences farther out and feel good about the long-term outlook, shorter-term corporate bookings continue to be relatively soft, implying business are holding off on booking last-minute travel plans as well as into 2018.

We note trends do not appear to be outright negative or decelerating, but there appears to be no sign of an acceleration. Arne Sorenson, CEO of Marriott, said “… when you look at the full year, …we would say leisure is the strongest. Secondly would be association group business, and then probably third would be all things corporate. And corporate remains…cautious… [T]hat’s a very deliberate word to use. It’s not weak in absolute terms. The hotels are performing well, and the corporate accounts are performing well, but I think there is a bit more focus on costs across the average corporate customer today than might have been the case in past economic recovery cycles.”

Leisure demand remains a bright spot for hotels

In contrast to corporate, leisure demand continues to be strong, as consumers are benefiting from low oil prices, high employment, and strong consumer sentiment. While companies such as Choice, Hilton, Host Hotels, Marriott, and Extended Stay all called out leisure as a bright spot, we also found this being echoed by others in adjacent industries during Q3 earnings such as cruise and airlines.

Jason Liberty, CFO of Royal Caribbean, highlighted that strong demand from Europe, North America, and China products essentially offset the negative impact from recent hurricanes in Florida, the Caribbean, and Texas.

Frank Del Rio, CEO of Norwegian Cruise Line, noted the company’s 2018 booked position for both load and pricing is ahead of this year’s record levels across all three brands (Norwegian, Regent Seven Seas, Oceania Cruises), and Glen Hauenstein, President of Delta Air Lines, indicated leisure demand and yields continue to show positive momentum.

Royal Caribbean CEO Richard Fain felt that the strength we are seeing in leisure is due in part to people focusing more on buying experiences rather than products: “Five or 10 years ago, I probably would have cited Samsung or LG as a primary concern of ours, because people are so focused on buying new TV sets or new appliances or whatever. More recently, the focus has decidedly shifted to people looking for experiences, in particular, experiences for the whole family. This shift in the way people vacation plays beautifully to our sweet spot. I believe that we’re experiencing the benefits of that shift today and it’s partially the reason that we’re doing so well.”

Tax reform would be beneficial, but how much?

Hilton CEO Chris Nassetta noted on the earnings call that he is more optimistic versus last quarter that some form of corporate tax reform will be enacted in the U.S. The benefit of lower corporate taxes is not lost on us. If businesses pay lower taxes, they’ll have higher free cash flow with which to hire additional employees and invest more in property and equipment and technology.

On a lagged basis, people should theoretically feel better about the overall economy, be more willing to pursue capital projects and, of course, travel more to meetings, conventions, and events.

international Strength helps offset tepid U.S. trends

While policy and economic uncertainty seems to be holding back corporate customers from traveling more in the U.S., international trends remain a different story. All hotel companies with exposure in the Asia Pacific called out phenomenal strength in China and Southeast Asia, and most cited an ongoing recovery in the Europe after geopolitical events negatively impacted results in 2016.

Company outlooks are ‘steady as she goes’

We will receive additional commentary regarding 2018 outlooks during Q4 earnings early next year; the hotel companies offered “cautiously optimistic” forward commentary.

Most expect ongoing strength in international markets will likely more than offset tepid performance in the U.S., despite forward indicators such as U.S. non-residential fixed investment, unemployment, and GDP forecasts all looking positive and supply growth remaining below long-term historical averages.

CEO James Risoleo of Host Hotels indicated that 2018 “… is going to really be dependent upon the psychology of travelers in general, but of businesses in particular. And if we see a tax bill come out of Washington, D.C.,… that maybe leads to an infrastructure build at some point during 2018, then I think that we feel really good about what that’s going to mean for our business. But… the only thing I can really tell you is that we’re sitting today with the same amount of group business on the books in 2018 as we had in 2017 at the same time in 2016.”

Overview of Third Quarter 2017 Hotel Earnings

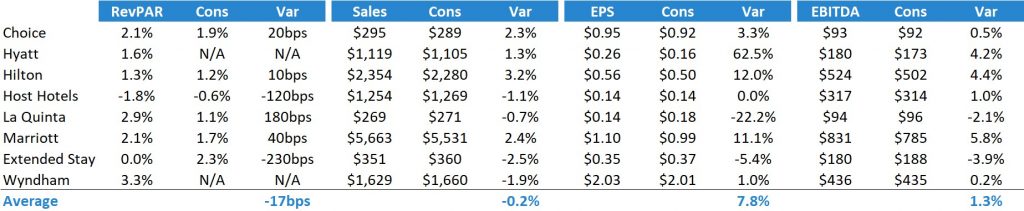

Third quarter 2017 hotel earnings were generally better than expectations with Revenue per Available Room (or “RevPAR”) growth coming in largely better than feared and Earnings per Share (“EPS”) and Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) above expectations.

As a note, RevPAR growth was already expected to decelerate versus the first half of 2017 due to calendar shifts in holidays and other events creating tough comparisons versus Q3 2016 — certain Jewish holidays occurred in September (Q3) 2017 rather than October (Q4), and July 4 was on a Tuesday, both resulting in softer travel demand. At the same time, the solar eclipse resulted in outsized demand for hotels in the path of totality, while catastrophic hurricanes and natural disasters benefited some who offered shelter for victims and negatively impacted others who continue to face hotel closures in key Caribbean and Florida/Texas markets.

Exhibit 1: Hotel Results Versus Analyst Expectations

Source: Company data, FactSet

See Table 1 for additional detail.

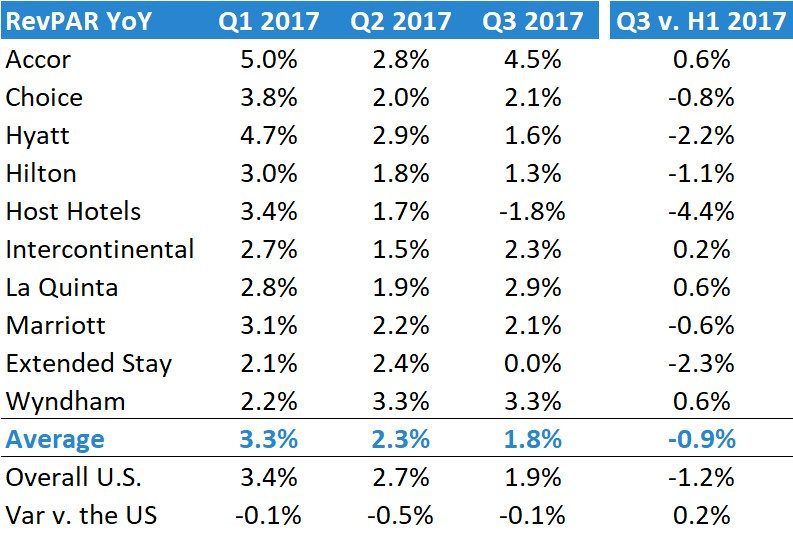

Exhibit 2: RevPAR growth yoy decelerated in Q3 2017 versus H1 2017 as expected

Source: Company data, Hotel News Now

See Table 2 for additional detail.

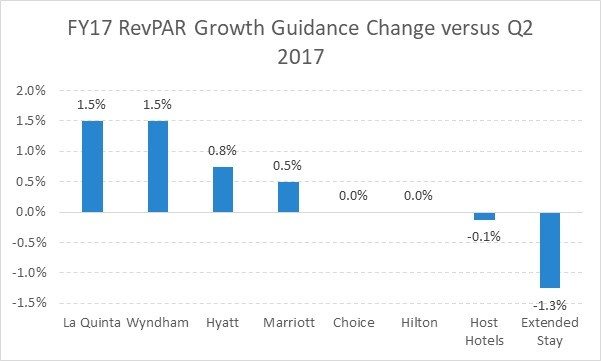

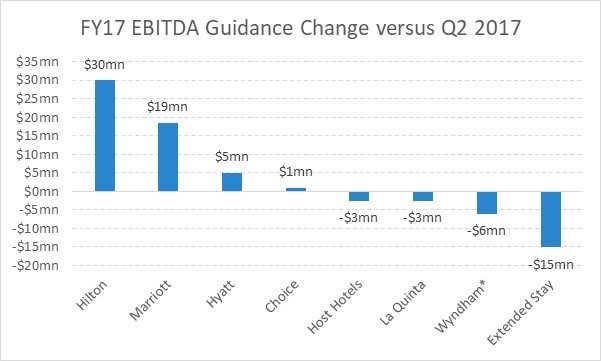

The largely better than feared results in Q3 helped drive management teams to increase their FY2017 guidance ranges for RevPAR growth by 0.4% at the midpoint and EBITDA by $4 million at the midpoint on average.

Exhibit 3: RevPAR YoY guidance was raised 0.4% on average

Source: Company data

See Table 3 for additional detail.

Exhibit 4: FY17 expected EBITDA ($mn) guidance was raised $4 million on average

*Represents Wyndham’s hotel group

Source: Company data

See Table 3 for additional detail.

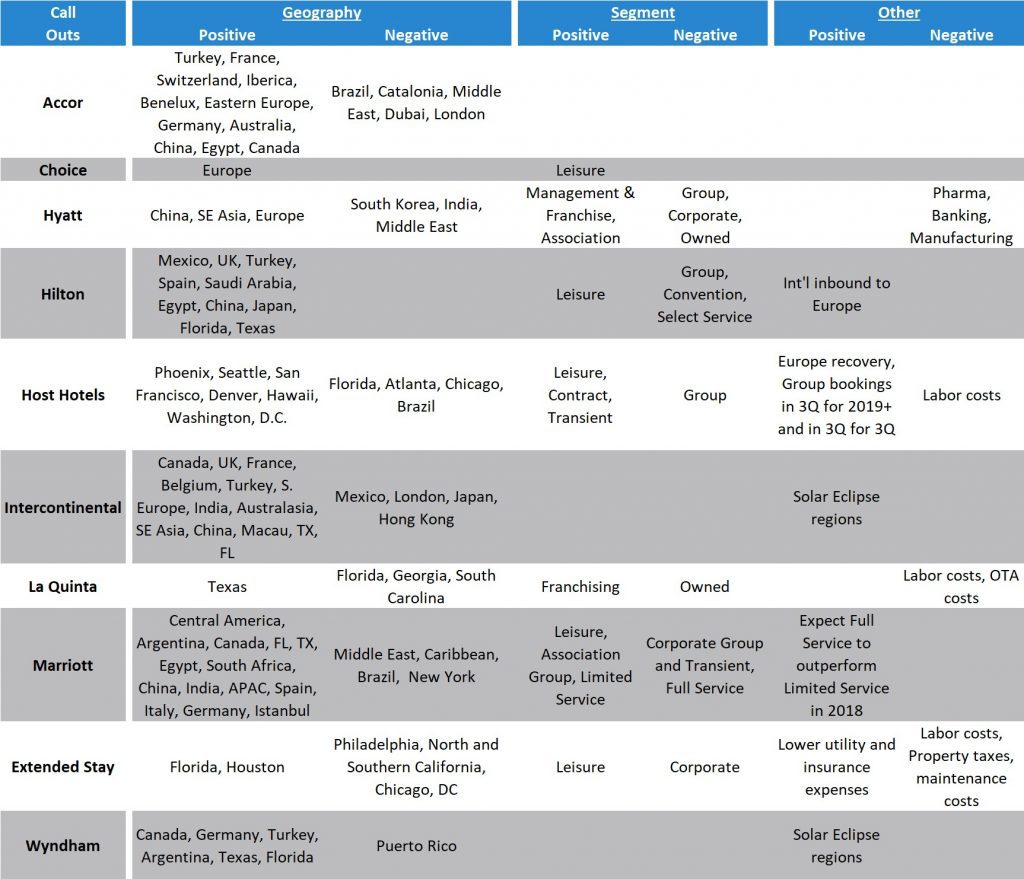

Exhibit 5: Positive and Negative Call Outs: Leisure and international demand remains strong, corporate and group weak

Source: Company data, FactSet

Table 1: Results were essentially in line with consensus expectations for RevPAR growth yoy and Sales (in $ million), but above for EPS and EBITDA (in $ million)

Table 2: RevPAR growth yoy decelerated in 3Q 2017 versus 1H 2017 as expected

Table 3: Hotel management teams raised guidance ranges for 2017E EBITDA (in $mn) and RevPAR growth YOY

Have a confidential tip for Skift? Get in touch

Tags: asset-light, corporate travel, direct bookings, skift research

Photo credit: A Create + Cultivate pop-up at the Portland Marriott Downtown Waterfront hotel. To grow and survive as digital platforms, the big hotel chains are unequivocally moving away from the hotel owner model and more towards branding, marketing, and technology-related functions. Marriott International